For defense contractors like Astronics Corporation ATRO, rising order volumes and subsequent improvement in the book-to-bill ratio potentially lay the groundwork for the company’s revenue acceleration in the coming quarters. Evidently, the company has recorded year-over-year bookings growth exceeding 5% in each of the past four quarters, with first-quarter 2025 bookings surging 37%. Resultantly, ATRO’s first-quarter 2025 book-to-bill ratio rose to an impressive 1.36X from 1.10X in the previous quarter and from 1.11X a year ago.

A rising book-to-bill ratio signals robust demand for ATRO’s products and a healthy sales pipeline. Moreover, a ratio above 1.0 suggests that the company is securing more business than it delivers, laying the foundation for future revenue growth and stable cash flow.

Impressively, Astronics has registered a solid year-over-year sales growth in each of its consecutive last four quarters and can be expected to deliver similar performance in the coming quarters as well, backed by the aforementioned improvement in its book-to-bill ratio. Reflecting this momentum, the Zacks Consensus Estimate for ATRO’s near-term sales suggests continued year-over-year improvement, as outlined below.

Image Source: Zacks Investment Research

Other Defense Stocks Exhibiting Solid Book-to-Bill

Factors like rising geopolitical tensions and cross-border hostilities worldwide have been prompting increased government defense spending in recent times, which, in turn, has been boosting the order growth for defense contractors. Additionally, modernization initiatives and demand for advanced aerospace and defense technologies are fueling new contract awards and backlogs, thereby strengthening its revenue prospects.

Consequently, stocks like Kratos Defense & Security Solutions Inc. KTOS and Esco Technologies ESE, which have significant exposure in the defense industry, are exhibiting a book-to-bill ratio of more than 1 and strong revenue growth prospects.

Kratos reported consolidated bookings of $365.6 million and a book-to-bill ratio of 1.2 to 1.0 for the first quarter of 2025. Looking ahead, the Zacks Consensus Estimate for KTOS’ 2025 and 2026 sales suggests a year-over-year improvement of 12.7% and 15%, respectively.

Esco Technologies’ Aerospace & Defense (A&D) segment recorded a book-to-bill ratio of 1.06x and a backlog of $607 million in the first quarter of fiscal 2025. Sales for this segment improved a solid 21% year over year.

The Zacks Rundown for ATRO

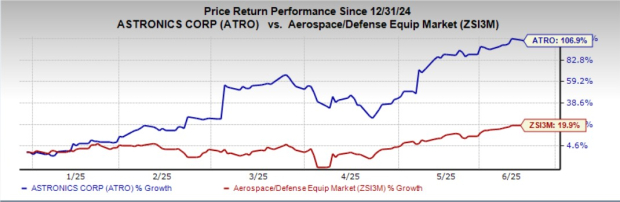

Shares of Astronics have surged a solid 109.6% year to date compared with the industry’s gain of 19.9%.

Image Source: Zacks Investment Research

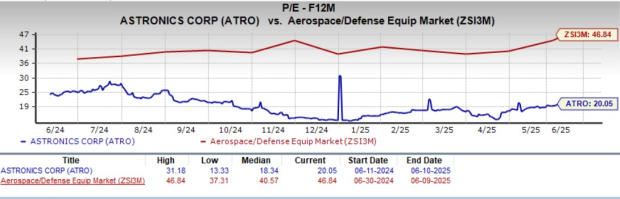

From a valuation standpoint, ATRO is currently trading at a forward 12-month earnings multiple of 20.05X, a roughly 57% discount when stacked up with the industry average of 46.84X.

Image Source: Zacks Investment Research

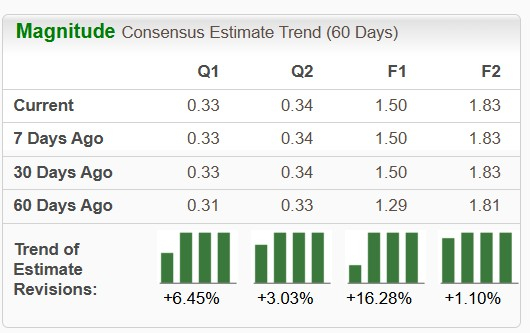

The Zacks Consensus Estimate for ATRO’s 2025 and 2026 earnings per share has been trending higher over the past 60 days.

Image Source: Zacks Investment Research

ATRO currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ESCO Technologies Inc. (ESE): Free Stock Analysis Report

Astronics Corporation (ATRO): Free Stock Analysis Report

Kratos Defense & Security Solutions, Inc. (KTOS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Cisco%20Systems%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)