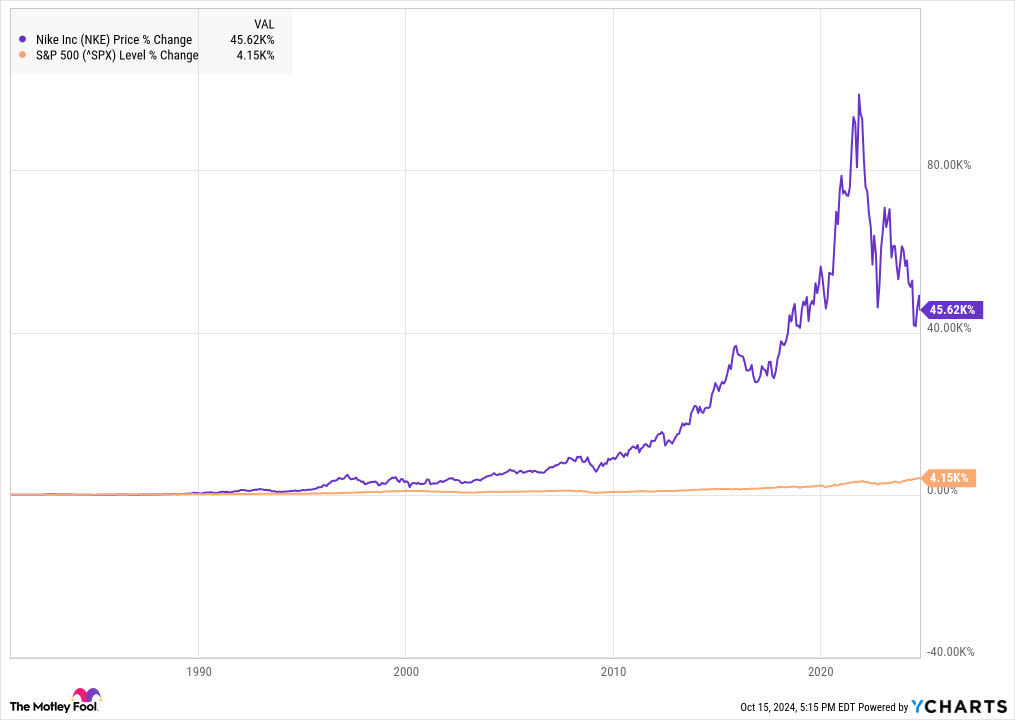

If you had bought one share of Nike (NYSE:NKE) when it went public in 1980, you'd be sitting on a monster return right now.

As you can see from the chart below, the stock has trounced the S&P 500 over its history. It's up roughly 45,600% since then, despite poor performance in recent years.

Like most top-performing stocks, Nike has also issued a number of stock splits over its history, as its current share price is under $100.

To see how many shares you'd have now if you'd bought Nike at its IPO, you need to know its stock split history.

Nike's stock split history

The chart below shows Nike's stock splits over time.

| Stock split date | Size of stock split | # of shares after split |

|---|---|---|

| 1/5/83 | 2-for-1 | 2 |

| 10/5/90 | 2-for-1 | 4 |

| 10/30/95 | 2-for-1 | 8 |

| 10/23/96 | 2-for-1 | 16 |

| 4/2/07 | 2-for-1 | 32 |

| 12/24/12 | 2-for-1 | 64 |

| 12/23/15 | 2-for-1 | 128 |

Data source: Nike.

As you can see from the chart, if you had bought just one share of Nike at its IPO, you would have 128 shares today. At its current price of $82, you would own $10,496 in Nike stock. That's not a bad gain from Nike's IPO price of $22 a share.

However, that wouldn't be your only source of gains. You'd also have a nice chunk of dough from Nike's dividends. Nike first started paying a dividend in 1985, and raised it every year since 2004. Nike stock has typically offered a dividend yield of 1% to 2%.

While it's difficult to tabulate exactly how much in dividends you would have over that history, according to Nike, you would have collected about $13 a share in dividend income if you had started investing in 1995.

Based on that figure and 128 shares after all the splits, you'd have earned more than $1,664 in dividend income if you had bought one share at the IPO.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $831,707!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Jeremy Bowman has positions in Nike. The Motley Fool has positions in and recommends Nike. The Motley Fool has a disclosure policy.

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)