Pittsburgh, Pennsylvania-based The Kraft Heinz Company (KHC) is one of the world’s largest food and beverage companies. Its offerings include sauces, cheese, meals, meat, refreshment beverages, coffee, and more. With a market cap of $31.8 billion, Kraft Heinz’s operations span the Americas, Europe, Indo-Pacific, and internationally.

Companies worth $10 billion or more are generally described as "large-cap stocks." Kraft Heinz fits this bill perfectly. Given the company’s long-standing name in the packaged foods industry, its valuation above this mark is not surprising. The company’s extensive brand portfolio includes Kraft, Oscar Mayer, Lunchables, Velveeta, Ore-Ida, Wattie's, and more.

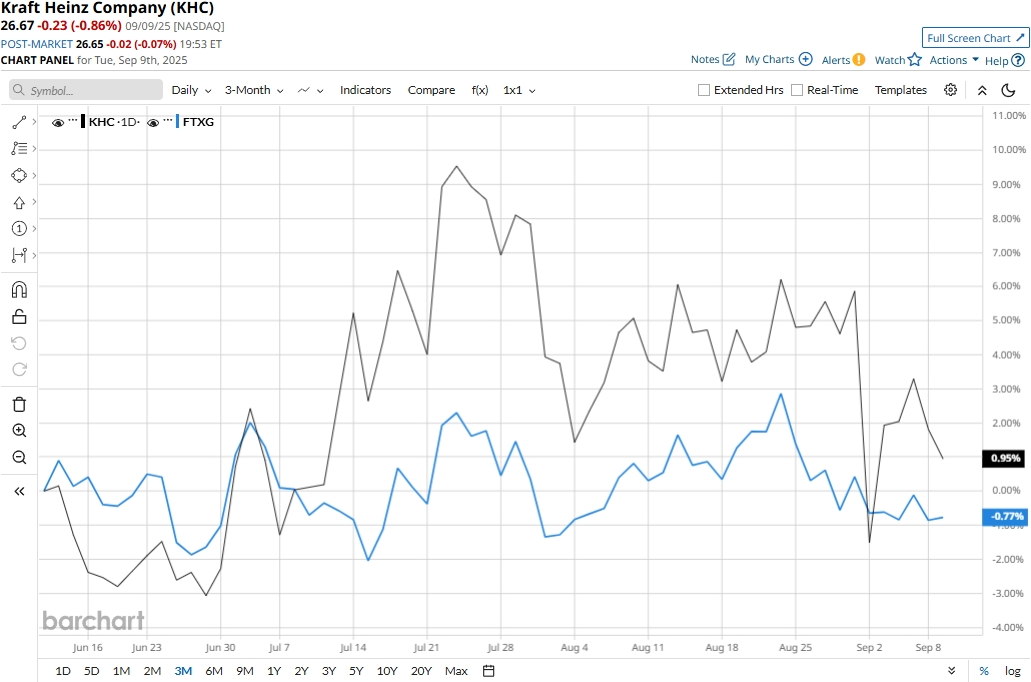

Despite its notable strengths, KHC stock has plummeted 26.5% from its 52-week high of $36.31 touched on Oct. 21, 2024. Meanwhile, KHC stock has observed a marginal 72 bps uptick over the past three months, performing slightly better than the industry-focused First Trust Nasdaq Food & Beverage ETF’s (FTXG) 1.3% dip during the same time frame.

KHC’s performance has remained lackluster over the longer term. The stock has plunged 13.2% on a YTD basis and 26% over the past 52 weeks, significantly underperforming FTXG’s 3.5% dip in 2025 and 14.4% decline over the past year.

To confirm the bearish trend, KHC stock has traded mostly below its 200-day and 50-day moving averages over the past year, with some fluctuations.

Kraft Heinz’s stock prices observed a marginal dip in the trading session following the release of its Q2 results on Jul. 30. The company’s organic sales dropped by 2%, leading to the overall topline dropping 1.9% year-over-year to $6.35 billion. Meanwhile, the company’s adjusted gross margins contracted 140 bps from the year-ago quarter to 34.1%. Further, Kraft Heinz’s adjusted operating income declined 7.5% year-over-year to $1.3 billion. Moreover, its adjusted EPS plunged by 11.5% to $0.69, but surpassed the consensus estimates by 7.8%.

Kraft Heinz has performed slightly better than its peer, Hormel Foods Corporation’s (HRL) 18.7% decline on a YTD basis, but underperformed HRL’s 21.2% plunge over the past 52 weeks.

Among the 22 analysts covering the KHC stock, the consensus rating is a “Hold.” As of writing, its mean price target of $28.67 represents a modest 7.5% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)