Market-watchers are whispering about market breadth again. So, what do I think? I’m watching it. But I’m not worrying too much (yet).

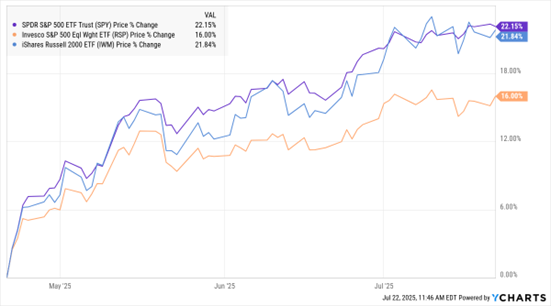

Take a look at the MoneyShow Chart of the Day here. It shows the three-month percentage change in the SPDR S&P 500 ETF Trust (SPY), the Invesco S&P 500 Equal Weight ETF (RSP), and the iShares Russell 2000 ETF (IWM).

SPY, RSP, IWM (3-Mo. % Change)

Data by YCharts

As you can see, the performance gap between the SPY and the RSP has gradually widened out since mid-April. The former is beating the latter by about six percentage points.

That has been accompanied by warnings from the likes of Goldman Sachs, which recently said the averages were exhibiting “one of the narrowest readings of market breadth in recent decades.” Morningstar also noted that only 18% of the stocks in its US Large-Mid Index hit new 52-week highs in July, and that “Big Tech” was the primary driver of Q2 gains for US stocks.

But we’re still seeing healthy performance by smaller-cap stocks, as indicated by the IWM advance. Plus, I’m not seeing worrisome moves in the credit markets – or in other indicators I follow like the Citigroup Economic Surprise Index.

We have a lot of “big events” coming up. That includes Fed meetings and the Aug. 1 tariff deal deadline. So, I don’t want to just whistle past the graveyard. But so far, breadth looks like just another thing to watch…rather than worry too much about.

If you want to get more articles and chart analysis from MoneyShow, subscribe to our Top Pros’ Top Picks newsletter here.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)