5 | Twins

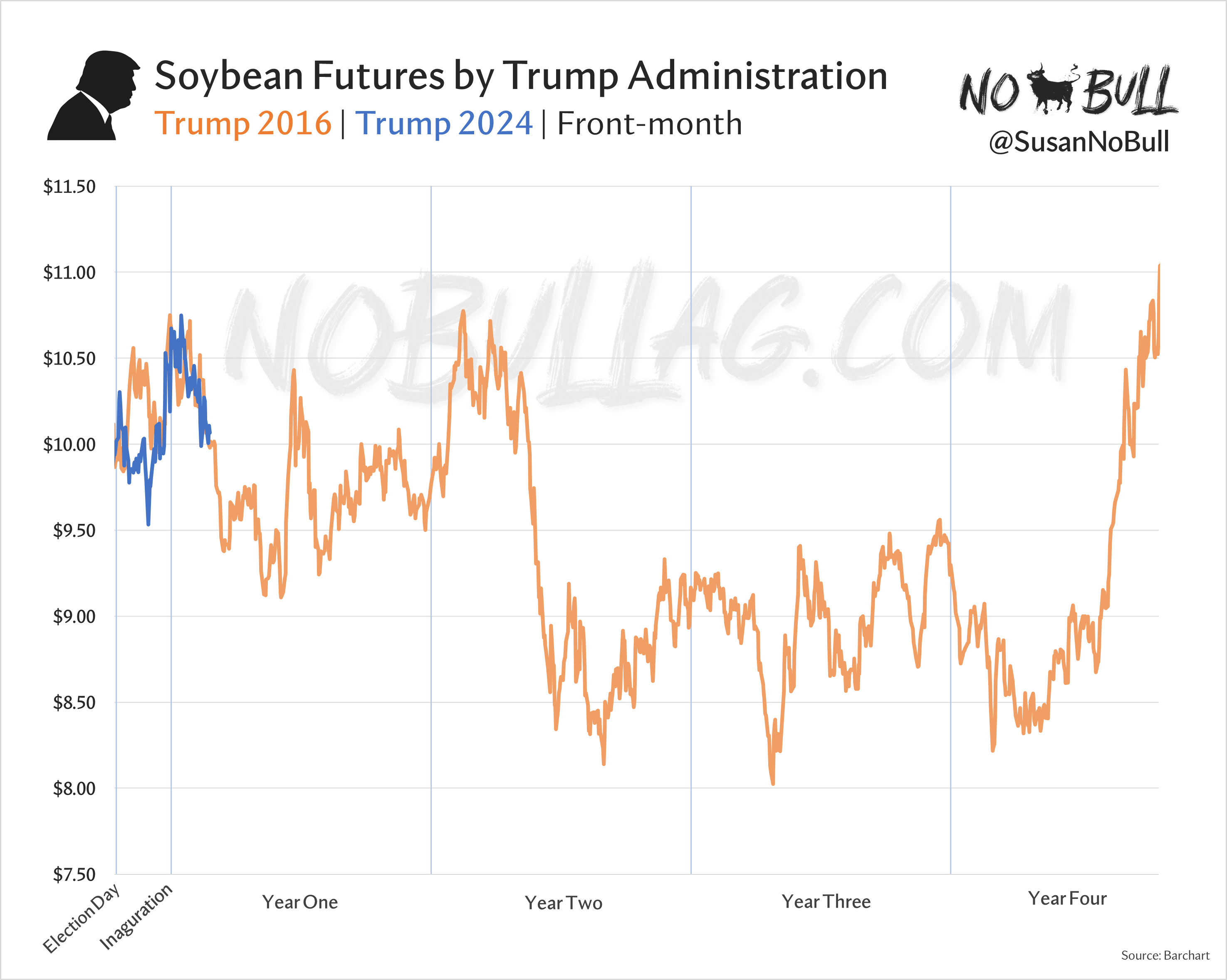

It’s purely coincidental that old crop beans seem to be following the same pattern as they did during Trump's first term in office, but important to note that we didn't dive headfirst into an all-out trade war until the second year of his first term versus a mere 43 days into his term this time around.

