/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

CoreWeave (CRWV) shares tanked over 10% this morning following reports that Blue Owl Capital has failed to secure the necessary $4 billion in debt financing for a massive data center project in Lancaster, Pennsylvania.

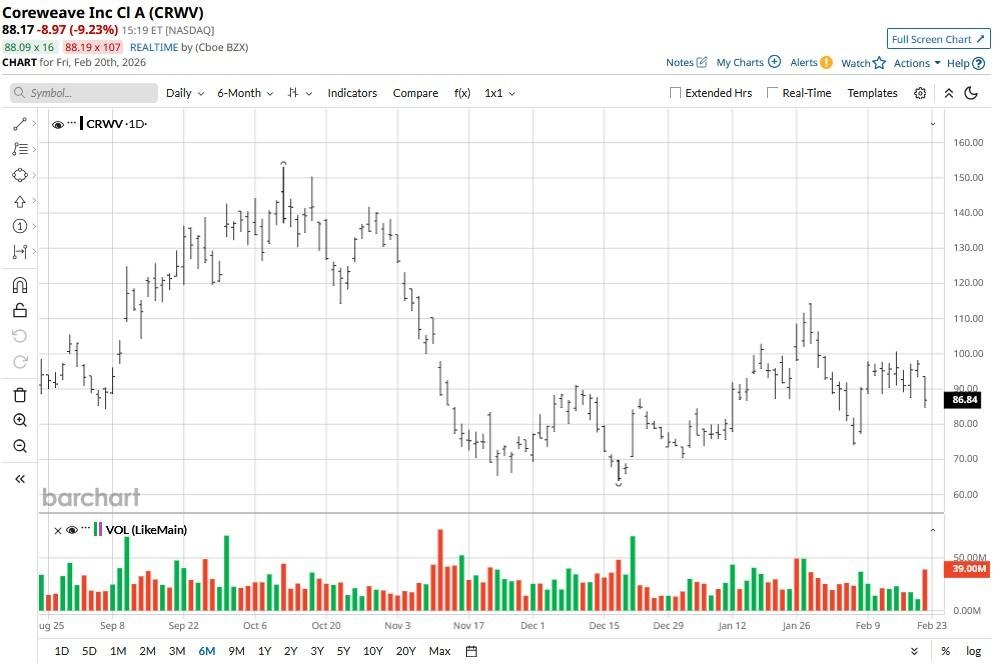

Investors bailed on CRWV mostly because it was slated to be the anchor tenant of this facility. The selloff on Feb. 20 even saw the Nasdaq-listed firm crash below its 20-day moving average (MA), indicating downward pressure may sustain in the near-term.

Versus its year-to-date high, CoreWeave stock is now down more than 20%.

Is It Worth Buying CoreWeave Stock on the Pullback?

According to media reports, at least one major lender passed on the aforementioned data center deal, citing concerns about CoreWeave’s B+ credit rating and the sustainability of its debt-heavy business model.

This triggered fear among investors that the “easy money” used to fund AI expansion is drying up. In fact, such concerns even made Morgan Stanley analysts issue a cautious note on CRWV shares.

Failure of data center projects to find debt financing creates a “significant valuation overhang” for the AI infrastructure firm, especially since it’s unlikely to turn a GAAP profit this year, they told clients.

Morgan Stanley emphasized that CoreWeave’s massive backlog ($55 billion) is meaningless if the company can’t secure the billions required to actually build the servers to fulfill those orders.

Senior Insider Recently Sold CRWV Shares

Caution is warranted in buying CoreWeave shares on the pullback also because Brannin McBee, company’s chief development officer, unloaded more than 133,000 shares on Feb. 17.

What this means is that even internal leadership is locking in gains this year instead of betting on long-term upside. For investors, it’s a signal that ongoing weakness in CRWV may be structural in nature.

Investors should also note that the AI stock is now hovering around its 50-day MA at the $86 level. A decisive break below that price may accelerate bearish momentum in the near term.

Moreover, CoreWeave is expected to report $0.61 a share of loss for its Q4 on Feb. 26, which makes it even less attractive as a long-term holding.

What’s the Consensus Rating on CoreWeave?

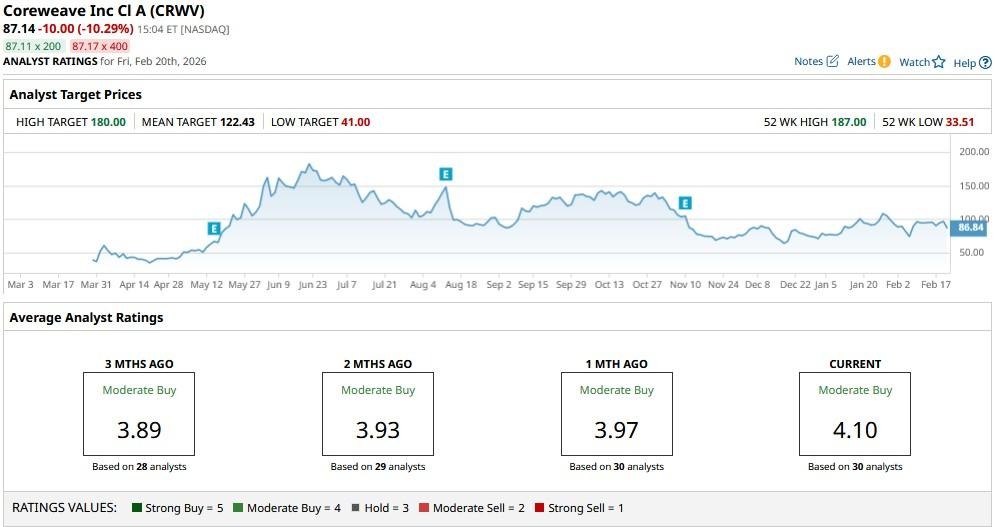

Other Wall Street firms, however, seem to disagree with Morgan Stanley’s cautious view on CRWV shares.

The consensus rating on CoreWeave sits at “Moderate Buy” currently with the mean target of about $122 indicating potential upside of roughly 40% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)