Here are three stocks with buy rank and strong income characteristics for investors to consider today, November 8:

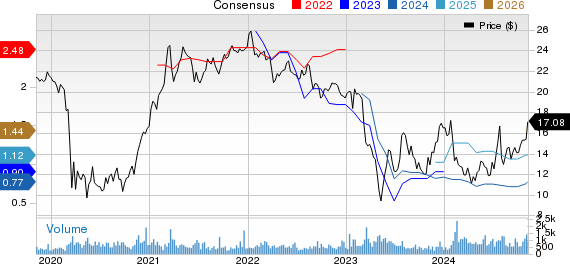

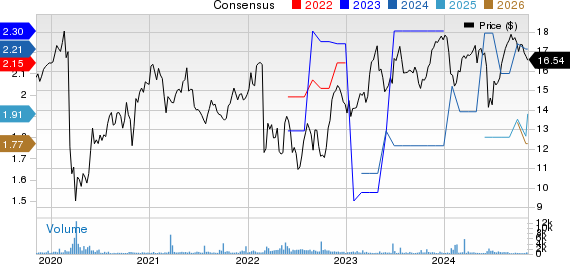

Flushing Financial Corporation FFIC: This bank holding company for Flushing Bank has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.6% the last 60 days.

This Zacks Rank #1 company has a dividend yield of 4.9%, compared with the industry average of 3.0%.

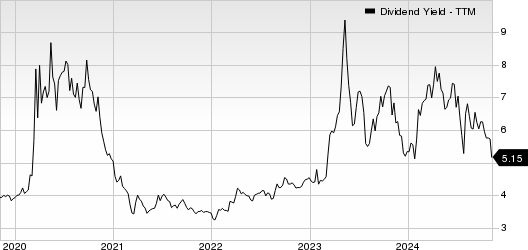

Sappi Limited SPPJY: This wood fiber-based renewable resources company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 16.7% the last 60 days.

This Zacks Rank #1 company has a dividend yield of 4.0%, compared with the industry average of 1.5%.

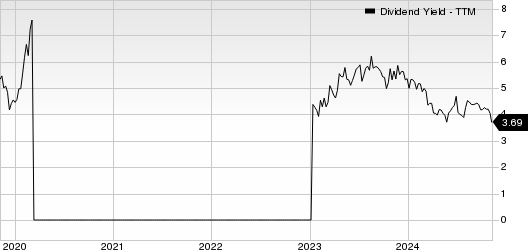

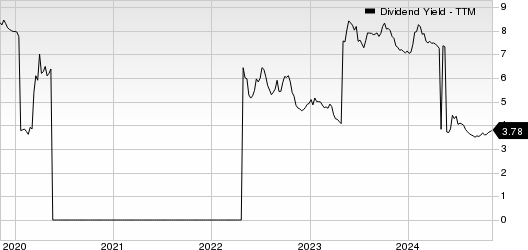

Engie SA ENGIY: This energy company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.7% the last 60 days.

This Zacks Rank #1 company has a dividend yield of 3.8%, compared with the industry average of 3.3%.

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flushing Financial Corporation (FFIC): Free Stock Analysis Report

Sappi Ltd. (SPPJY): Free Stock Analysis Report

ENGIE - Sponsored ADR (ENGIY): Free Stock Analysis Report

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Space%20Technology%20by%20Rini_%20com%20via%20Shutterstock.jpg)