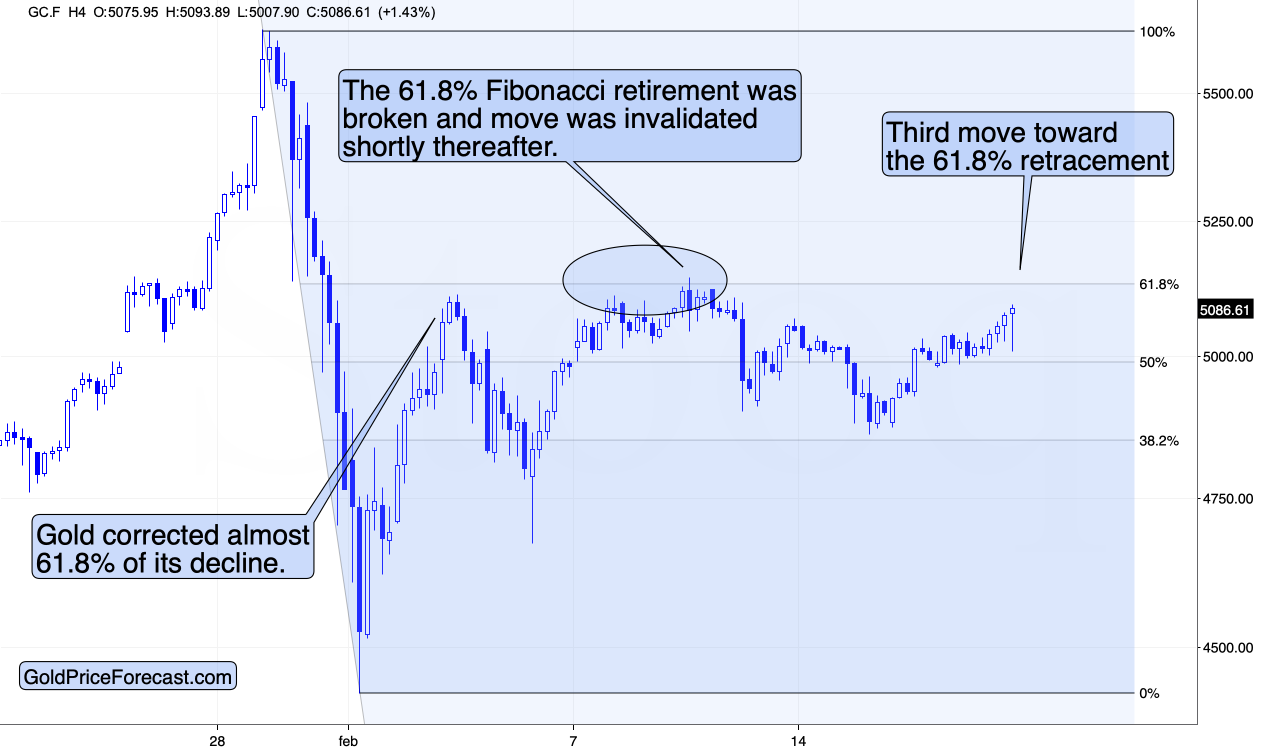

Gold is re-testing its 61.8% Fibonacci retracement once again instead of declining.

Is it really bullish, though?

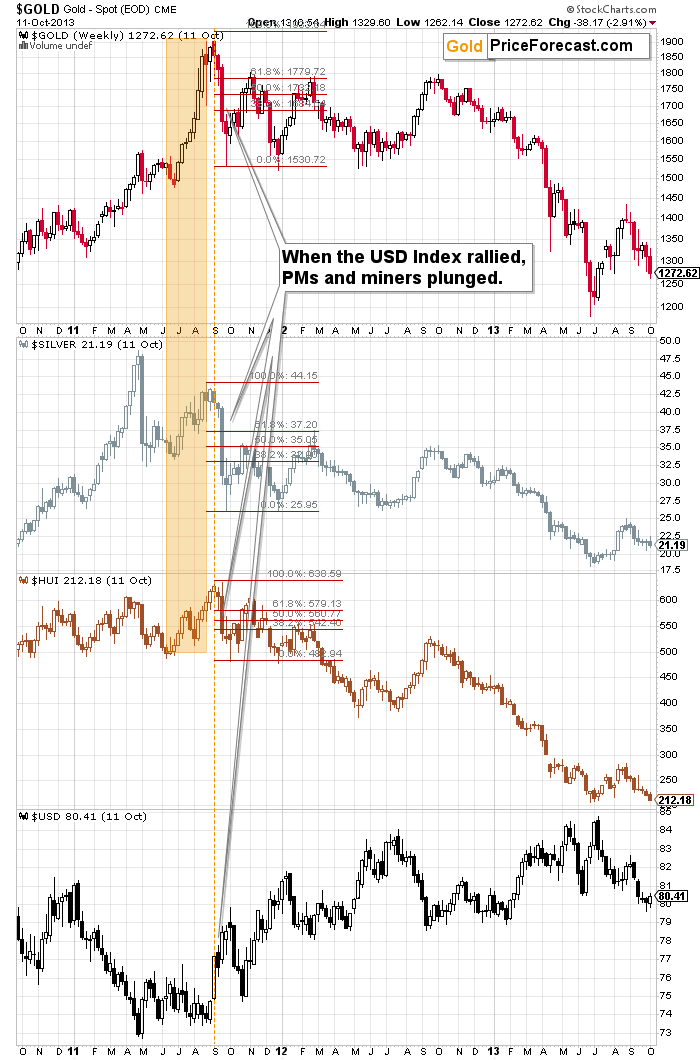

I previously wrote that based on the similarity to how gold behaved after another key (2011) top, we might be in the stage where it declines in a back-and-forth manner.

