In a September 25, 2025, Barchart article on oil products heading into the final months of 2025, I commented that:

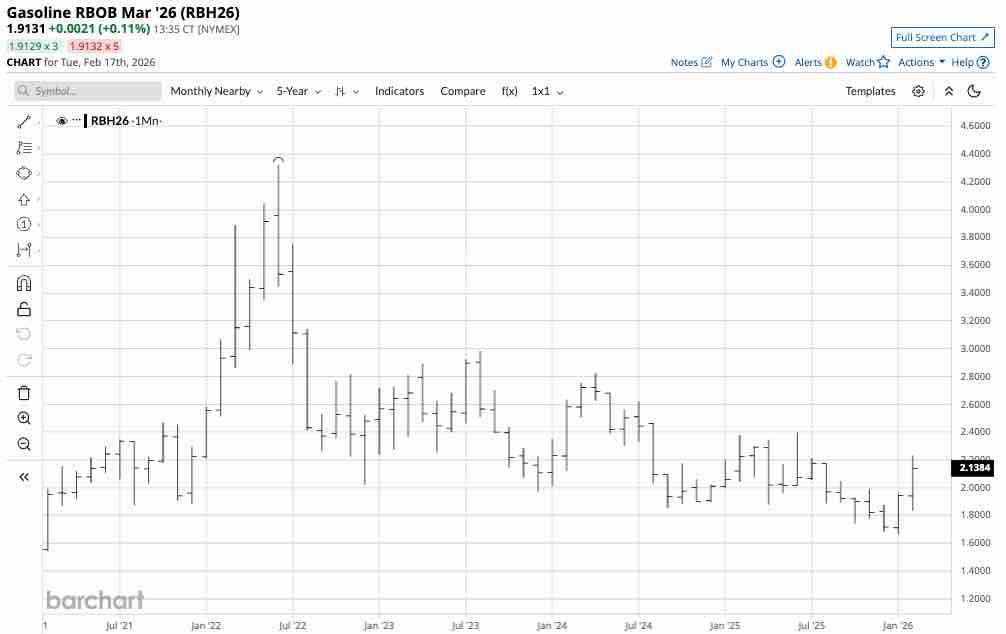

Gasoline is a seasonal fuel. Prices tend to peak during spring and summer and decline during late fall and winter as poor weather conditions cause drivers to put fewer miles on their odometers. The trend in gasoline futures is bearish in late September 2025 as the fuel heads into the low-demand season.

Nearby NYMEX gasoline futures were trading at $1.9580 per gallon on a wholesale basis on September 24, 2025, as winter approached.

The price fell to a low in January, during the heart of winter

Gasoline prices fell to a seasonal low in January 2026.

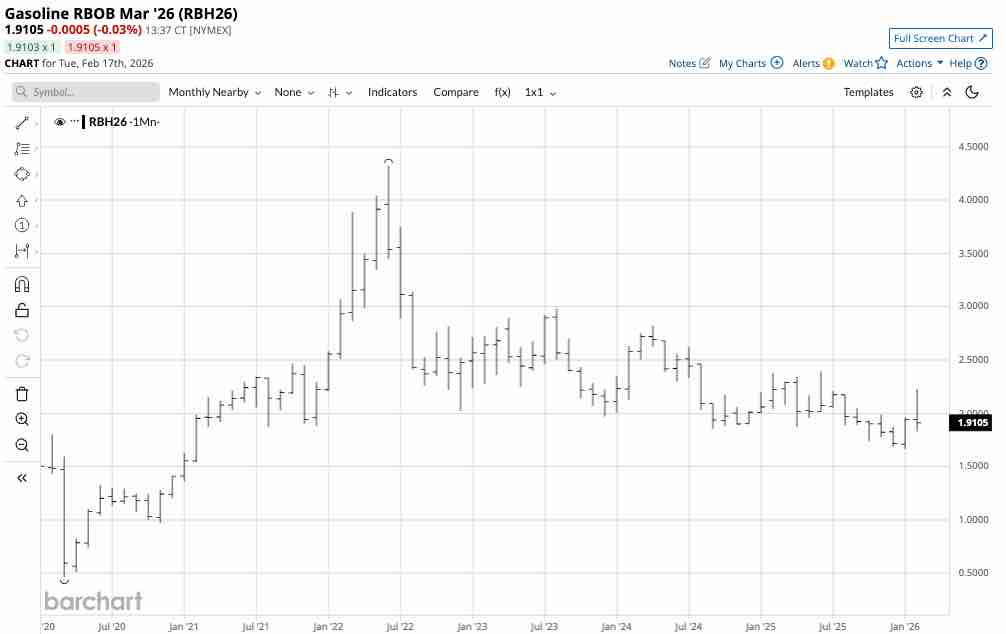

The continuous monthly chart shows that nearby NYMEX gasoline futures reached a low of $1.6656 per gallon wholesale during January, where they found a bottom.