4 | Shots fired

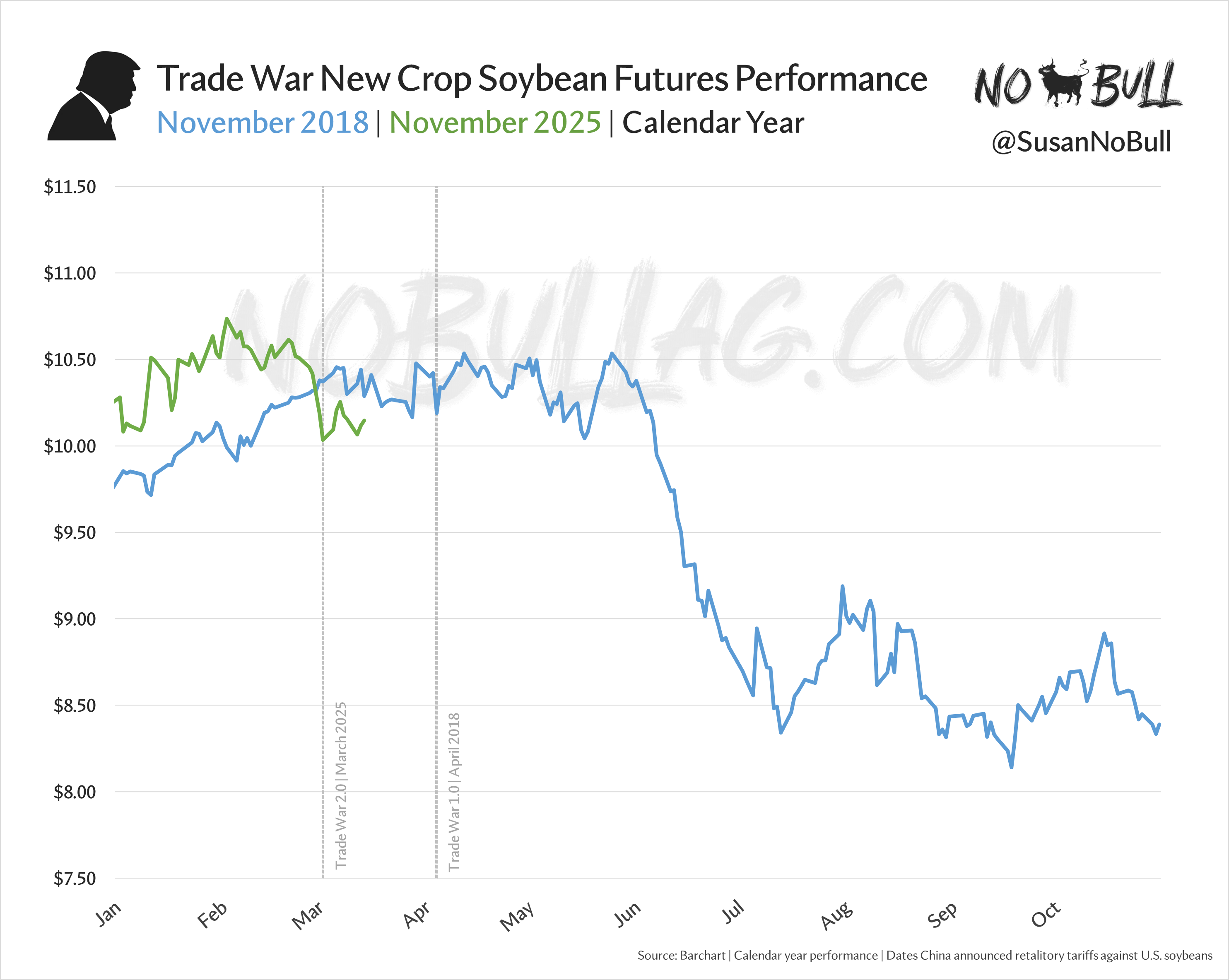

Trade War 2.0 officially got underway in the first few days of March, commencing just shy of seven years after Trade War 1.0 began.

When China announced retaliatory tariffs against the U.S. in wee hours of an early April morning in 2018, it caused new crop soybean futures to collapse 50 cents, before recouping half of their losses by the close.

