/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

Apple (AAPL) plans to manufacture most U.S.-bound iPhones in India by the end of 2026, to navigate potential China tariffs. While production costs in India are 5% to 8% higher, the iPhone maker is holding urgent talks with Foxconn and Tata to achieve this goal. According to a report from StreetInsider, Apple already shipped $2 billion worth of India-made iPhones to the U.S. in March, with Foxconn accounting for $1.3 billion.

This strategic manufacturing diversification comes amid U.S.-China trade tensions, with India facing lower tariffs. The U.S. levied 26% tariffs on India, which are now paused. Goods imported from China face tariffs above 100%, although consumer electronics products face reduced tariffs of 20%.

Three existing factories in India and two more under construction position Apple to continue reducing its manufacturing dependency on China.

Valued at a market cap of $3.1 trillion, AAPL stock is down more than19% from all-time highs. Let’s see if you should buy the dip right now.

What Do Analysts Expect From Apple Stock in Fiscal Q2?

Apple is scheduled to report its fiscal Q2 2025 (ended in March) results on Thursday, May 1. Wall Street estimates the hardware giant to report revenue of $94.23 billion and adjusted earnings per share of $1.61 in the March quarter. In the year-ago period, it reported revenue of $90.75 billion and adjusted earnings per share of $1.53.

Notably, Apple has beaten revenue and earnings estimates in each of the last five quarters despite navigating a challenging macro environment, inflation, and elevated interest rates.

How Did Apple Perform in Fiscal Q1?

Apple delivered an impressive performance in its fiscal Q1, reporting record revenue of $124.3 billion, up 4% year-over-year. Earnings per share touched an all-time high of $2.40, a 10% increase from the previous year.

The technology giant saw strength across product categories and geographic regions. iPhone revenue stood at $69.1 billion, relatively flat year-over-year. However, CEO Tim Cook noted that markets where Apple Intelligence was available showed stronger iPhone 16 performance compared to regions where the AI features had not been launched yet.

Mac and iPad segments demonstrated remarkable growth, with revenue increasing 16% and 15% year-over-year, respectively. The Mac performance was driven by strong uptake of the new M4-powered devices, including MacBook Pro, iMac, and Mac mini. For iPad, growth was fueled by the new iPad mini and iPad Air models.

The Services segment grew sales by 14% year-over-year to $26.3 billion in Q1. This growth was broad-based across Apple's service offerings, with the company now having over 1 billion paid subscriptions across its platform.

Apple’s installed base of active devices reached a new milestone, exceeding 2.35 billion devices worldwide, growing across all geographic segments. This expanding ecosystem provides Apple with significant opportunities for future Services growth.

Is AAPL Stock a Good Buy Right Now?

Looking ahead to the March quarter, Apple expects total company revenue to grow low to mid-single digits year-over-year, with Services continuing to grow at low double-digit rates, despite a projected 2.5% headwind from foreign exchange rates.

Apple Intelligence remains a key strategic initiative, with international expansion continuing in April 2025 to include additional languages such as French, German, Italian, Spanish, Japanese, Korean, and Chinese. Management expressed confidence that these AI features are driving upgrade decisions and enhancing user satisfaction across its product ecosystem.

With gross margins holding steady at 47% and a cash position of $141 billion, Apple maintains the financial flexibility required to invest in innovation while returning capital to shareholders through its ongoing buyback program.

Wall Street expects Apple’s adjusted earnings to grow from $6.75 per share in fiscal 2024 to $8.80 per share in fiscal 2027. In the last 10 years, AAPL stock has traded at an average price-earnings multiple of 31.3 times, which is higher than its current multiple of 28.8 times.

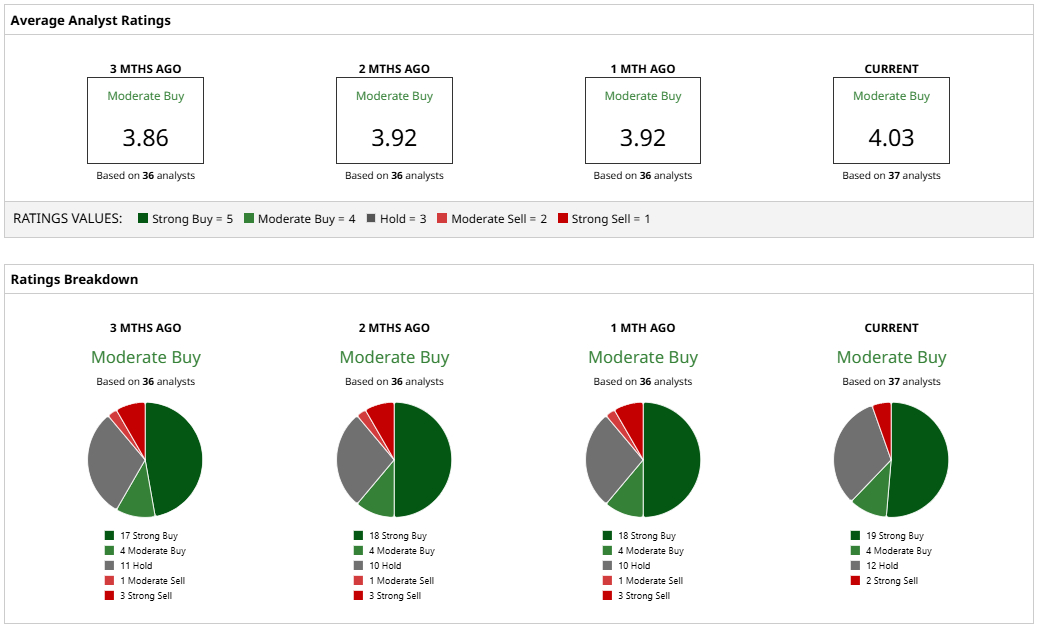

If AAPL stock trades at 20x forward earnings, it will be priced around $176 in early 2027, below its current trading price of $210. Out of the 37 analysts covering AAPL stock, 19 recommend “Strong Buy,” four recommend “Moderate Buy,” 12 recommend “Hold,” and two recommend “Strong Sell.” The average target price for Apple stock is $238.26, indicating 15% upside potential from current prices.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)