Precisely, I meant its late-2012 performance.

Gold price moved higher instead but did it make the entire analogy useless? No. It simply means that we’re most likely in a different part thereof.

After the 2011 top, there were three corrections to the 61.8% retracement. What we now see is the third move of this kind. The pattern didn’t break – it continues with greater precision than I had assumed.

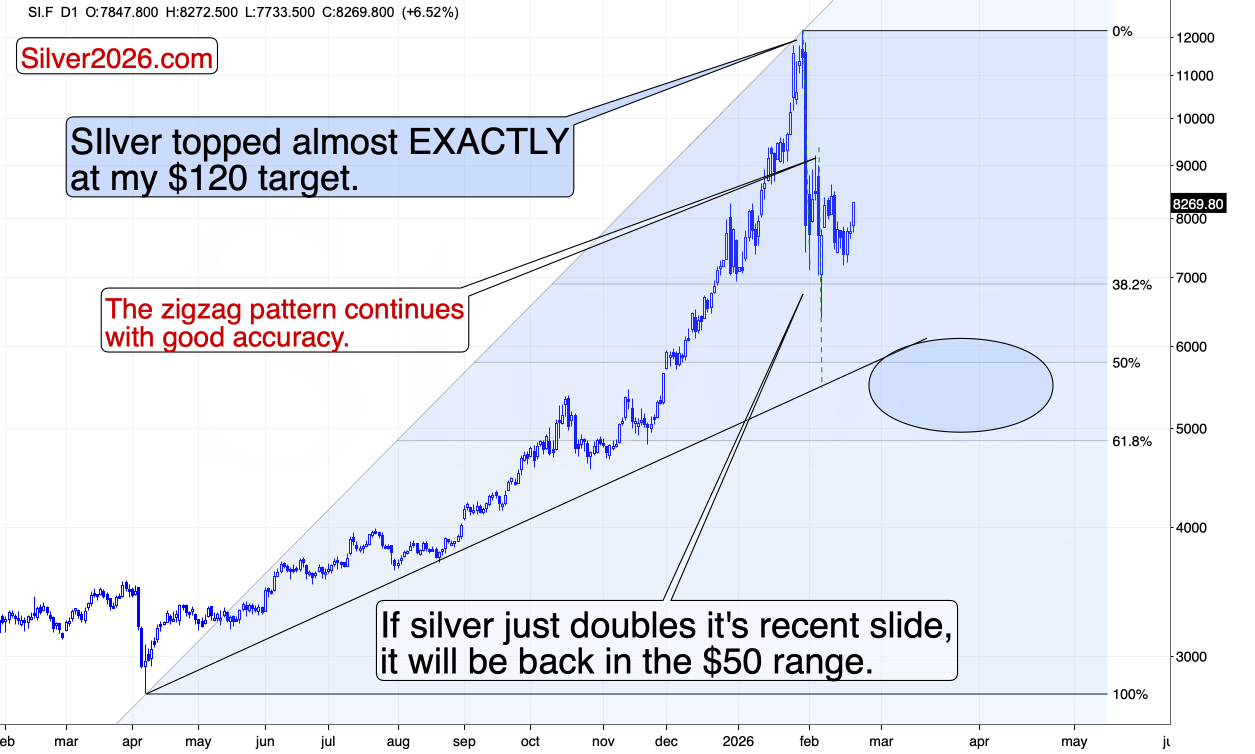

And you know what else happened when gold moved to its 61.8% retracement for the third time in 2012? Silver moved higher but it was clear that it was weaker than gold on a relative basis – it didn’t reach its previous highs.

We see the same thing right now.

Yes, silver is still strong from the long-term point of view (and has ridiculously favorable fundamentals)

Yes, silver rallied strongly today (over 6%).

But when we compare today’s price high to silver’s recent local highs, it’s obvious that each one is lower than the previous one – just like what we saw after the 2011 top.

If stocks are about to decline (which seems likely) and the USD Index is about to move higher (which also seems likely), then we’re likely to see bigger declines on the precious metals market in the following weeks, even though if we don’t see them within the next few days.

Meanwhile, our second short position in bitcoin is only slightly profitable now, but it continues to have great potential. Please note that bitcoin declined sharply and significantly earlier this year. If this market had real potential here, it would soar back up with vengeance – the volatility would be present also on the upside. This is not happening.

Instead, we see a so-called “dead cat bounce” – barely noticeable rebound that confirms the bearish case for the “new gold”.

Thank you for reading my today’s free analysis. I’ll continue to send you occasional updates and, as always, I’ll keep my Gold Trading Alert subscribers informed (also on insurance-, investment-, and trading-capital-based details) at all times.

If enjoyed it and would like to get the follow-ups, I encourage you to sign up for my free gold newsletter today.

Thank you.

Przemyslaw K. Radomski, CFA

Founder

Golden Meadow®

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)