Rolls-Royce Holdings Plc RYCEY, like most aerospace and defense industry players, has faced significant supply-chain challenges in recent years, particularly with its Trent 1000 engine program. However, the company’s proactive initiatives, including the formation of a dedicated Trent 1000 Task Force, have helped mitigate this disruption and can be expected to continue playing a crucial role in its near-term growth story.

Supply-Chain Disruption & RYCEY’s Response

Persistent supply-chain bottlenecks arising from a combination of factors like raw material shortages, logistic issues, as well as delays in the availability of engine parts and components, immensely affected Rolls-Royce’s engine production and maintenance schedules. These challenges resulted in a charge of approximately $518 million (£382 million), with prolonged supply-chain disruptions cited as the primary cause.

The company’s Trent 1000 engine program was particularly affected. British Airways was even forced to cancel flights on a key transatlantic route, attributing the issue to the limited availability of Trent 1000 engines used in Boeing 787 Dreamliners.

To address this, Rolls-Royce established the Trent 1000 Task Force last year to streamline repairs, expedite part deliveries and improve supplier coordination. These efforts are already yielding results — the company increased Trent 1000 supply-chain output by around 20% in 2024, easing pressure on its Maintenance, Repair and Overhaul operations.

To bolster this momentum, Rolls-Royce embedded around 250 staff across key suppliers to boost technical skills and enable more effective integrated planning.

To further mitigate the challenges, in June 2025, RYCEY launched the first of two Durability Enhancement Packages, which are intended to more than double the time Trent 1000 engines can remain in service before needing maintenance. Impressively, Rolls-Royce is incorporating this durability enhancement program, worth approximately $1.28 billion (1 billion GBP), all across its Trent engine fleet.

These initiatives will not only enhance Rolls-Royce’s operational resilience but also support broader industry recovery, improving engine availability for aircraft manufacturers like Boeing and airline operators such as British Airways, both critical players in the global aerospace supply chain.

Other Stocks Taking Initiatives

With virtually no aerospace company being able to escape the impact of the worldwide supply-chain bottleneck, other stocks in the sector like Boeing BA and Airbus EADSY, which also have taken notable recovery initiatives, are thus worth a look.

Notably, in May 2025, Boeing celebrated the opening of its third distribution center in Germany, which came with the capacity to store more than 9,000 unique parts for Boeing aircraft, including large items such as landing gear components. This warehouse will primarily serve BA’s European commercial airline customers.

On the other hand, Airbus is advancing closed-loop recycling by reusing titanium scraps from production and end-of-life aircraft to ease the supply-chain pressures. Partnering with EcoTitanium and IMET Alloys, the company produced its first ingot from recycled titanium in 2025, helping reduce dependence on virgin materials and stabilizing critical metal supply (as per a July 2025 report published by EADSY).

The Zacks Rundown for RYCEY

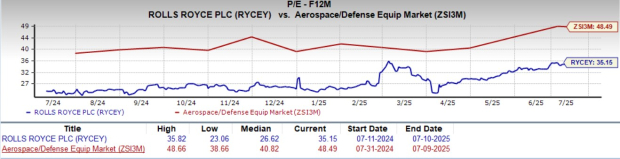

Shares of Rolls-Royce have surged a solid 134.5% in the past year compared with the industry’s growth of 48.9%.

Image Source: Zacks Investment Research

From a valuation standpoint, RYCEY is currently trading at a forward 12-month earnings of 35.15X, a roughly 27.5% discount when stacked up with the industry average of 48.49X.

Image Source: Zacks Investment Research

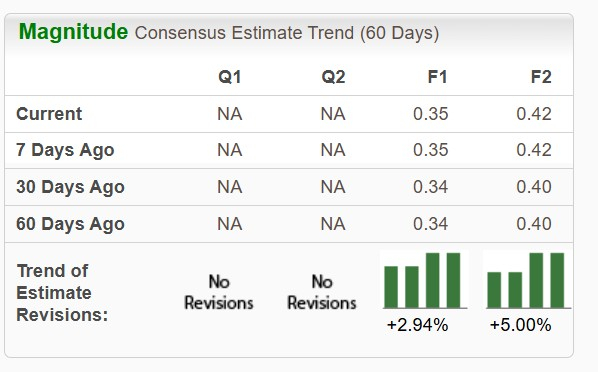

The bottom-line estimate for 2025 and 2026 has moved north over the past 60 days.

Image Source: Zacks Investment Research

Rolls-Royce currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA): Free Stock Analysis Report

Rolls-Royce Holdings PLC (RYCEY): Free Stock Analysis Report

Airbus Group (EADSY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)