Marvell Technology MRVL delivered approximately $1.9 billion in revenues for the first quarter of fiscal 2026, up 63% year over year, driven by explosive growth in its Data Center end market. Management now forecasts its second-quarter revenues to be $2.0 billion (+/- 5%), setting the stage for what could be the company’s highest-ever quarterly revenues. The revenue projection suggests growth of 57.4% year over year and 5.5% sequentially.

The growth is likely to be powered primarily by demand for AI-driven custom silicon, which has become the largest component of Marvell Technology’s data center revenues. The company’s custom silicon programs continued to ramp and were the primary driver of growth in its data center business during the last reported quarter.

Marvell Technology’s custom AI silicon chips mainly account for custom AI XPUs and electro-optics solutions. These custom XPUs are a key part of the company’s architecture strategy, including multi-die packaging and high-bandwidth memory integration. Marvell is witnessing strong adoption of its custom AI silicon chips among hyperscalers, which is driving strong revenue growth in the data center end market. In the first quarter, the data center end market witnessed a robust 76% year-over-year revenue growth.

To capture the growing opportunity, Marvell Technology is heavily investing in its custom silicon programs to rapidly scale production. Introduction of the 2.5D advanced packaging platform and continuous focus on strengthening the portfolio of its custom application-specific integrated circuits will enable MRVL to stay ahead of its competitors in the custom AI silicon space.

In the second quarter, data center revenues are expected to grow sequentially in the mid-single-digit percentage range, supported by volume ramps in custom AI silicon and strong electro-optics shipments for AI and cloud infrastructure. If these trends hold, Marvell Technology appears well-positioned to cross the $2 billion mark and solidify its role as a critical enabler of AI at scale.

How Competitors Fare Against MRVL

Broadcom AVGO, in its second quarter of fiscal 2025, reported $4.4 billion in AI-related semiconductor revenues, indicating 46% year-over-year growth. AI networking grew more than 170% year over year, representing 40% of Broadcom’s AI revenues. Broadcom is also working on custom AI XPU accelerators, currently partnering with three customers and engaging with four more prospects, which could open up new opportunities in AI compute going forward.

Advanced Micro Devices AMD, in the first quarter of fiscal 2025, its Data Center segment brought in $3.7 billion, up 57% year over year, as adoption of its AI GPUs continues to grow. AMD is also making progress in the AI market, driven by strong demand for its Instinct MI300 accelerators. Moreover, AMD is preparing to roll out its next-generation MI350 and MI400 series in the second half of the year to build on this momentum.

MRVL’s Price Performance, Valuation and Estimates

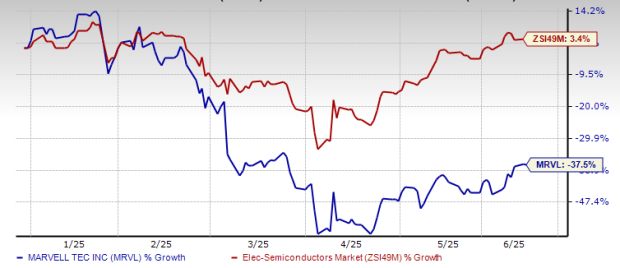

Shares of Marvell have lost 37.5% year to date against the Electronics - Semiconductors industry’s growth of 3.4%.

MRVL YTD Price Performance Chart

Image Source: Zacks Investment Research

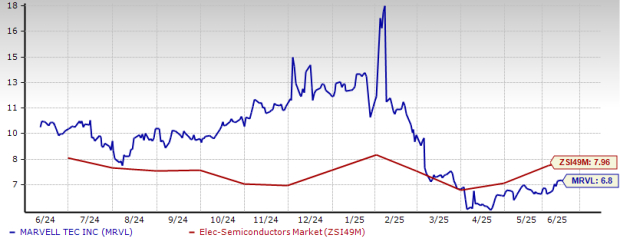

From a valuation standpoint, Marvell Technology trades at a forward price-to-sales ratio of 6.8X, lower than the industry’s average of 7.96X.

Marvell Technology Forward 12 Month (P/S) Valuation Chart

Image Source: Zacks Investment Research

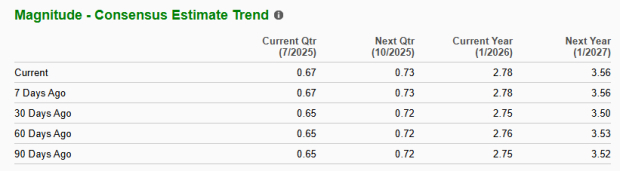

The Zacks Consensus Estimate for Marvell Technology’s fiscal 2026 and 2027 earnings implies year-over-year growth of 77.07% and 28.06%, respectively. The estimates for fiscal 2026 and 2027 have been revised upward in the past 30 days.

Image Source: Zacks Investment Research

Marvell Technology currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Marvell Technology, Inc. (MRVL): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)