5 | King Corn

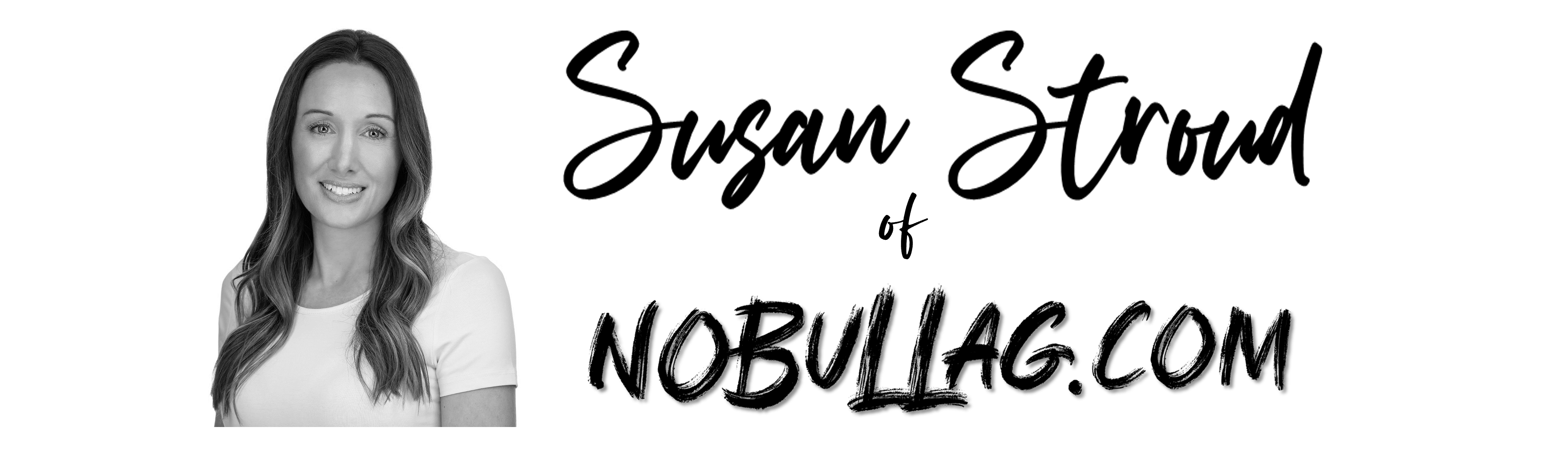

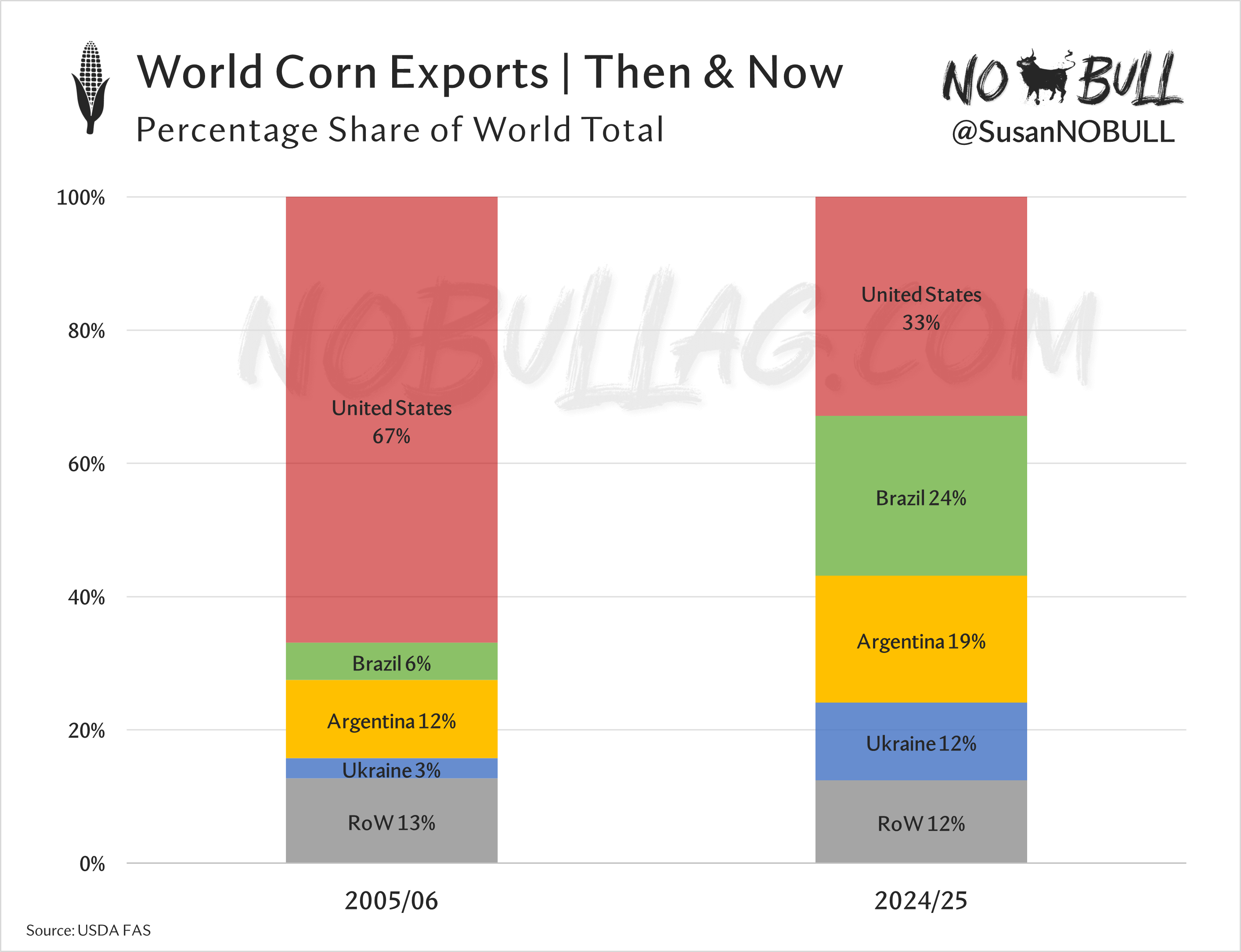

Corn export sales remain strong, with total 2024/25 commitments surpassing 1.9 billion bushels in the week ending February 20, up 28% year-on-year and 60% higher than this point in 2022/23.

Cumulative commitments continue to exceed the pace needed to hit USDA’s current 2.45 billion bushel full-year estimate by nearly 200 million bushels.

