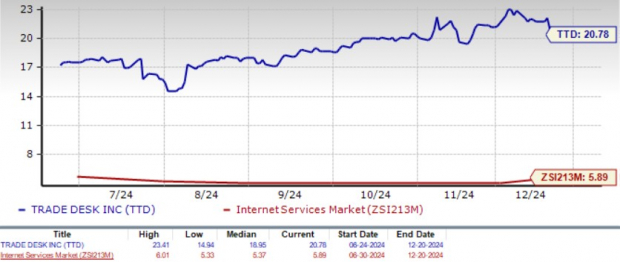

The Trade Desk TTD shares are trading at a stretched valuation, as suggested by the Value Score of F. In terms of the 12-month Price/Sales (P/S), TTD is currently trading at 20.78X, a premium compared with the Zacks Computer & Technology sector’s 6.44X and the Zacks Internet – Services industry’s 5.89X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Shares of The Trade Desk have surged 73.7% in the year-to-date period, outperforming the broader sector’s appreciation of 32% and the industry’s return of 32.8%.

TTD’s exceptional performance can be attributed to its impressive portfolio, growing market share in the Connected TV (CTV) domain and expanding partnerships.

YTD Performance

Image Source: Zacks Investment Research

The Trade Desk offers positive guidance for the near term. It expects fourth-quarter 2024 revenues to be at least $756 million, indicating 25% year-over-year growth. Adjusted EBITDA is expected to be nearly $363 million.

We expect positive growth to continue in the near term. But is the strong growth prospect enough to justify a premium valuation? Let’s dig deep to find out.

TTD’s Earnings Estimates Trend Steady

The Zacks Consensus Estimate for fourth-quarter 2024 earnings is pegged at 58 cents per share, unchanged over the past 30 days, suggesting 41.46% growth year over year.

The Zacks Consensus Estimate for fourth-quarter 2024 revenues is pegged at $758.05 million, indicating year-over-year growth of 25.13%.

The Zacks Consensus Estimate for TTD’s 2024 revenues is pegged at $2.46 billion, indicating year-over-year growth of 26.51%. The consensus mark for earnings is pegged at $1.65 per share, unchanged over the past 30 days, indicating 30.95% growth year over year.

TTD’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 6.09%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Innovative Portfolio Aids TTD’s Prospects

The Trade Desk has been benefiting from its innovative portfolio, an expanding global footprint, advancements in omnichannel ad inventory and the growing adoption of programmatic advertising.

TTD’s CTV business continues to be its largest and fastest-growing segment as top brands make the transition from linear TV and user-generated content to CTV. Powered by AI, TTD’s Kokai solution is helping advertisers identify and target new potential customers with much greater precision.

The Trade Desk recently launched Ventura, a cutting-edge streaming TV operating system designed to improve user experience and advertising efficiency. Its standout features include seamless cross-platform content discovery, personalized recommendations and simplified subscription management. TTD will be collaborating with Smart TV original equipment manufacturers (OEM) and streaming TV aggregators to deploy Ventura.

Rich Partner Base Bodes Well for TTD

The Trade Desk’s rich partner base is a key catalyst. Spotify Technology SPOT has extended its partnership with TTD, piloting integrations with OpenPath and UID2 through the Spotify Ad Exchange. Its robust network includes major players like Disney DIS, NBCU, Walmart, Roku ROKU, LG, Fox and Netflix, providing a strong foundation for continued growth.

TTD has also been signing prominent clients, growing its footprint in varied sectors. Reach, a U.K. news publisher of 130 media brands has adopted EUID to enhance ad experiences while also protecting journalism.

Global media company Motorsport Network has adopted EUID to offer relevant ads to its 60 million users, focusing on privacy and transparency. Cint has also integrated UID2 for enhanced and omnichannel brand lift measurement.

Roku recently announced its adoption of UID2 to enhance advertiser targeting precision and enable secure data collaboration through Roku Media.

Buy, Sell or Hold TTD Stock?

Macroeconomic uncertainties and the intensely competitive nature of the digital advertising industry, dominated by industry giants, such as Google and Amazon, pose a significant challenge to TTD’s prospects.

Increasing regulatory scrutiny around data privacy and shifts in consumer data practices have the potential to disrupt traditional methods of audience targeting.

Hence, we believe TTD’s premium valuation is unjustified at current levels.

However, The Trade Desk’s strong portfolio, rich partner base and expanding clientele are key catalysts. Hence, investors who already own the stock might expect the company’s growth prospects to be rewarding over a longer term.

The Trade Desk carries a Zacks Rank #3 (Hold), which implies investors should wait for a more favorable entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS): Free Stock Analysis Report

The Trade Desk (TTD): Free Stock Analysis Report

Roku, Inc. (ROKU): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)