Walmart (WMT) stock is in focus today after the retail behemoth reported market-beating financials for its Q4 as the share of e-commerce sales climbed to a record 23% of its overall sales. And while WMT issued conservative guidance for the full year due to “some pressure on the lowest income cohort,” options traders remain convinced the company’s share price will push higher in 2026.

Their confidence in Walmart shares’ future performance is particularly significant given it's already up about 12% versus the start of this year.

Where Options Data Suggests Walmart Stock Is Headed

According to Barchart, derivatives data for Walmart remains largely skewed to the upside, with options pricing indicating the retail stock could be trading at $139 by mid-May.

And technicals seem to substantiate that bullish narrative. As of this writing, WMT shares sit decisively above their key moving averages (50-day, 100-day, 200-day), reinforcing that bulls are firmly in control.

Note that Walmart, alongside better-than-expected numbers for its fiscal Q4, announced a new $30 billion stock buyback plan as well, signaling confidence in its long-term growth and shareholder value.

A 0.74% dividend yield makes WMT even more attractive to own in 2026.

Why Jan Kniffen Remains a Permabull on WMT Shares

A strong Q4 featuring growing presence in e-commerce and a 37% year-on-year growth in high-margin advertising business made industry expert Jan Kniffen reiterate his long-standing “permabull” stance on Walmart shares.

In a post-earnings interview with CNBC, Kniffen said the retail behemoth is no longer just “playing catch-up” in digital sales; it has successfully turned its massive physical footprint into a high-speed distribution network.

According to him, WMT is strongly positioned to diversify its supply chain and lean on domestic production to keep prices lower while maintaining profitability above its rivals even amid tariffs uncertainty.

Walmart’s history of closing both March and April in green makes it all the more exciting in the near term.

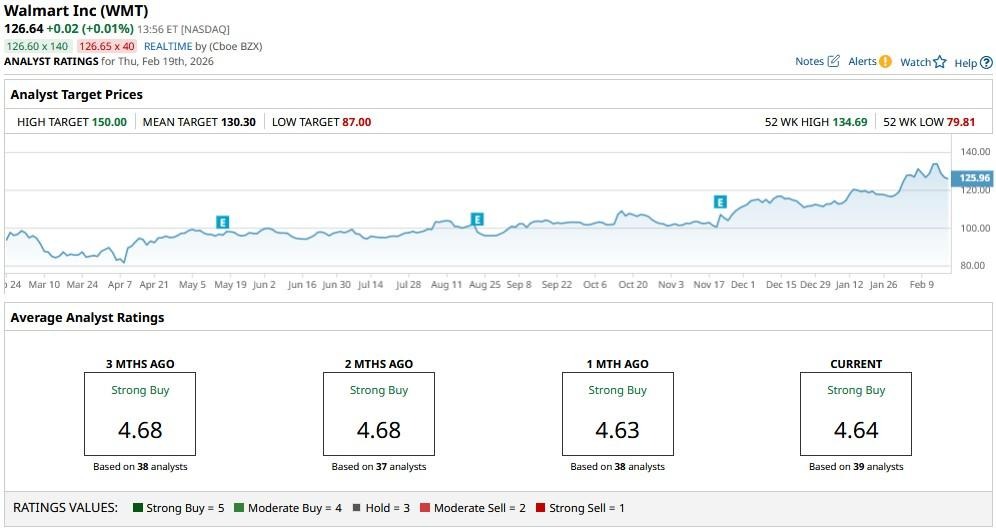

Walmart Is a Buy-Rated Stock Among Wall Street Analysts

What’s also worth mentioning is that Wall Street firms remain bullish as ever on Walmart after its Q4 earnings.

The consensus rating on WMT shares sits at a “Strong Buy” currently, with price objectives as high as $150 indicating potential upside of another 20% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)