Here are three stocks with buy ranks and strong growth characteristics for investors to consider today February 5th:

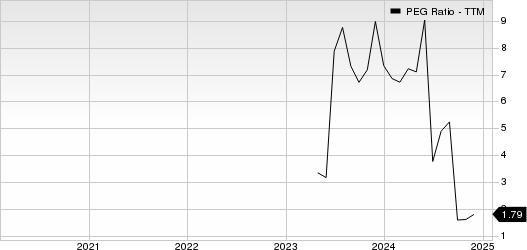

Pitney Bowes PBI: This global technology company powering billions of transactions - physical and digital - in the connected and borderless world of commerce, carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.3% over the last 60 days.

Pitney Bowes' has a PEG ratio of 0.52 compared with 3.13 for the industry. The company possesses a Growth Score of A.

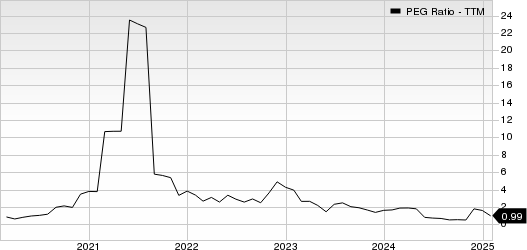

The Greenbrier Companies GBX: This company which is a leading supplier of transportation equipment and services to the railroad and related industries, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13.5% over the last 60 days.

The Greenbrier Companies has a PEG ratio of 0.93 compared with 1.95 for the industry. The company possesses a Growth Score of A.

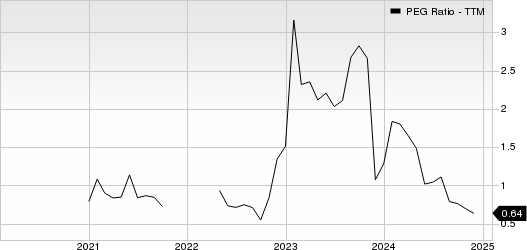

KT KT: This company which provides telecommunication services, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.5% over the last 60 days.

KT has a PEG ratio of 0.35 compared with 1.07 for the industry. The company possesses a Growth Score of B.

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KT Corporation (KT): Free Stock Analysis Report

Pitney Bowes Inc. (PBI): Free Stock Analysis Report

Greenbrier Companies, Inc. (The) (GBX): Free Stock Analysis Report

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)