/Dell%20Technologies%20by%20Gustianto%20via%20Shutterstock.jpg)

Valued at $90.3 billion by market cap, Dell Technologies Inc. (DELL) operates as one of the largest laptop and PC companies in the world. The Round Rock, Texas-based PC designer operates through Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG) segments. Its operations span numerous countries across the Americas, Indo-Pacific, and EMEA.

Companies worth $10 billion or more are generally described as "large-cap stocks." Dell fits right into that category, reflecting its significant presence and influence in the computer hardware industry.

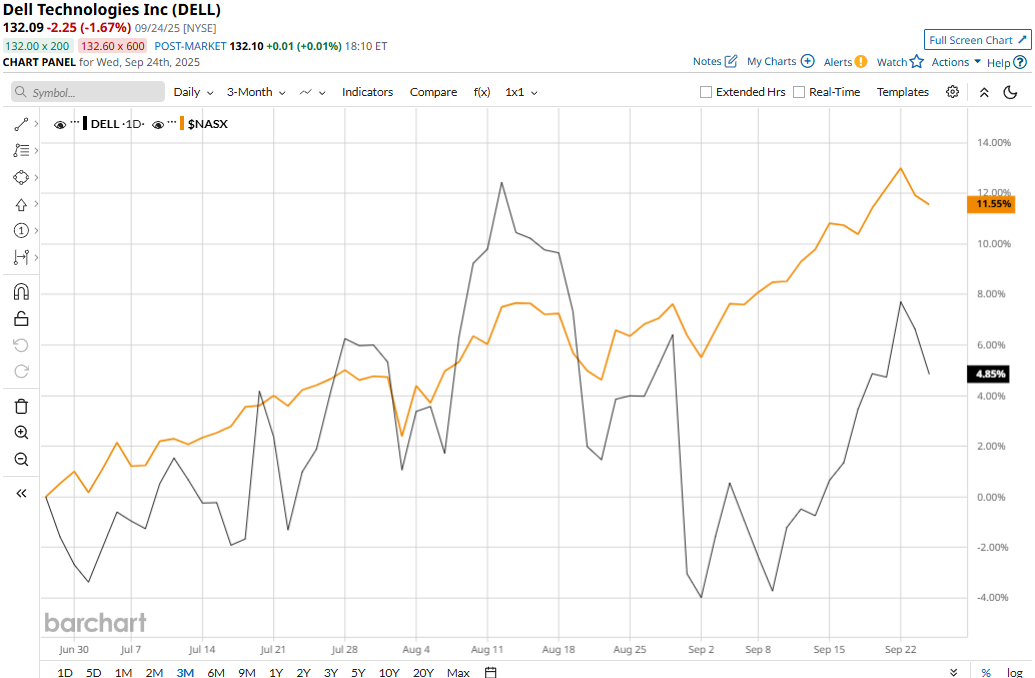

Dell touched its 52-week high of $147.66 on Nov. 25, 2024, and is currently trading 10.5% below that peak. Meanwhile, the stock has gained 9.5% over the past three months, slightly underperforming the Nasdaq Composite’s ($NASX) 13% surge during the same time frame.

Dell has lagged behind the Nasdaq over the longer term as well. The stock has gained 14.6% in 2025 and 12.6% over the past 52 weeks, compared to NASX’s 16.5% surge in 2025 and 24.5% returns over the past year.

Meanwhile, the stock has traded mostly above its 50-day moving average since early May and above its 200-day moving average since mid-May, with some fluctuations, highlighting its bullish trend.

Despite delivering better-than-expected results, Dell Technologies’ stock prices declined 8.9% in a single trading session following the release of its Q2 results on Aug. 28. The company has continued to observe a massive surge in the infrastructure solutions group’s revenues. Its ISG revenues reached a record $16.8 billion during the quarter, marking a 44% year-over-year growth. Overall, the company’s topline for the quarter grew 19% year-over-year to a record $29.8 billion, beating the consensus estimates by 1.6%. Meanwhile, the company’s non-GAAP EPS soared 19% year-over-year to $2.32, surpassing Street’s expectations.

However, for Q3, Dell expected to report a topline of $27 billion plus or minus $500 million, marking an 11% year-over-year growth, which didn’t impress investors and led to the sell-off.

Nonetheless, Dell has significantly outperformed its peer, HP Inc.’s (HPQ) 15.7% decline on a YTD basis and 23.3% plunge over the past 52 weeks.

Among the 20 analysts covering the Dell stock, the consensus rating is a “Moderate Buy.” Its mean price target of $150.61 suggests a 14% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)