The real collapse that year did not happen until late-May though, as trade tensions escalated (tariffs against U.S. soybeans went into full effect in early July) and Brazil's RECORD 123.4mmt (4.5bbu) crop plus RECORD 76.1mmt (2.8bbu) exports {up 21% YoY} began to put the whammy on the market.

3 | Off to a great start

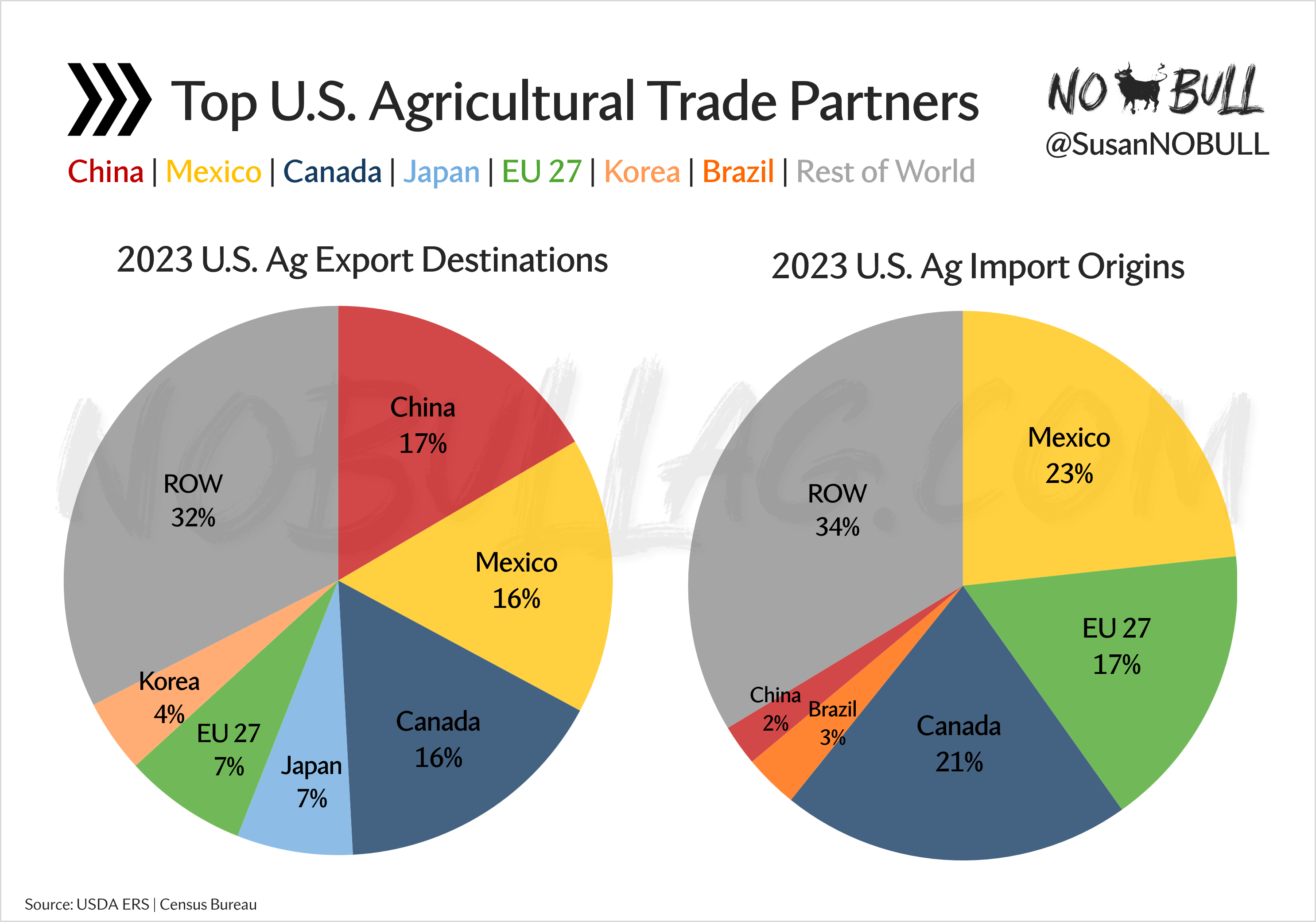

Seven weeks in to Trump's second term and we have successfully angered every major U.S. trading partner in epic fashion as trade tensions escalated with the European Union earlier this week.

