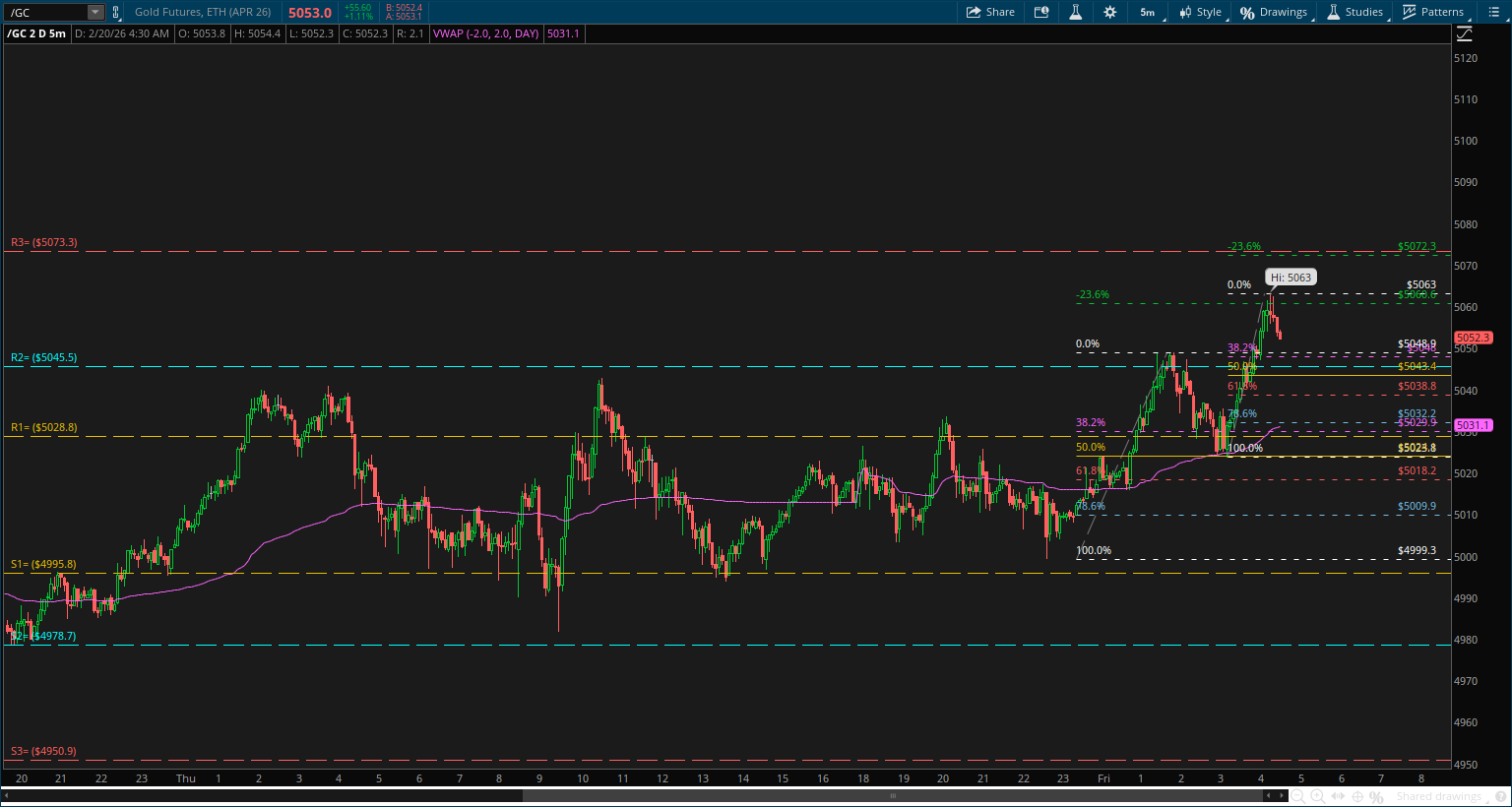

Spot gold reclaimed the $5,000 level after reaching an overnight low of 4,999.1, as market participants evaluated risks related to potential conflict between the United States and Iran, alongside the Federal Reserve’s relatively hawkish minutes released late Wednesday. Market dynamics currently reflect a divergence between fundamental traders, who assess gold’s value in relation to Treasury yields and the US dollar, and speculators positioning gold as a traditional safe-haven asset. Early trading today was subdued, with a subsequent Fibonacci retracement following the initial overnight high of 5,048.9. Participation remained limited, keeping market sentiment cautious; however, the profit target was achieved after a pullback to 5,023.8, and the price moved to 5,063.

Additional factors influencing market sentiment include shifting expectations regarding Federal Reserve rate cuts. A month ago, traders anticipated at least two rate reductions in 2026, but recent geopolitical developments have altered the landscape significantly.

The central debate continues: is gold best viewed as an investment or as a safe-haven asset? In late January, if the Federal Reserve had removed one or two planned rate cuts for 2026, prevailing opinion would likely have turned bearish on gold, potentially prompting profit-taking. Notably, when the Fed’s monetary policy statement was released on January 28, followed by remarks from Chair Powell, gold reached a peak of $5,602.23 the following day.

Reviewing yesterday’s Federal Reserve minutes, policymakers were nearly unanimous in maintaining the current benchmark interest rate. However, there was some divergence regarding how to address inflation, with certain members considering rate hikes should inflation persist, while others viewed cutting rates amid elevated inflation as inadvisable. According to the CME’s FedWatch Tool, expectations for a rate cut in March are negligible, and the probability of a reduction in June stands at approximately 50.4%.

From a geopolitical perspective, if it had been suggested a month ago that three US Navy fleets—including the largest warship—would be stationed off the coast of Iran, with both sides poised for escalation, market consensus would have viewed this scenario as bullish for gold. Presently, despite heightened tensions, gold has shown limited reaction following yesterday’s 2% gain. This period of consolidation may extend into June with the appointment of a new Fed Chair, although intermittent speculative movements are possible due to thin liquidity. Current price action indicates that traders remain predominantly focused on interest rate trajectories rather than geopolitical risks. As such, the safe-haven appeal is not sufficiently robust to offset the impact of anticipated stable or unchanged interest rates, resulting in continued consolidation for gold.

Therefore, pullbacks into 5032.2 to 5043.4 deliver opportunity for long focused trades targeting 5072.3 into the close of today's session. Also keep a close eye on the intraday support and resistance levels shows with the longer dashed lines and crips price markers.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)