The iShares MSCI Peru and Global Exposure ETF (EPU), a part of BlackRock, looks to track the investment results of an equity index with exposure to Peru.

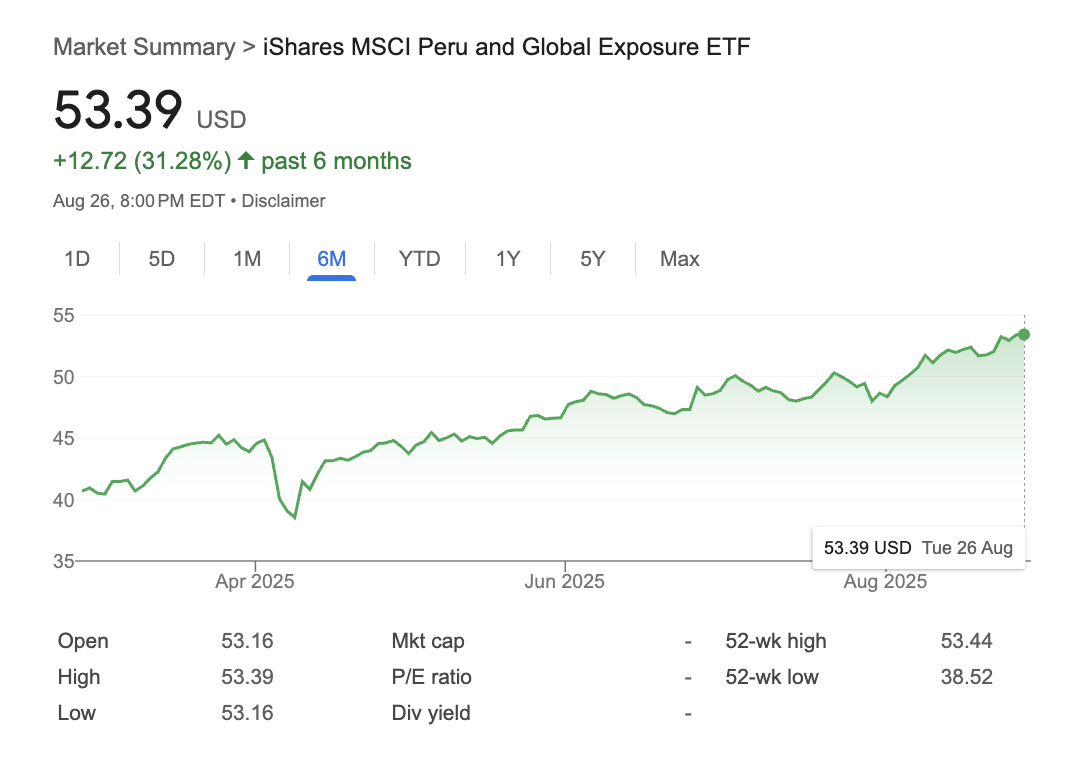

Looking at its most recent standings, we can see impressive results. In the past 12 months, the Peru ETF has seen a 35.42% increase in price, reaching a near all-time high of $53.39 USD.

The sharp increase is thanks in large part to the stable growth of the country’s mining sector over the last decade, responsible for a 7.5% CAGR in GDP between 2000-2023, and still offering solid growth potential on the road ahead. Approximately 51.35% of EPU’s holdings is in the "Basic Materials" sector, which includes mining. EPU’s current P/E ratio is 13.13.

This growth has been aided further thanks to low inflation rates in the country, a reduction in external debts, and a stable exchange rate.

Given the latest data, EPU may appear to offer a solid investment opportunity on initial review. However, it’s important to note that a new geopolitical risk has unfolded rapidly in recent weeks isn’t fully included in the current valuation.

Located in the Amazon River, Santa Rosa Island is subject to a historic border dispute between Colombia and Peru. Although the situation has been fairly stable for several decades, Peru’s congress moved to formalize the legal status of Santa Rosa in June, causing Colombian President Gustavo Petro to accuse the government of annexing a disputed island, setting off a chain of events that is still in motion at the time of writing.

