Headquartered in Dallas, Texas, Invitation Homes Inc. (INVH) is the largest single-family home leasing and management company in the U.S., operating as a real estate investment trust (REIT).

The company acquires, renovates, leases, and manages homes in desirable neighborhoods across multiple major markets. Its operations emphasize technology-driven property management and high resident retention. The company has a market capitalization of $18.10 billion. Hence, it is considered a “Large cap” stock.

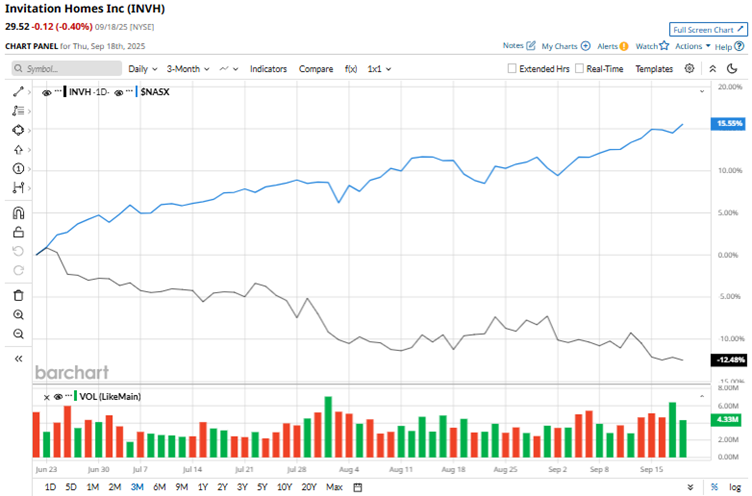

Invitation Homes’ stock reached a 52-week low of $29.37 on April 9, 2025, and is currently up only marginally from this low. In contrast, it had reached a 52-week high of $36.75 in September 2024 and is now down 19.7% from this high. Over the past three months, the stock has declined by 12.5%. In contrast, the broader Nasdaq Composite ($NASX) index gained 15% over the same period.

Invitation Homes’ stock is facing pressure from the sector’s downturn and cautious market sentiments. Over the past 52 weeks, the stock has declined 17.7%, while it is down 7.7% year-to-date (YTD). On the other hand, the Nasdaq Composite has gained 27.9% and 16.4% over the same periods.

Invitation Homes’ stock has shown a downturn, trading lower than its 50-day and 200-day moving averages since late June.

On July 30, Invitation Homes reported robust second-quarter results for fiscal 2025. However, investors might have been expecting more, as the stock declined 1.9% intraday on July 30 and 2.3% on July 31. The REIT’s same-store average occupancy was 97.2%. This represents an expected annual decline of 40 basis points.

On the other hand, the company’s total revenue increased 4.3% year-over-year (YOY) to $681.40 million, surpassing the $676.90 million that Wall Street analysts had expected. Its net income per common share was $0.23, representing a 91.7% increase from the prior year’s period. Its core FFO per share increased modestly YOY to $0.48, which was higher than the $0.47 figure that Wall Street analysts were expecting.

Despite the stock’s recent selloff, Wall Street analysts are bullish about Invitation Homes. The stock has a consensus rating of “Moderate Buy” from the 24 analysts covering it. The mean price target of $36.21 shows a 22.7% upside compared to current levels. However, the Street-high price target of $41 indicates a 38.9% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)