China + Mexico + Canada + EU = 56% of US ag export destinations

China + Mexico + Canada + EU = 63% of US ag import origins

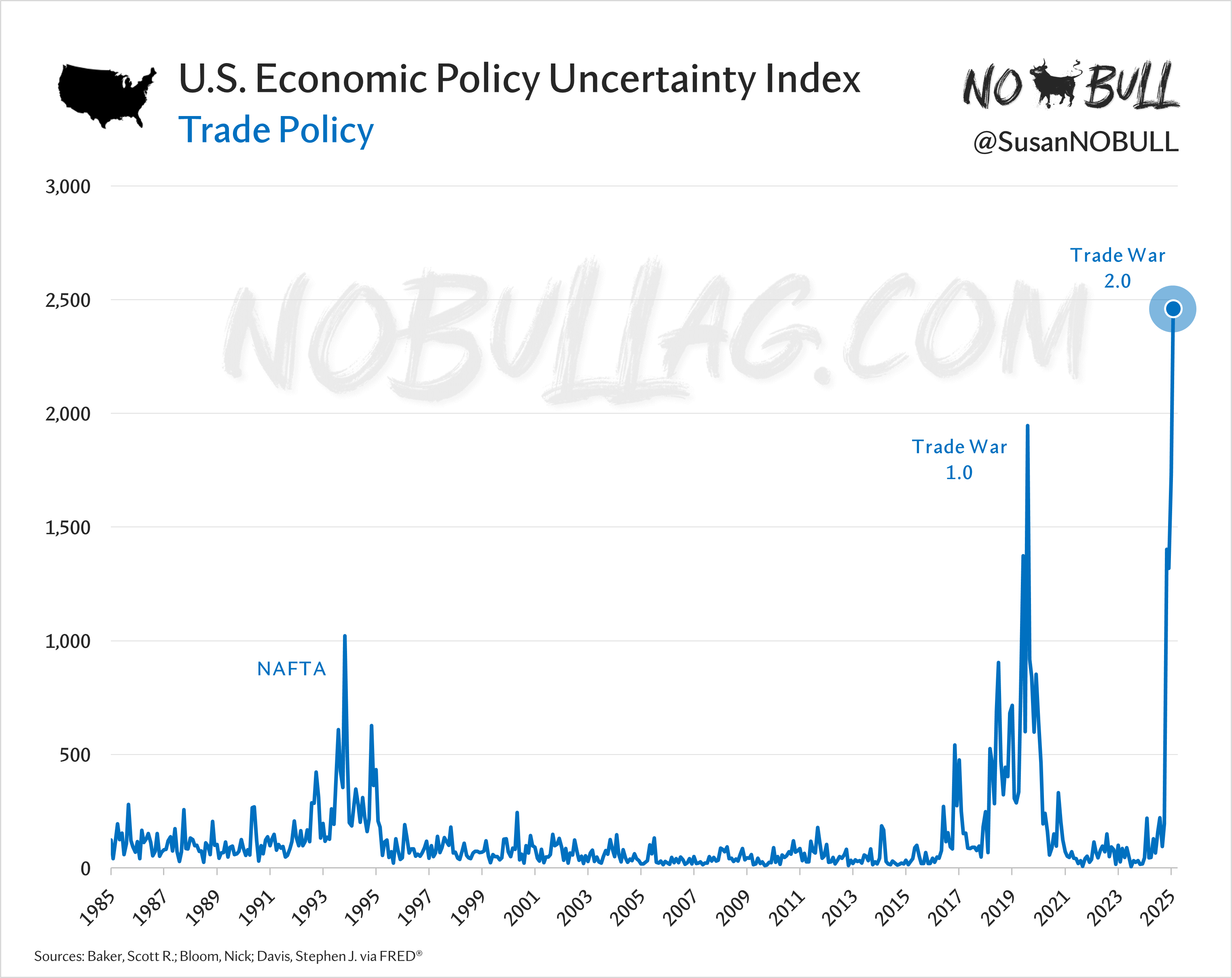

2 | Certainly Uncertain

If you are feeling uncertain, you are not alone.