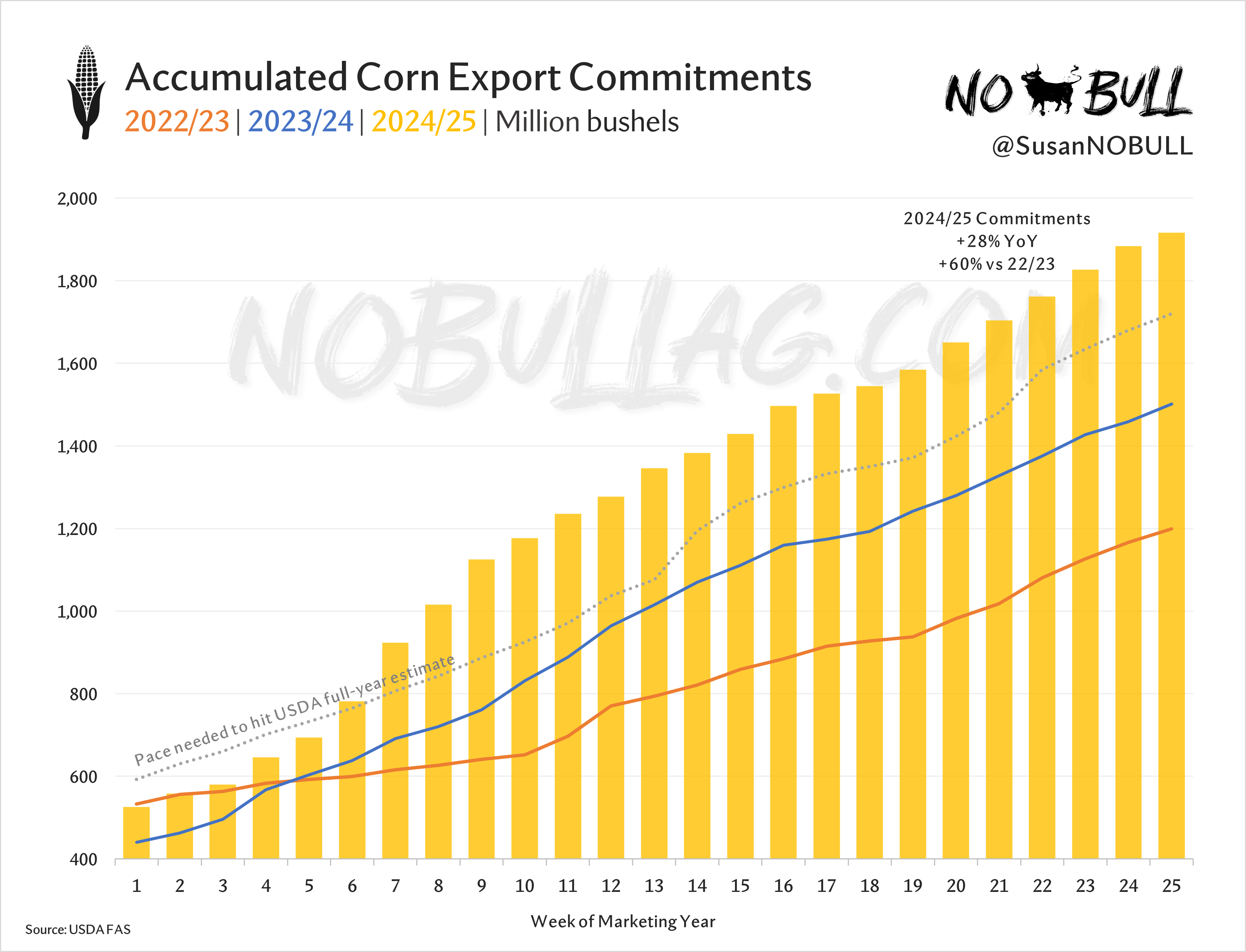

2024/25 is quickly closing in on 2021/22’s pace and chugging right along toward 2020/21 (record year) - and that is WITHOUT any meaningful commitments from China.

(remember - China purchased a record 840mbu of US corn in 2020/21 and 540mbu in 2021/22, making for the US’ two largest export programs on record)

