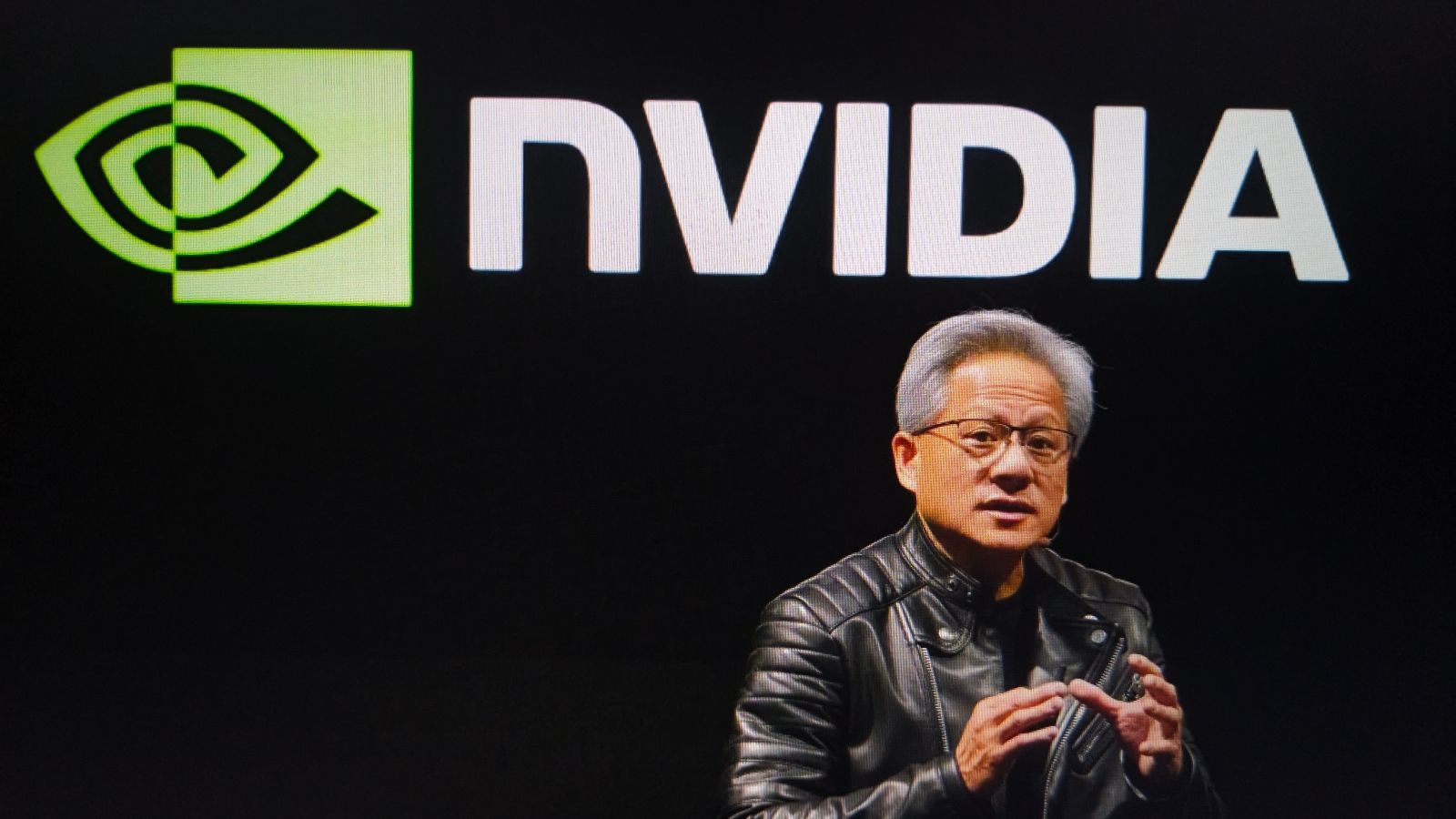

Are you looking for a potentially underrated artificial intelligence (AI) stock to buy for 2025? While it may be tempting to simply invest in chipmaking giant Nvidia, given its hefty $3.3 trillion market capitalization, the returns from owning the stock this year may be limited from here. Although it's a good buy, there may be better options for investors to consider.

One undervalued AI stock that could be due for a strong year in 2025 is computer maker Dell Technologies (NYSE:DELL). Here's why I see a lot of upside for the stock not just this year, but over the long haul.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

A big upgrade cycle may be overdue

Due to challenging economic conditions and rising inflation, many consumers have held off on upgrading their phones and computers in recent years. But there could be multiple reasons for that to change this year, specifically when it comes to personal computers (PCs).

Many AI-enabled PCs are becoming available and may give consumers a reason to finally upgrade their machines, to take advantage of next-gen technologies. Plus, an estimated 60% of Windows PCs are still running Microsoft's Windows 10 operating system, support for which is ending on Oct. 14. While that doesn't mean the machines will stop working after that date, they won't get security updates anymore, resulting in potential vulnerabilities for users who remain on the outdated operating system.

That's a problem because AI is equipping not only regular users with advanced capabilities, but hackers as well, and the need for consumers and businesses to keep their computers protected could provide them with an additional reason to upgrade their machines this year. While it's possible to simply upgrade an operating system rather than buying an entirely new machine, by upgrading to a new computer, consumers can benefit from both a new operating system as well as new AI-powered capabilities; an upgrade could make the most sense. This is why a big upgrade cycle may take place this year.

Strong PC sales could make 2025 a fantastic year for Dell

The one area of Dell's business that hasn't been doing well of late is its client solutions group segment, which includes PC sales. The company last reported earnings in November and while Dell's sales totaled $24.4 billion and grew by 10% for the quarter ended Nov. 1, 2024, that was despite softness in its client solutions group, where revenue declined by 1% to $12.1 billion. On the consumer side of that segment, sales were down by 18%.

Dell's strong infrastructure sales have been propping up the top line, with server and networking revenue rising by 58% during the period, coming in at $7.4 billion. For Dell, the benefit of an increase in PC sales is obvious. It will pad the company's top line and result in a faster rate of growth, which can lead to an increase in bullishness in the stock, and stronger returns for investors.

Dell looks like a slam-dunk buy right now

Although 2024 wasn't a bad year for Dell -- its share price rose by 51% -- the stock is still looking incredibly cheap, trading at a forward price-to-earnings multiple of 12 (based on analyst expectations). And its price/earnings-to-growth multiple of 0.6 also suggests that this can be a dirt cheap stock to buy given how much growth may be on the horizon for the business over the next five years.

Dell's relatively modest valuation alongside its strong server and networking sales, plus a potential catalyst waiting in the wings with respect to an upcoming PC refresh cycle, makes it easy to see why this can be a top-performing AI stock in 2025 and beyond. Dell's a great option for investors to load up on while its value remains low.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $807,495!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 13, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)