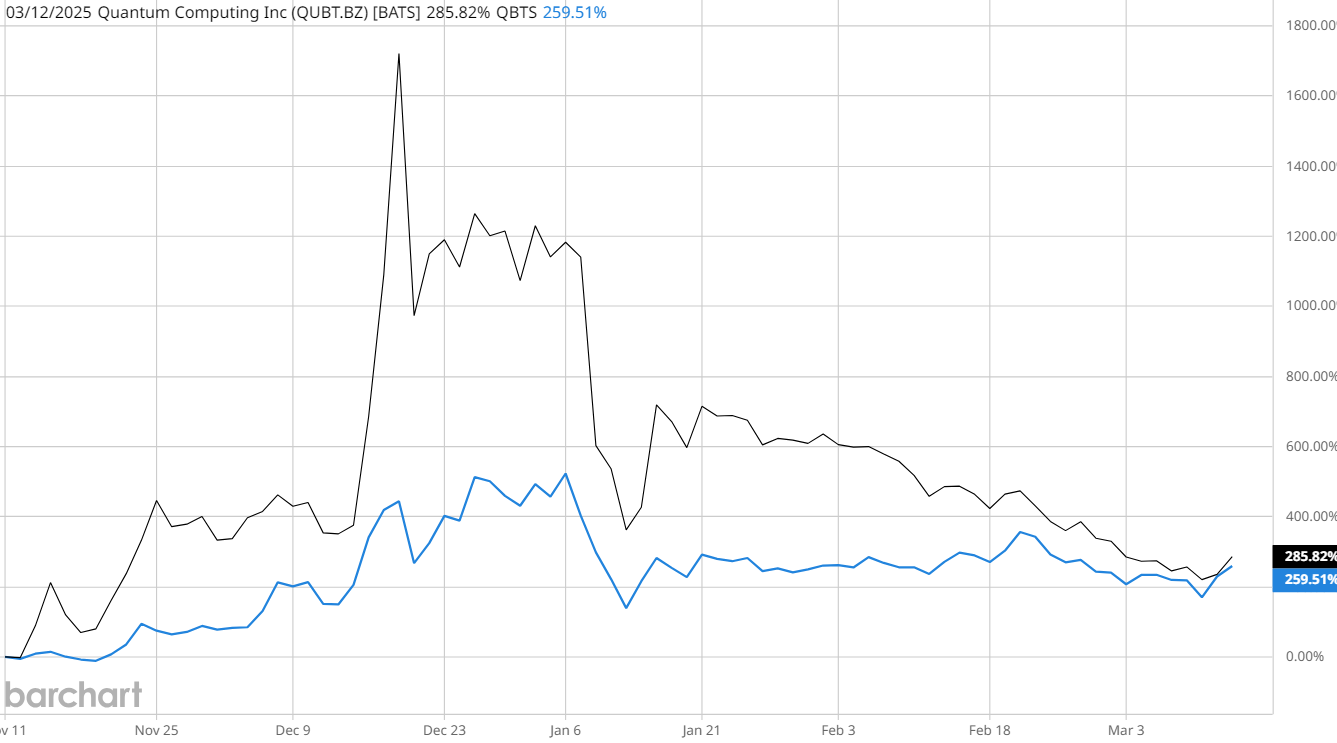

It’s been a mixed session for stocks this Wednesday, but there are some major percentage movers breaking out over on the Nasdaq exchange. Among the top gainers are daily discount website Groupon (GRPN), which set a new year-to-date high earlier, and aptly named quantum computing stock Quantum Computing (QUBT) - currently up 13.4%, and on pace for its biggest daily gain since January.

QUBT stock is climbing alongside industry peer D-Wave Quantum (QBTS), which published a paper today that its CEO Alan Baratz described as a “demonstration of quantum computational supremacy.” QBTS stock is up 9.4% on the news.

Meanwhile, among the notable decliners today is iRobot (IRBT), which is having its worst day since Nov. 6, 2024. Here’s a closer look at what’s behind the big moves in GRPN and IRBT.