The U.S. Economic Policy Uncertainty Index for Trade Policy has never been this high:

1 | Number One

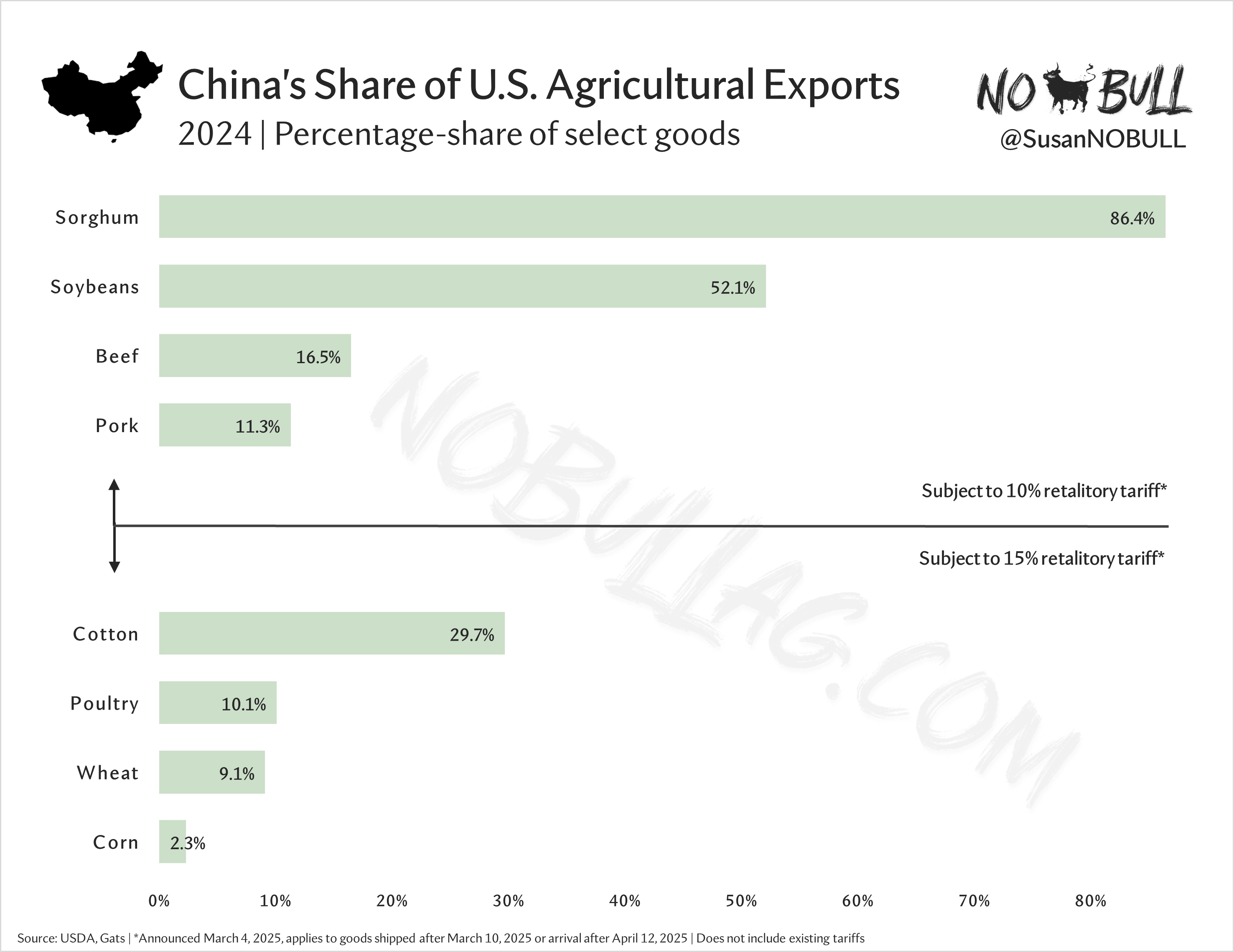

China is the largest commodity consumer in the world and a key market for several U.S. agricultural goods:

For the full version of this post and to subscribe, visit NoBullAg.Substack.com.

Thanks!

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)