After a strong 2024 for SoundHound AI (NASDAQ:SOUN), it's been a rough start to 2025. However, the stock rallied from its recent lows following a strong fourth-quarter earnings report. Shares have nearly doubled over the past year, as of this writing, but they're down 50% year to date.

SoundHound popped up on investors' radar after chip giant Nvidia revealed an investment in the artificial intelligence (AI) company in Feb. 2024. However, the stock has tumbled the past few weeks following the news that Nvidia exited its position late last year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Let's take a look at the company's latest developments to see what may lie ahead for investors.

Revenue is soaring

SoundHound continued to grow rapidly in Q4 as revenue more than doubled year over year to $34.5 million. Its adjusted net loss increased slightly from $0.04 per share to $0.05 per share. Both results easily surpassed the analyst consensus for a loss of $0.10 on revenue of $33.7 million, as compiled by Factset.

The company finished the year with a cumulative subscriptions and bookings backlog of $1.2 billion, up more than 75%. The average duration of its contracts is around six years, and the size of the backlog is a bullish sign for future revenue growth.

In its automotive segment, the company said it saw double-digit unit price expansion, but that unit growth was hurt by some macroeconomic factors pressuring the auto industry. This was helped by existing customers upgrading to SoundHound Chat AI Automotive with generative AI, which adds additional royalties per unit. It also noted that it won deals with four electric vehicle (EV) manufacturers, including Lucid and Togg, and several large automakers were pursuing proof-of-concept for its new technology, which allows drivers to discover nearby restaurants and place orders.

Image source: Getty Images.

Within the restaurant vertical, SoundHound said AI customer-service adoption at restaurants is increasing, and it works with 30% of the top quick-service restaurants. Burger King recently went live with its solutions in the U.K., while it saw a number of other expansions and wins. It also noted that it works with four of the five largest pizza chains in the world.

However, the company is starting to win business outside of its two main verticals with the help of its Amelia acquisition. Management said SoundHound had four notable wins in the healthcare space, while it is working with 70% of the top financial institutions in the world. However, its biggest win in the quarter was in the utility sector, a completely new vertical for the company.

Looking ahead, SoundHound raised its full-year revenue outlook for 2025. It now expects revenue between $157 million and $177 million, up from a prior outlook of $155 million to $175 million. It's the second time the company has increased its 2025 guidance before even reporting Q1 results for the year.

| Original Forecast (Aug. 2024) |

Prior Forecast |

New Forecast |

|

|---|---|---|---|

| 2025 revenue | At least $150 million | $155 million to $175 million | $157 million to $177 million |

Can the stock rebound?

Operationally, SoundHound is enjoying solid momentum across various industry verticals, and the Amelia acquisition looks to be a game changer.

Looking ahead, the AI market continues to evolve quickly, and the company is ready to turn to agentic AI. While existing generative AI produces results based on user prompts, agentic AI can go out and complete tasks with little human interaction. SoundHound is building and testing agentic use cases across its major verticals. This is a big opportunity but still very early. Meanwhile, it will have to compete against companies like Salesforce, which has its own industry AI agents already in the market.

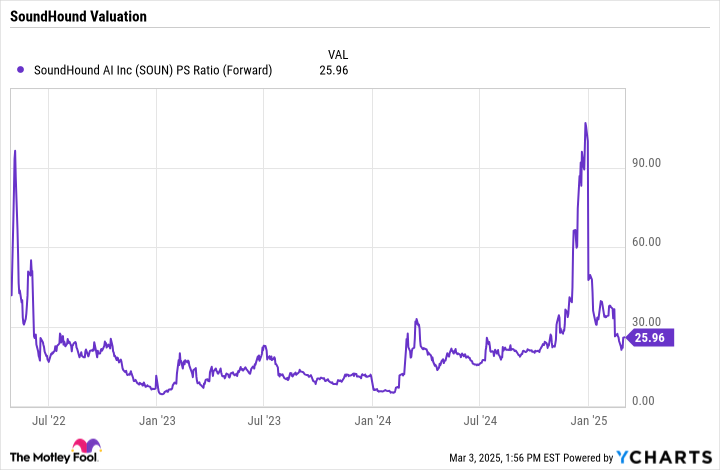

From a valuation perspective, SoundHound trades at a price-to-sales (P/S) multiple of 26 times the consensus analyst estimate for 2025.

Data by YCharts.

While SoundHound has a big opportunity in front of it, its valuation is still quite elevated, despite the stock's big decline from its previous peak. If it can become the AI voice leader across industries and successfully move into agentic AI, then the upside potential is promising. However, it remains a small player in a nascent industry full of tech giants -- who the eventual winners will be is very much uncertain.

That means SoundHound remains a speculative growth stock, and I'd prefer to see even more of a pullback before buying in.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $718,876!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Geoffrey Seiler has positions in Salesforce. The Motley Fool has positions in and recommends FactSet Research Systems, Nvidia, and Salesforce. The Motley Fool has a disclosure policy.

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)