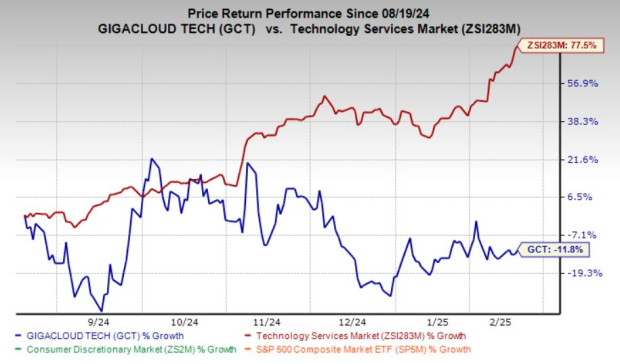

GigaCloud Technology Inc. GCT has faced a challenging few months, with its stock plummeting 12% in the last six months. This decline contrasts sharply with the industry’s 78% growth. Meanwhile, competitors such as Revolve Group RVLV recorded a 28% rise, while Beyond BYON suffered a 15% drop in the same period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The question now arises: does this dip present an attractive buying opportunity? Here’s an in-depth analysis to help investors decide.

GCT’s B2B Marketplace Expansion

GCT leverages its supplier-fulfilled retailing model alongside advanced research and development to optimize its cloud infrastructure. This strategic approach elevates its B2B selling and sourcing capabilities, catering to the growing demand for large-parcel merchandise.

The results of these efforts are evident. In the third quarter of 2024, GigaCloud Marketplace reported a 70.2% year-over-year surge in sales, an 80.2% increase in Gross Merchandise Value, an 85.5% rise in active buyers, and 41.8% growth in active third-party sellers. GCT’s commitment to expanding its marketplace is further exemplified by its introduction of a Branding-as-a-Service (BaaS) offering, which enhances product competitiveness for sellers. Additionally, GCT’s efforts to diversify its supplier base, incorporating products from Colombia, Mexico and Turkey, have bolstered product variety and buyer satisfaction. Expanding its global fulfillment network ensures the company can meet rising marketplace demand effectively.

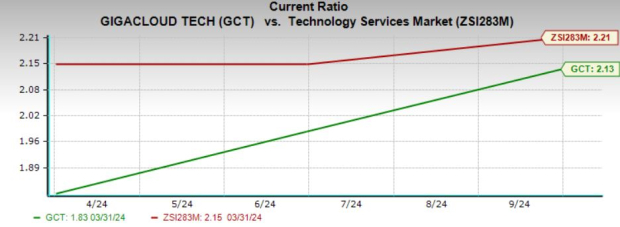

GCT’s Strong Liquidity for Sustainable Growth

GCT boasts a robust liquidity position, with a current ratio of 2.13 as of the third quarter of 2024, compared with the industry average of 2.21. A current ratio exceeding 1 indicates financial stability, enabling GCT to meet short-term obligations and invest in growth initiatives. This financial flexibility positions the company to navigate market challenges while pursuing long-term opportunities.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

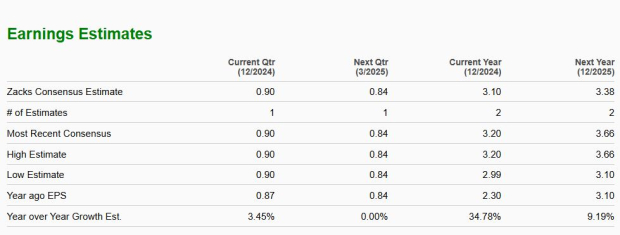

GCT’s Promising Sales and Earnings Growth

Market analysts remain optimistic about GCT’s growth trajectory. The Zacks Consensus estimate for 2024 projects sales to reach $1.16 billion, marking a 64.1% year-over-year increase, while earnings per share (EPS) are expected to grow 34.8% to 3.1 cents. Looking ahead to 2025, sales are anticipated to rise by 14.3%, with EPS expected to grow an additional 9.2%. These projections reflect the company’s solid fundamentals and capacity to sustain momentum.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Evaluating the Right Entry Point

GCT has seen a decline in recent months, underperforming its industry. However, its strong B2B marketplace expansion, impressive sales growth and financial stability support a long-term positive outlook. With continued marketplace momentum and promising revenue projections, GCT remains fundamentally strong. While short-term volatility persists, its liquidity and growth initiatives suggest resilience. Investors should hold the stock, adopting a wait-and-see approach to assess sustained execution and broader market trends before making further moves.

Currently, GCT carries a Zacks Rank #3 (Hold), making it an attractive option for those looking to capitalize on its promising trajectory. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Revolve Group, Inc. (RVLV): Free Stock Analysis Report

GigaCloud Technology Inc. (GCT): Free Stock Analysis Report

Beyond, Inc. (BYON): Free Stock Analysis Report