Bristol Myers Squibb Company BMY touched a 52-week high of $56.8 on Nov. 6. The stock is currently trading at $54.14. This biotech giant has been having a good run for the past three months, regaining its lost territories and giving anxious investors a ray of hope.

Shares of BMY have risen 20.1% in the past six months compared with the industry’s growth of 5.3%. The stock has also outperformed the sector and the S&P 500 during this period.

On Oct. 31, Bristol-Myers reported better-than-expected third-quarter results, driven by higher demand for Reblozyl, Breyanzi, Camzyos and Opdualag. Growth in Eliquis drug also led to an upside in the top line. Consequently, the company raised its annual earnings guidance. Following this, the stock also rallied.

Bristol Myers Outperforms Industry, Sector & S&P 500

Image Source: Zacks Investment Research

Newer Drugs Boost BMY’s Top Line

BMY is banking on newer drugs like Reblozyl, Breyanzi, Camzyos and Opdualag to stabilize its revenue base as its legacy drugs face generic competition. Reblozyl has put up a stellar performance in the past few quarters with strong growth in the United States as well as international markets. The drug should contribute significantly in the coming decade.

The sales of oncology drug Opdualag have been robust, fueling the top line. Per BMY, the drug has already become a standard of care in first-line melanoma setting in the United States with a market share of 30%.

Sales of Breyanzi also continue to gain traction from the approval of recent new indications and expanded manufacturing capacity.

BMY Boosts Portfolio With Schizophrenia Drug

Bristol Myers, like its fellow biotech player Gilead Sciences, Inc. GILD, is looking to counter generic competition for its key drugs through strategic acquisitions and the introduction of new drugs to its product portfolio.

The company recently won FDA approval for xanomeline and trospium chloride (formerly KarXT), an oral medication for the treatment of schizophrenia in adults. The drug was approved under the brand name Cobenfy, representing the first new pharmacological approach to treating schizophrenia in decades. The approval of Cobenfy for schizophrenia broadens BMY’s portfolio and validates the acquisition of Karuna Therapeutics.

BMY earlier acquired Mirati Therapeutics for $4.8 billion. The acquisition added Mirati’s lung cancer drug Krazati (adagrasib) to its oncology portfolio.

The acquisition of RayzeBio added its proprietary radiopharmaceutical platform, along with its innovative pipeline of potentially first-in-class and best-in-class actinium-based radiopharmaceutical therapeutics, to Bristol Myers’ oncology portfolio.

Challenges for Older BMY Drugs

While the new drugs drive growth, one of BMY’s top drugs, Revlimid (indicated for multiple myeloma), faces generic competition, adversely impacting its top line.

While Revlimid sales continue to decline, the drug managed to beat on earnings in the third quarter and provided an upside to the top line.

Blood thinner medicine Eliquis, for which BMY has a worldwide co-development and co-commercialization agreement with pharma giant Pfizer PFE, is the biggest contributor to the top line. An upside in Eliquis sales in the third quarter helped BMY beat on revenues in the quarter.

However, Eliquis is slated to face generic competition later in the decade, and Opdivo might face a slowdown as core indications mature.

These three drugs comprise a major chunk of the company’s revenues. Meanwhile, leukemia drug Sprycel is also facing generics in the United States, which is adversely impacting its sales. Pomalyst is facing generics in Europe.

Cost-Cutting Measures Should Boost BMY's Earnings

In April 2024, BMY announced a strategic cost-reduction plan that should result in approximately $1.5 billion in savings by the end of 2025. The company will focus on prioritizing investing in candidates that will deliver the best long-term returns and optimizing operations across the organization.

BMY’s High Debt Ratio Worrisome

While BMY’s strategy of acquiring companies with promising drugs/candidates is encouraging, the company has undertaken colossal debt to finance these acquisitions. As of Sept. 30, 2024, Bristol Myers’ total debt-to-total capital ratio was a staggering 74.3%. This is worrisome. The company had cash and equivalents of $7.9 billion and a long-term debt of $48.7 billion as of the aforementioned date.

Valuation

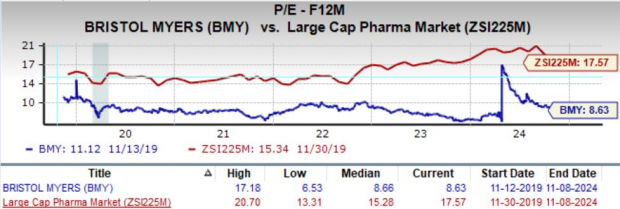

Going by the price/earnings ratio, BMY’s shares currently trade at 8.63x forward earnings, lower than both its mean of 8.66x and 17.57x for the large-cap pharma industry.

Image Source: Zacks Investment Research

Estimate Movement

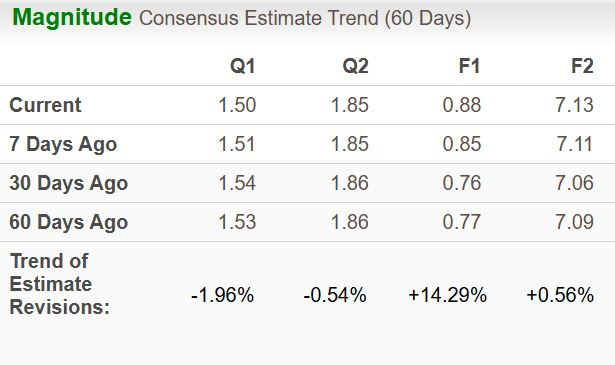

Over the past 30 days, the Zacks Consensus Estimate for 2024 earnings per share (EPS) has increased to $0.88 from $0.76. EPS estimate for 2025 has also gained 7 cents.

Image Source: Zacks Investment Research

It’s worth noting that the annual earnings estimate has taken a massive hit due to acquisition-related expenses in 2024.

Conclusion

Large biotech companies are considered safe havens for investors interested in this sector. The recent rally raises hope of a turnaround for BMY. Newer drugs pave the way for growth, but it will take some time for them to fill the gap caused by generic competition for legacy drugs.

Given the stock's current trading levels, it would be prudent for investors already owning the stock to stay invested. Any dip in share price can be used as a buying opportunity, as BMY is a good stock to own in the long term.

BMY has also been consistently paying out and increasing dividends. The current yield of 4.43% is quite attractive.

BMY currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is the backbone of our economy. It’s a multi-trillion dollar industry that has created some of the world’s largest and most profitable companies.

Now state-of-the-art technology is paving the way for clean energy sources to overtake “old-fashioned” fossil fuels. Trillions of dollars are already pouring into clean energy initiatives, from solar power to hydrogen fuel cells.

Emerging leaders from this space could be some of the most exciting stocks in your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY): Free Stock Analysis Report

Pfizer Inc. (PFE): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report