“How Climate Change, the Global Green Economy & a Great India Monsoon Add to the Bullish Frenzy of Silver Prices”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

Weekend Report - September 26-28, 2025

I normally do not discuss precious metals, but Silver prices continue to rise.

Below is an excerpt of my recent WeatherWealth newsletter about the silver market. You can sign up for FREE reports about many commodities and the weather’s impact here:

https://weatherwealth.substack.com/.

Soaring silver prices are due to a powerful combination of monetary policy shifts, persistent supply deficits, surging industrial demand (especially for green technologies), and the boom in both AI and new technologies keyed to Climate Change.

A great 2025 Indian monsoon can also result in massive buying of both gold and silver. Good Indian summer rains lead to higher agricultural and rural incomes.

Gold and silver have a deep-rooted cultural significance in India, used for jewelry and gift-giving during the holidays. The end of the Indian monsoon (Sept-Dec) coincides with India’s peak festival and wedding seasons, making this an active time for precious metals.

Image Source: AI and WeatherWealth Newsletter

The global silver market has seen seven consecutive years of supply shortfall, with mine production and recycling unable to keep up with accelerating demand. The 2025 deficit is estimated at over 100 million ounces, further tightening the market and diminishing visible inventories.

The metal has caught multiple tailwinds:

1. Silver has a strong correlation with gold, which has rallied to new all-time highs. Geopolitical risks, combined with a looser monetary policy setting, have driven the rally. A good Indian Monsoon can actually influence millions of India’s farmers to buy precious metals for their loved ones.

Image Source: Source: SRC: Resource Capital Ag

2. Silver demand in industrial applications, primarily photovoltaics, is rising strongly. China’s policy push for an energy transition is not losing steam, propelling solar panel demand. The latest photovoltaic technologies use more silver than older technologies.

3. Most silver mining is a byproduct of mining for other metals. Mining activity for the primary metals for which silver is a byproduct has decelerated in the past year.

4. Positive demand and constrained supply point to another year of supply deficit in 2025-2026

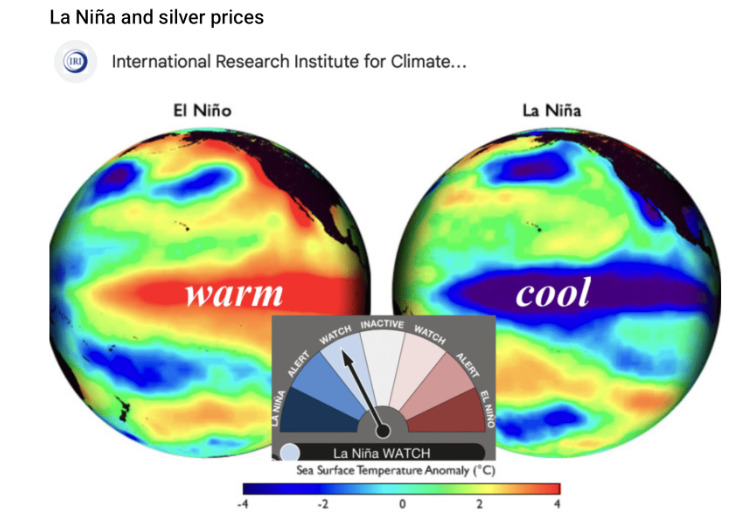

Climate Change and Silver

Climate change exerts a significant and multifaceted impact on the silver market, primarily through its acceleration of the global clean energy transition and its disruptive effects on mining operations

Demand Surge: Clean Energy and Electrification

- Rise of Solar and Green Tech: Silver’s critical role in photovoltaics (solar panels), electric vehicles, and other clean technologies has driven up demand as nations aggressively pursue climate goals and decarbonize their economies. Photovoltaics alone account for a rapidly growing share of silver use, contributing to persistent supply deficits.

- Persistent Market Deficit: The push for renewables has helped shift industrial silver demand from around 10% to roughly 50% of total global output over the last century. These trends have created annual deficits of 200+ million ounces in recent years, contributing to higher prices.

Supply-Side Disruptions

- Weather Extremes and Water Risks: Climate change increases the incidence of floods, droughts, and other extreme weather events, which can disrupt mining via flooding, water scarcity, or logistical breakdowns. Both surplus and shortage of water pose operational risks for mining projects globally, potentially leading to more frequent supply shocks

- Regulatory and Environmental Pressures: As the effects of climate change worsen, governments are strengthening regulations on mining to protect water resources and reduce pollution. This results in higher compliance costs, delayed new projects, and restrictive policies, further constricting supply.

Image Sources: IRI and Australian Weather Bureau

Sign up for a two-week FREE trial period, with trading strategies at Weather Wealth here. Learn how to trade multiple commodities on the weather with specific trade ideas >>> Please Click Here to Sign Up

OR >>> at the top of the page you can sign up for WeatherWealth reports on SUBSTACK, but… without trading ideas.

Thanks for your interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)