Kyndryl KD is scheduled to release fourth-quarter fiscal 2025 results on May 7, after market close.

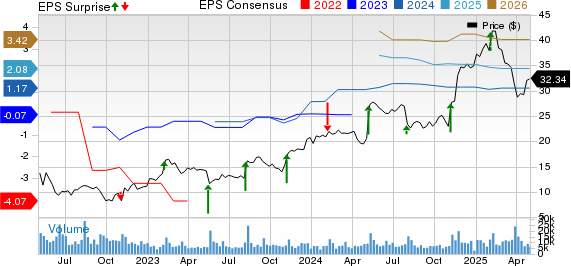

The company surpassed the Zacks Consensus Estimate in the past four trailing quarters. On average, it delivered an earnings surprise of 60.5%.

Kyndryl Holdings, Inc. Price, Consensus and EPS Surprise

Kyndryl’s Q4 Expectations

The Zacks Consensus Estimate for revenues is pegged at $3.8 billion, indicating a 1.9% decline from the year-ago quarter’s actual. The top line is expected to have declined on the back of exit from negative and low-margin revenue streams within ongoing customer relationships.

The consensus estimate for the bottom line is pegged at 52 cents per share, whereas it reported a loss per share of a penny a year ago. Multiple factors, including the company’s accounts initiative, growth in Kyndryl Consult driven by Three As initiatives and expense control, are anticipated to have boosted the bottom line.

What Our Model Says About KD

Our proven model does not predict an earnings beat for Kyndryl this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

KD has an Earnings ESP of 0.00% and a Zacks Rank of 2 at present.

Stocks That Warrant a Look

Here are a few stocks from the broader Business Services sector, which, according to our model, have the right combination of elements to beat on earnings this season.

V2X, Inc. VVX: The Zacks Consensus Estimate for first-quarter 2025 revenues is pegged at $1 billion, indicating growth of 2% from the year-ago quarter’s actual. For earnings, the consensus mark is pegged at 92 cents per share, suggesting a 2.2% rise from the year-ago quarter’s reported number. It surpassed the consensus estimate in three of the past four quarters and missed once, with an average beat of 14%.

VVX has an Earnings ESP of +1.53% and a Zacks Rank of 3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company is scheduled to declare its first-quarter 2025 results on May 5. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Remitly Global, Inc. RELY: The Zacks Consensus Estimate for first-quarter 2025 revenues is pegged at $347 million, indicating 28.9% growth from the year-ago quarter’s actual. The consensus mark for loss is pegged at 4 cents per share, indicating an 11% decrease from the year-ago quarter’s reported number. RELY surpassed the consensus estimate in the past four quarters, with an average of 58.8%.

The company has an Earnings ESP of +14.29% and a Zacks Rank of 3. It is scheduled to declare first-quarter 2025 results on May 7.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Remitly Global, Inc. (RELY): Free Stock Analysis Report

Kyndryl Holdings, Inc. (KD): Free Stock Analysis Report

V2X, Inc. (VVX): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)