/CPU%20Chip.jpg)

Super Micro Computer (SMCI) shares extended gains on Feb. 19, on the back of a dramatic surge in bullish options activity, signaling rising confidence in the artificial intelligence (AI) server firm.

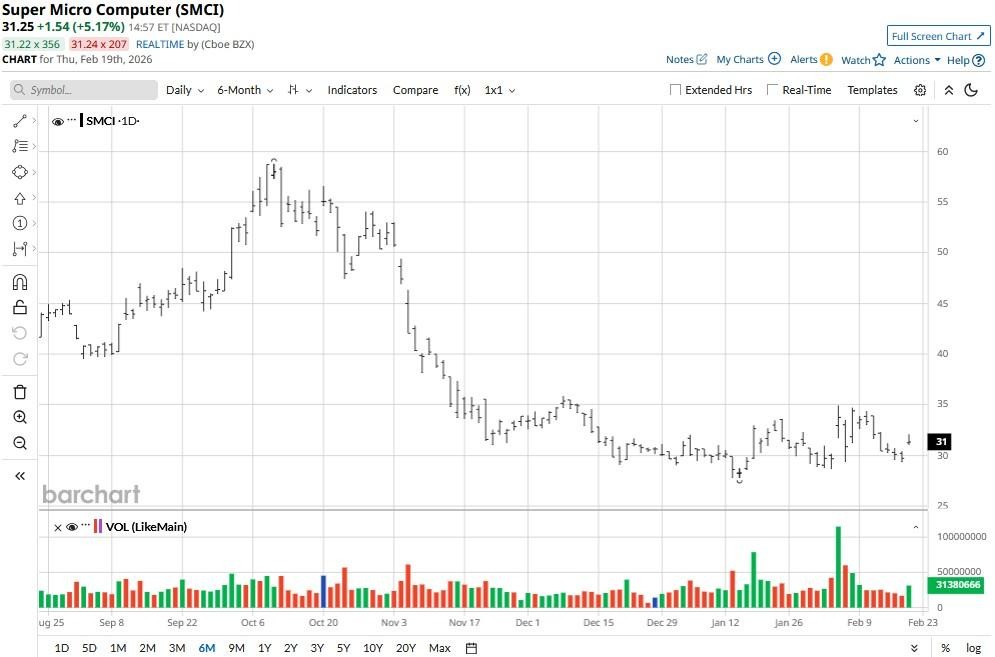

As derivatives traders flooded the tape with call orders, SMCI gapped up and reclaimed its 50-day moving average (MA), indicating bullish momentum may sustain in the near term.

Despite today’s rally, however, Supermicro stock remains down about 45% versus its October high.

Is There Any Further Upside Left in Supermicro Stock?

Interestingly, options traders aren’t alone in turning bullish on SMCI stock. Recent insider activity suggests a similar sentiment is building among high-ranking officials as well.

In early February, Supermicro’s chief executive, Charles Liang, and its chief of finance, David Weigand, loaded up on company shares at an average price of about $33.33.

These investments imply that those with inside knowledge view Super Micro Computer as undervalued at current levels.

Moreover, SMCI is currently trading at a forward price-to-earnings (P/E) multiple of less than 17x currently, which makes it exceptionally inexpensive to own for a business that sits right at the heart of the AI revolution.

Why Else Are SMCI Shares Worth Owning in 2026?

Long-term investors should consider gaining exposure to SMCI shares also because the company’s recent guidance for the current quarter topped Street estimates by an impressive $2.13 billion.

And as its Data Center Building Block Solutions gain scale, a favorable shift in the profit mix may boost margins, potentially enabling Supermicro to shatter this blockbuster guidance.

Moreover, Supermicro’s deep ties to Nvidia (NVDA) and other chipmakers ensure early access to cutting-edge GPUs, strengthening its role as a preferred supplier for hyperscale AI deployments.

Note that SMCI’s relative strength index (14-day), despite recent gains, sits at 51 only, signaling the bullish momentum is far from exhaustion for now.

What’s the Consensus Rating on Super Micro Computer?

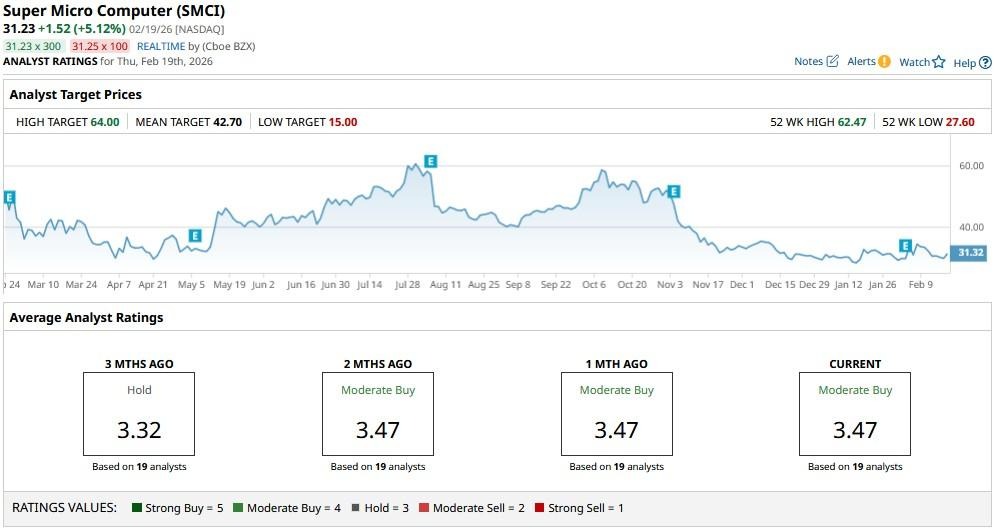

Wall Street analysts seem to agree with insiders that Supermicro shares are undervalued at current levels.

The consensus rating on SMCI currently sits at “Moderate Buy,” with the mean target of roughly $43 indicating potential upside of another 35% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)