This may prove to have a notable influence on investments connected to Peru, which is why we recommend investors Hold on the ETF.

To understand the nuances of this situation further, we explore the historical nature of the dispute, how it impacts on Peru’s highly important mining industry, and the wider effects on the country’s projected economic performance.

The backstory to the dispute over Santa Rosa Island

Santa Rosa Island, also referred to as Santa Rosa de Yavarí, is a city on the Amazon River with a population of around 3,000. It has strategic importance due to a triple border with Brazil, Colombia and Peru.

Peru has administered Santa Rosa for decades, and the city serves as the Peruvian border crossing of Tres Fronteras. Peru maintains that Santa Rosa is part of Chinería Island, assigned to them during the 1922 Salomón-Lozano Treaty signed by both Colombia and Peru.

However, Colombia argues that these border lines were based on the deepest point of the Amazon River at that time, and that Santa Rosa didn’t emerge until a much later date as a result of changing water levels and ongoing sedimentation in the river. Therefore, it's current President argues that it should not be subject to the original treaty by default.

This border dispute has rumbled on since the 1970s, but tensions soared drastically this month. Peru’s Prime Minister, Eduardo Arana, declared Santa Rosa a district of the country’s Loreto province to formalize its legal status, with Colombia’s President Petro responding with a public campaign of criticism, accusing Peru of annexing the disputed island to assert control.

“Islands have appeared north of the current deepest line, and the Peruvian government has just appropriated them by law and placed the capital of a municipality on land that, by treaty, should belong to Colombia,” Petro wrote.

According to reporter Alfie Pannell of Latin America Reports, the issue has become more strategically charged, “as the sediment build-up on Santa Rosa threatens to cut off Colombia’s access to the Amazon river, important for commercial and defense purposes.”

After these initial comments, Petro broke with annual independence day traditions to make an address in Leticia, Colombia's southernmost town and closest point to Santa Rosa which was also subject to similar border disputes in the 1920’s.

During this visit, Petro declared that “Colombia does not recognize Peru’s sovereignty over the so-called Santa Rosa Island and does not recognize the de facto authorities imposed in the area.” Just hours later, Peru's Prime Minister Eduardo Arana visited the island to show solidarity.

After Colombia denied Peru’s jurisdiction over Santa Rosa Island, the tensions appear to be escalating rapidly, as demonstrated by the arrest of three Colombian men who were on the island doing land surveying work, described by Petro as a “kidnapping.”

How the dispute spills over into Peru’s mining sector

While the current border dispute has a long and complex history, it’s also clear that political friction has been growing between the two nations for a number of years. Petro’s administration has been reticent to have any sort of relationship with Peru after Pedro Castillo was ousted from government, while Peru’s Foreign Ministry has made it clear it will be “solid in the defense of our territory and interests.”

This suggests that the tensions from the Santa Rosa border dispute could rapidly spill over into a much more significant conflict that would test international alliances and trade deals significantly.

Given that EPU’s performance is largely tied to the mining industry, a rise in geopolitical tensions could have material negative consequences. Mining in Peru is especially vulnerable to the effects of conflict.

If current tensions turn into direct conflict, it could delay or cancel billions in investments, and disrupt communities and economies through social unrest. The strategic location of the island in the heart of the Amazon is a key point of access into, and out of, South America and the highly valuable natural resources held here. As a result, continued conflict over Santa Rosa could contribute to the illegal exploitation of resources and reduce foreign direct investment in capital-intensive mining projects.

While investors are betting that no conflict will occur, it is worth noting that in May of 2025 Petro, considered by some analysts to be Colombia's first-ever left-wing President, signed onto China's Belt and Road initiative, which many in the business community had not initially expected him to do.

While the BRI membership does not have any immediate legal obligations, it is a significant political statement in an evolving geopolitical landscape. Peru’s current government is generally considered right-leaning.

