Enterprise Products Partners EPD recently disclosed in an 8K filing, about the receipt of a letter from the Bureau of Industry and Security (“BIS”), U.S. Department of Commerce. The letter signifies the removal of previous restrictions on ethane exports to China or entities linked to the Chinese military, boosting investors' sentiments for the operator of a marine export terminal located along the Houston Ship Channel.

Enterprise Products plays a key role in the midstream space by handling everything from gathering natural gas to processing, transporting, and storing it. After processing natural gas liquids (NGL) from natural gas, EPD transports the NGLs through its pipeline network. After that, through the process of fractionation at specialized plants, the partnership engages in separating the NGL mixture into its components, such as ethane. Enterprise Products’ midstream services also include storing the components and loading these products onto ships at its marine export terminal for overseas export.

Now, the resumption of ethane exports to China is likely to generate cash flows for Enterprise Products. From transporting natural gas, to processing it into NGLs and transporting and loading NGLs like ethane, the partnership will generate stable fee-based revenues, which is beneficial for investors. However, given the ongoing U.S.-China tensions, EPD’s overall risk persists.

WMB & ET Also Have NGL Midstream Assets

The Williams Companies, Inc. WMB has a 50% ownership interest in The Overland Pass Pipeline. WMB stated that the pipeline network covers 760 miles, transporting NGL to the Mid-Continent market hub located in Conway, KS, from Opal, WY. The pipeline network of Williams Companies has a daily capacity of 245,000 barrels of NGL.

Energy Transfer LP ET is also involved in transporting NGL. The pipeline network of ET, transporting NGL, spans approximately 5,700 miles. Energy Transfer noted that the pipeline network has a daily transportation capacity of three million barrels.

EPD’s Price Performance, Valuation & Estimates

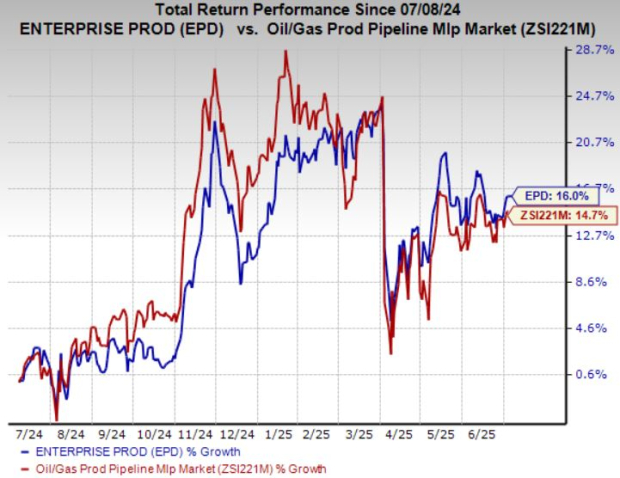

Units of EPD have surged 16% over the past year, outpacing the 14.7% improvement of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

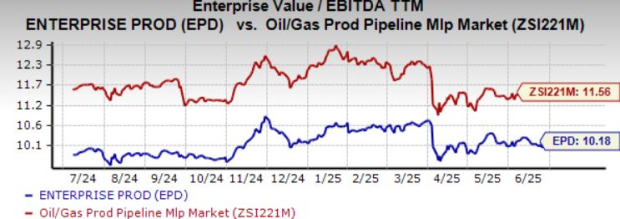

From a valuation standpoint, EPD trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 10.18X. This is below the broader industry average of 11.56X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for EPD’s 2025 earnings hasn’t been revised over the past seven days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

EPD stock currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands have taken advantage of this opportunity.

Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. (The) (WMB): Free Stock Analysis Report

Enterprise Products Partners L.P. (EPD): Free Stock Analysis Report

Energy Transfer LP (ET): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)