Prices have recovered in February as the driving season approaches

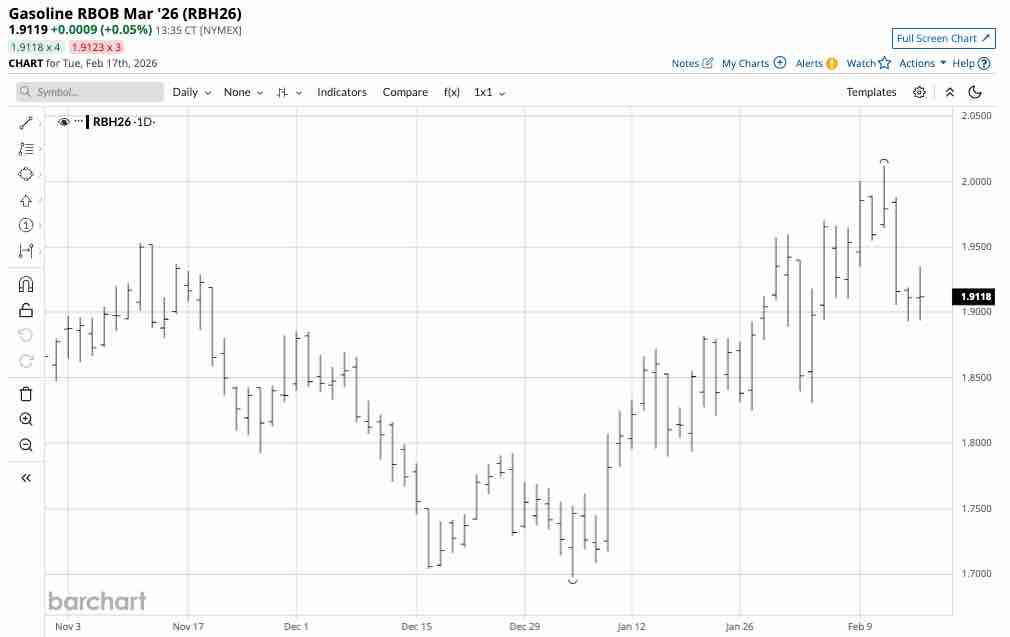

NYMEX RBOB gasoline futures for March delivery fell to $1.6978 per gallon wholesale on January 5, 2026.

As the daily chart shows, gasoline futures have made higher lows and higher highs, rising 18.5% to the latest high of $2.0120 per gallon wholesale on February 11, 2026.

Gasoline prices are rising as the 2026 driving season approaches. Drivers will begin putting more clicks on their odometers over the coming weeks and months as the weather improves.

Crude oil, the ingredient in gasoline, is likely to become volatile for two reasons

Crude oil, the energy commodity that is the primary ingredient in gasoline production, faces bullish and bearish factors in February 2026.

U.S. energy policy under the Trump administration favors a “drill-baby-drill” and “frack-baby-frack” approach to U.S. crude oil production, favoring lower prices. Meanwhile, the U.S. military operation in Venezuela that deposed the Maduro regime could cause investment to flow back into the country with the world’s leading petroleum reserves, putting additional pressure on oil prices.

However, the increasing tensions between the U.S. and Iran are bullish. The U.S. military buildup in the Middle East and threat of hostilities could close down the Strait of Hormuz, a critical chokepoint through which one-third of the world’s seaborne crude oil flows. Any flare-ups or a regional war could send crude oil prices soaring.

Seasonality favors higher gasoline prices, but we could see extreme volatility

Crude oil faces bullish and bearish factors, pulling the price in opposite directions in February 2026. Prepare for the potential of extreme volatility in crude oil prices in the coming weeks and months, which could ripple through gasoline prices.

The monthly continuous NYMEX RBOB gasoline futures chart shows that critical technical resistance that would negate the current bearish trend in place since the $4.3260 high in June 2022 is currently at $2.3950 per gallon. A break above $2.40 per gallon could cause a technical rally. Seasonality favors the upside, as the gasoline market moves toward peak demand.

UGA is the ETF that tracks U.S. gasoline futures

The most direct route for a risk position in gasoline is through the CME’s NYMEX gasoline futures and options. The U.S. Gasoline Fund (UGA) is an ETF that tracks NYMEX gasoline prices. At $67.93 per share, UGA had over $84.63 million in assets under management. UGA trades an average of over 33,500 shares per day and charges a 0.96% management fee.

The latest rally in NYMEX March RBOB gasoline futures lifted the price by 18.5% from early January through February 11.

Over the same period, UGA rallied 17.8%, from $60.70 to $71.50 per share, as the gasoline ETF did an excellent job tracking gasoline prices.

Seasonality favors a higher gasoline price over the coming weeks and months. A break above the $2.40 per gallon wholesale critical technical resistance level in the nearby futures could trigger a substantial rally, lifting the UGA ETF as it follows the futures.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)