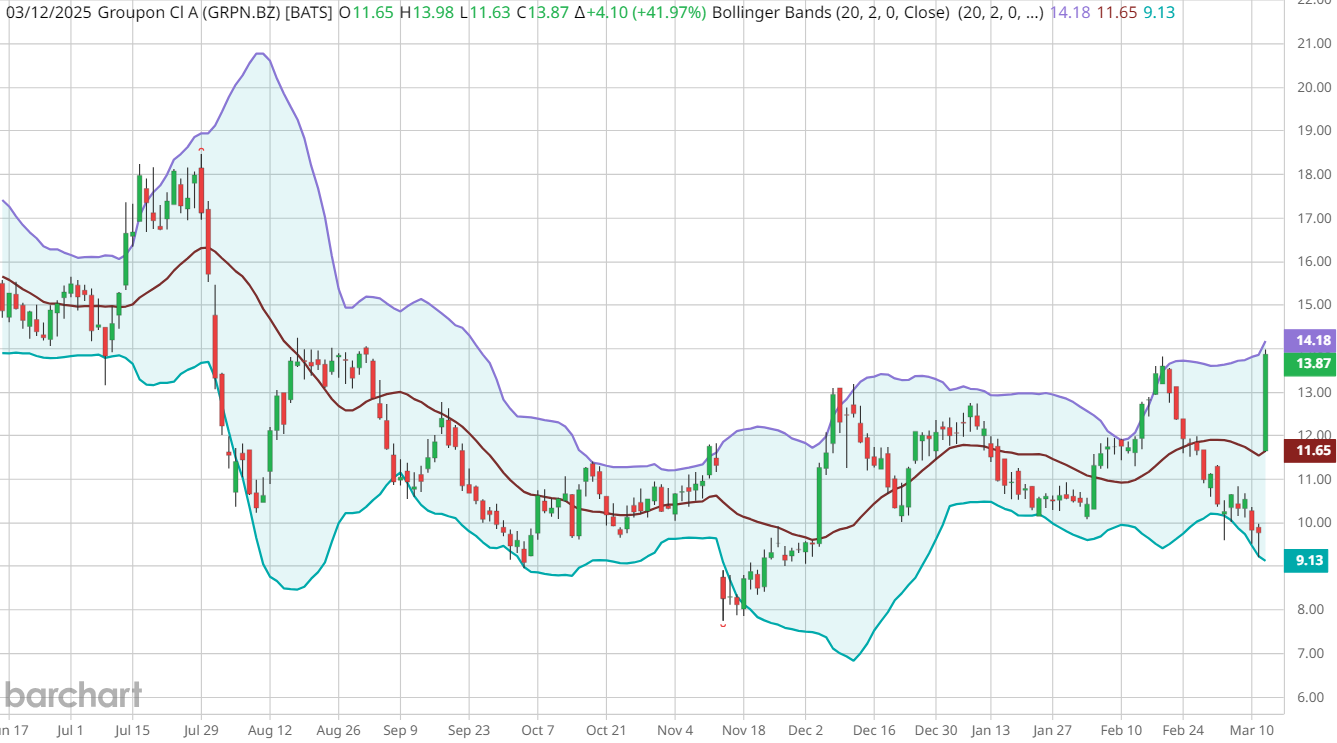

Groupon Stock Soars on Q4 Earnings, 2025 Guidance

Groupon (GRPN) stock is up by a staggering 40.6% intraday after its fourth-quarter revenues of $130.4 million exceeded expectations, despite a 5.3% year-over-year decline. While GRPN posted a loss of $1.20 per share, the company achieved a notable milestone by generating positive free cash flow for the first time since the COVID-19 pandemic, along with an adjusted EBITDA of $18.7 million.

Looking forward, Groupon has provided an optimistic outlook for 2025, projecting revenues between $493-500 million, representing flat to 2% growth, and forecasting adjusted EBITDA of $70-75 million.

The North American market emerged as a bright spot in Groupon's operations, with local billings growing by 8% to $276.4 million in the fourth quarter, driven by 3% unit growth and higher average order values. This performance marks a significant turnaround from the technical difficulties experienced in the third quarter of 2024, demonstrating the company's resilience under CEO Dusan Senkypl's leadership.

iRobot Craters on Viability Concerns

iRobot Corporation (IRBT) has plunged 34.9%, triggered by alarming fourth-quarter results and serious concerns about its future viability. The company's financial performance has deteriorated dramatically, with fourth-quarter sales dropping 44% year-over-year to $172.03 million, accompanied by an adjusted loss per share of $2.06.

The situation has become so dire that iRobot's management has expressed "substantial doubt" about the company's ability to continue operations beyond the next 12 months, leading to the cancellation of their earnings call and withdrawal of 2025 guidance. In response to these challenges, the Board of Directors has initiated a comprehensive strategic review to explore various options, including potential sale or refinancing, while implementing aggressive cost-cutting measures.

iRobot’s workforce has been reduced by 51%, bringing the total employee count down to 541, as part of their desperate attempts to stabilize operations. Despite launching their largest product lineup in company history, featuring new Roomba models with advanced features, iRobot continues to struggle with poor consumer demand and intense competitive pressures. The collapse of the planned $1.7 billion acquisition by Amazon (AMZN) in January 2024 has significantly complicated the company's path to recovery, leaving it to face its mounting challenges independently.

The combination of a heavy debt burden, unfavorable macroeconomic conditions, and declining market share has created a perfect storm that threatens iRobot's survival in the consumer robotics industry. The company's future now hangs in the balance as it desperately seeks solutions to address its financial instability and operational challenges.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Tada%20Images%20via%20Shutterstock.jpg)

/Lululemon%20Athletica%20inc_%20leggings%20by-%20Sorbis%20via%20Shutterstock.jpg)