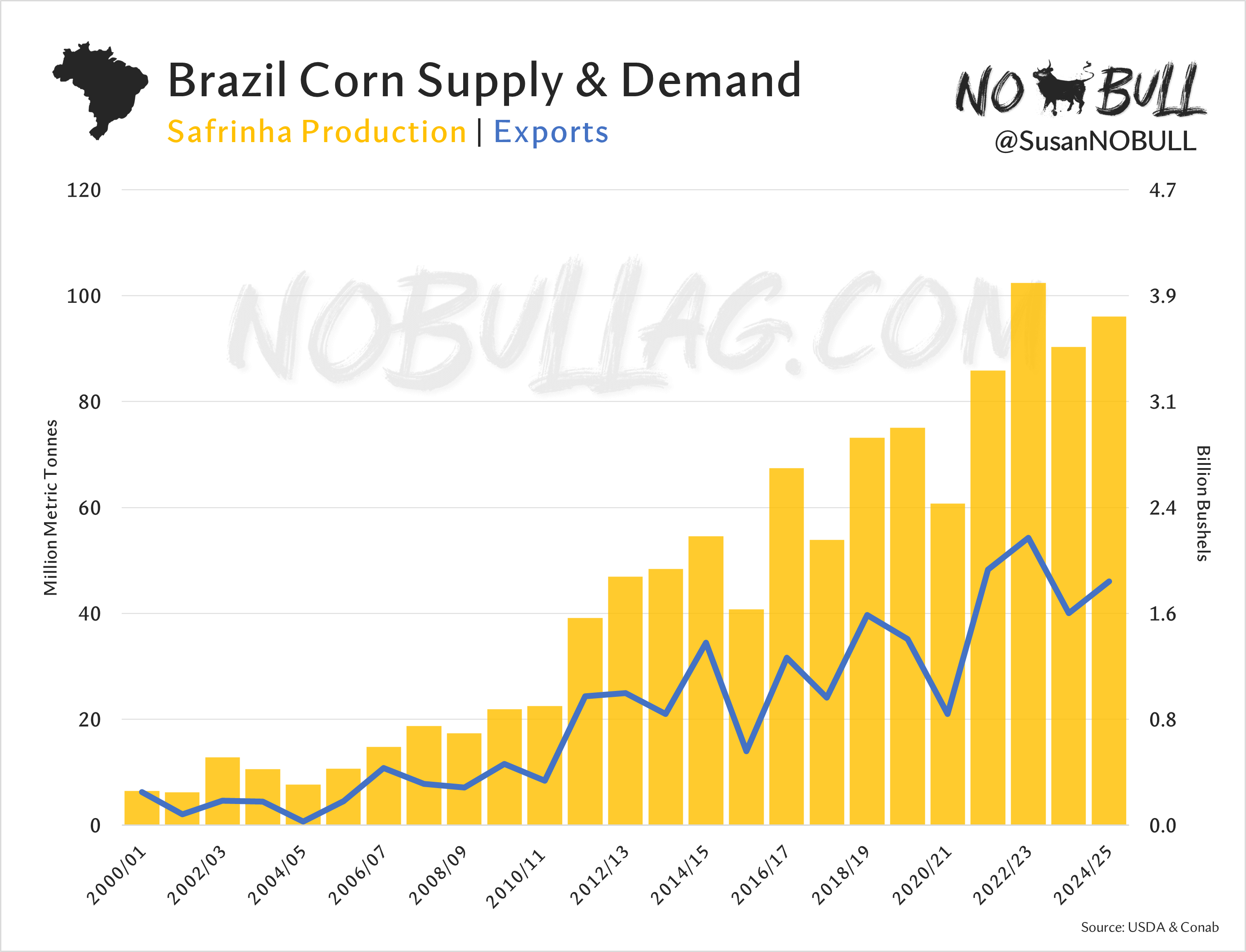

4 | Slimdown

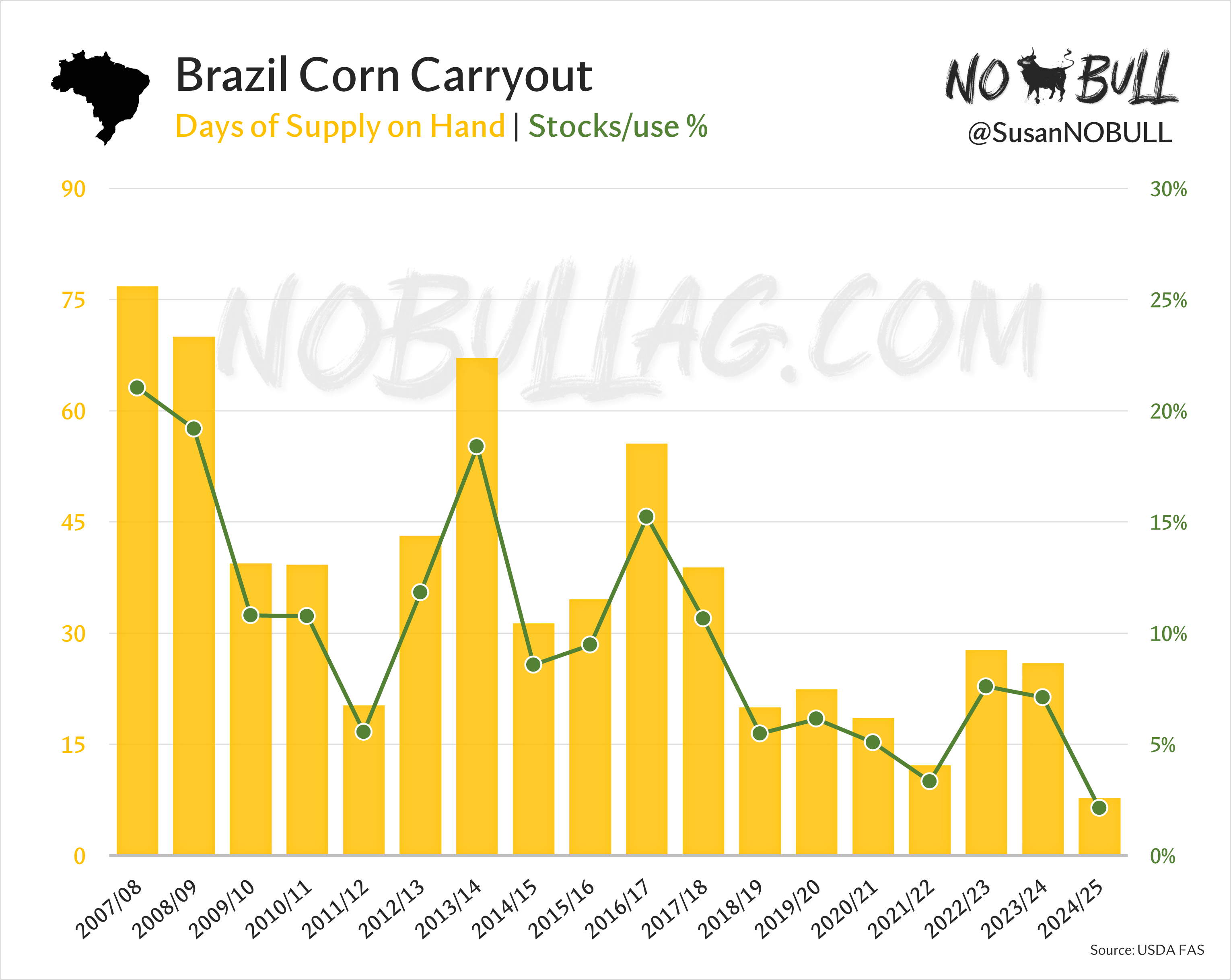

One of the largest fundamental drivers behind the United States’ return to corn export glory in 2024/25 is the fact Brazil’s stocks are on Ozempic.

Brazil’s corn stocks/use ratio sits at 2.1% in 2024/25 with an estimated 7.8 days of supply on hand, down from 7% and 26 days the year(s) before, leaving little room for error.

For reference, the U.S. currently sits at a 10.2% stocks/use ration with an estimated 37 days of supply on hand at the end of 2024/25.

