Artificial intelligence (AI) stocks are some areas in the market where investors are looking for stocks that could go parabolic -- a status given to a stock because its price chart looks like a parabola, quickly increasing on the price axis in a relatively short time.

I've identified two companies that could achieve this status: SoundHound AI (NASDAQ:SOUN) and Snowflake (NYSE:SNOW). Each has a strong chance of going parabolic in the future.

SoundHound and Snowflake have strong investment cases

Both companies are heavily involved in the AI arms race. SoundHound has AI technology that helps process audio inputs and converts them into inputs that computers can utilize. Two areas where this is seeing strong adoption are the restaurant and automotive industries.

In the restaurant sector, SoundHound's technology is replacing drive-thru attendants and delivered performance exceeding that of its human counterparts. On the automotive side, SoundHound's technology is being combined with generative AI models to create a more useful driving assistant. This technology has been implemented in multiple Stellantis vehicles and is in use in Europe and Japan, although a U.S. launch is likely coming soon.

SoundHound is a relatively small company right now, as its Q2 revenue total was only $13.5 million (up 54% year over year). However, management expects its 2025 revenue to top more than $150 million as more bookings are converted into actual product launches. It's this kind of growth that could turn SoundHound AI into a parabolic stock.

Snowflake is also involved in the AI revolution on the software side. Training these models requires an incredible amount of data, which is where Snowflake comes in. Snowflake's data cloud product gives companies the tools they need to capture data, store it efficiently, and feed it into applications. Snowflake also has the Snowflake Marketplace, where datasets can be purchased to train AI models. Snowflake's product squarely benefits from more companies using AI, which should be a catalyst for the business.

In Snowflake's second quarter of 2025 (ended July 31), it grew product revenue by 30% year over year to $829 million. However, its remaining performance obligations rose 48% to $5.2 billion, which shows that its contracted usage is rising. Product revenue is expected to rise about 26% for the full year.

With the stock trading for 12 times sales, it's starting to look like a great price for the software company. Snowflake is putting up strong results, but investors don't see the flashy AI levels of opportunity other businesses have. Just compare Snowflake to Palantir, which trades for 43 times sales and grew at a 27% pace in Q2 (yes, slower than Snowflake!).

If Snowflake received that same level of hype, it could easily go parabolic.

Why haven't these companies gone parabolic yet?

For Snowflake, if everything was going right for it, I wouldn't be talking about the chance of it going parabolic; it would already be happening.

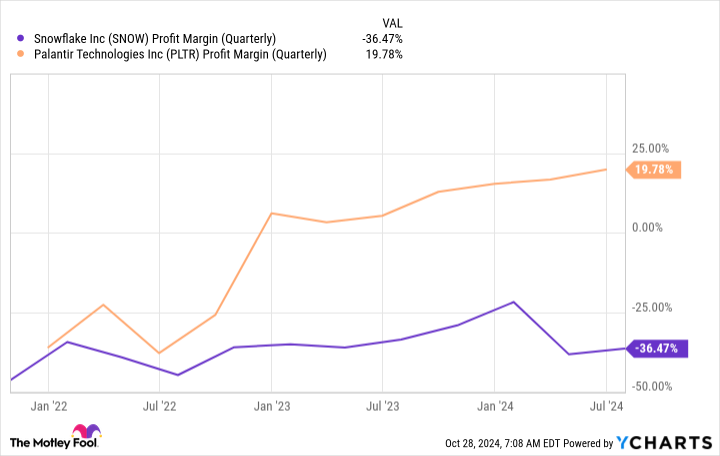

Snowflake needs to become more efficient and generate some profits. While Snowflake compares favorably to Palantir in some ways, it doesn't in others. Palantir is a fully profitable company that increases its profit margin each quarter, while Snowflake does not.

SNOW Profit Margin (Quarterly) data by YCharts

Each was at a similar profitability level three years ago, so a turnaround is possible. If Snowflake can generate some profits, it will gain respect in the market and see its stock price rise accordingly.

SoundHound has high expectations already baked into the stock, but investors are still waiting for a "wow" moment to really send the stock up. Over the next few quarters, SoundHound will have a chance to give investors what they're looking for, as it's poised to convert a massive amount of its $723 million backlog into realized revenue.

Until then, SoundHound will be trading on the prospects of a strong future business. However, if SoundHound's use case expands (like how it's doing with its Amelia product in banking), then it is primed to go parabolic.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $829,746!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 4, 2024

Keithen Drury has positions in Snowflake. The Motley Fool has positions in and recommends Palantir Technologies and Snowflake. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)