Why EPU's performance may still prove robust (despite political tension)

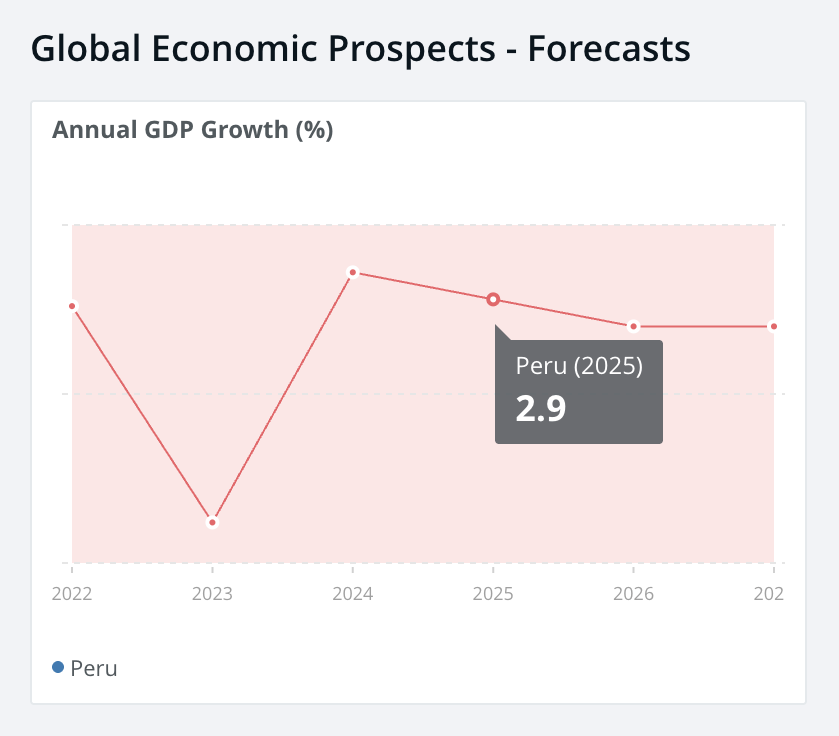

Looking beyond mining, Peru's economy as represented by GDP has enjoyed relatively strong growth rates over the years. Between 2000 and 2023 the CAGR for Peru's GDP was almost 7.5%, which is higher than Chile at 6.5% and Colombia with around 5.7% over the same period.

According to data from the World Bank, Peru's annual GDP growth is expected to be 2.9% in 2025.

Further, Peru has tended to enjoy relatively low levels of inflation relative to Latin America more broadly. Recent research from BBVA shows that in March, the inflation rate was just 1.3%, the lowest level since September 2018.

Peru’s natural resources are highly valued with global buyers due to their strategic importance. Peru is the second largest producer of zinc and molybdenum in the world and stands amongst the top four producers for copper, silver, tin, lead and mercury, making it a global leader in the mining industry.

It also holds 10.2% of the world's copper reserves, 3.9% of its gold, 21.8% of its silver, 8.7% of zinc, 5.2% of lead and 3.1% of tin reserves, according to recent data published by the US Geological Survey.

Copper, zinc, silver, and molybdenum are essential resources for the production of electric vehicles, solar panels, and energy storage systems. As more countries move to adopt renewable energy technologies at a national level, these minerals are an increasingly important commodity.

Copper is especially key here, given that electric vehicles require four times more copper than normal cars and it plays an important role in global power grids, which are being significantly upgraded as part of the transition to renewables.

This gives Peru a strong hand. Even if conflict adds to uncertainty and instability, the unwavering global need for these important but limited natural resources, combined with an investor-friendly regulatory framework and a commitment to sustainable mining practices, means that Peru’s mining sector could continue to grow despite the current geopolitical situation.

A Hold on Peru’s ETF stock

The abundance of natural resources with strategic international performance means that we expect Peru’s high-performing mining sector to remain robust.

Yet the serious geopolitical situation unfolding in real-time poses a significant risk which can’t be ignored. Given the near all-time high price of the stock and the risk, we recommend a Hold.

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)