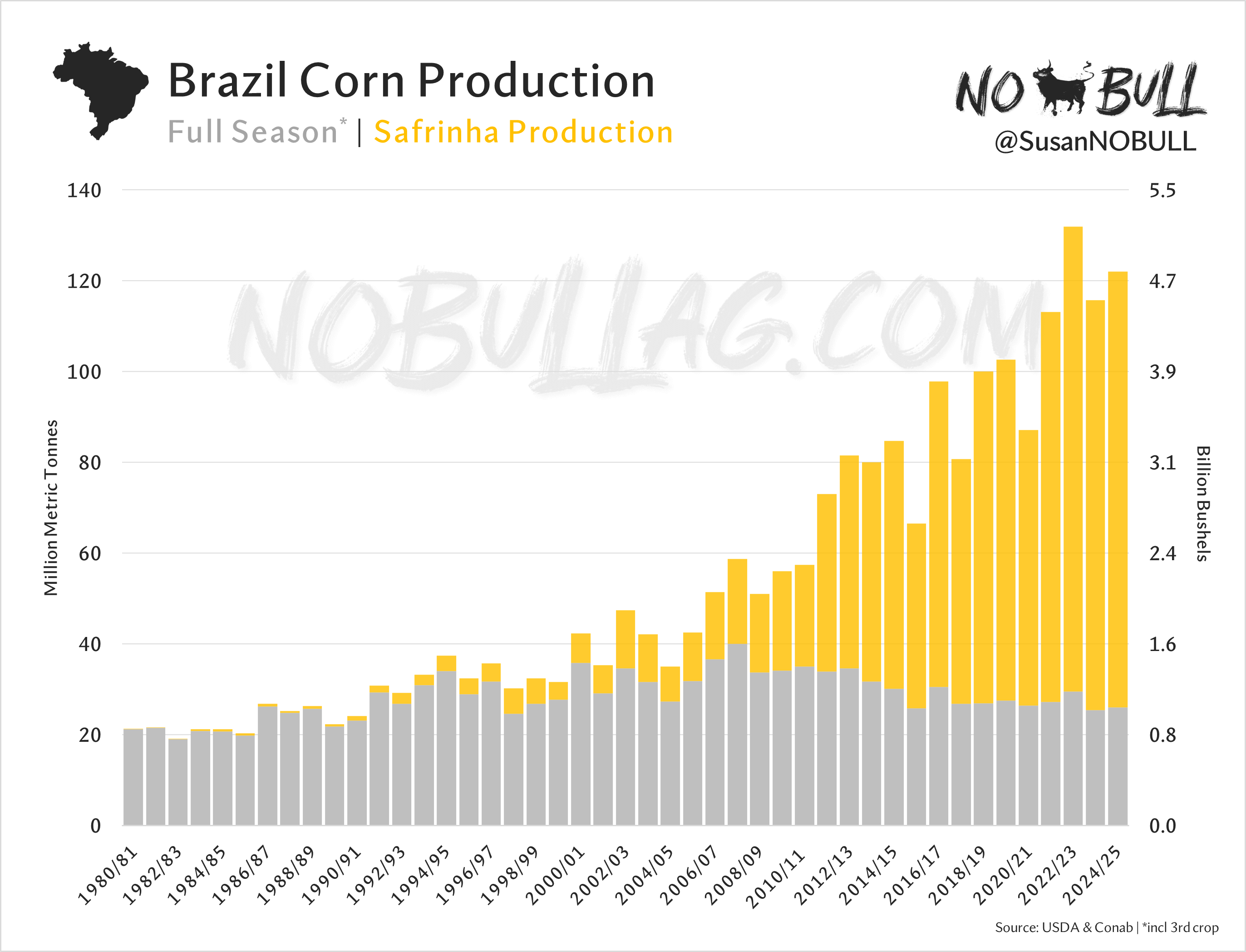

3 | The pressure is on

Brazil's tight stocks situation is why so much emphasis has been put on the success of Brazil’s Safrinha (second) corn crop in 2025.

The Safrinha crop now accounts for 80% of Brazil’s total corn production each year.

Today, Safrinha production is 2.5x larger than it was just 10 years ago and has grown 800% since 2005.

2 | Cause and effect

The boom in Safrinha production is directly related to Brazil’s corn export growth in recent years:

1 | World Corn Exports: Then & Now

What a difference 20 years can make:

For the full version of this post and to subscribe, visit NoBullAg.Substack.com.

Thanks!