Moderna (MRNA) stock closed higher on Wednesday after the FDA reversed its earlier refusal-to-file decision on the company’s mRNA-1010 seasonal influenza vaccine.

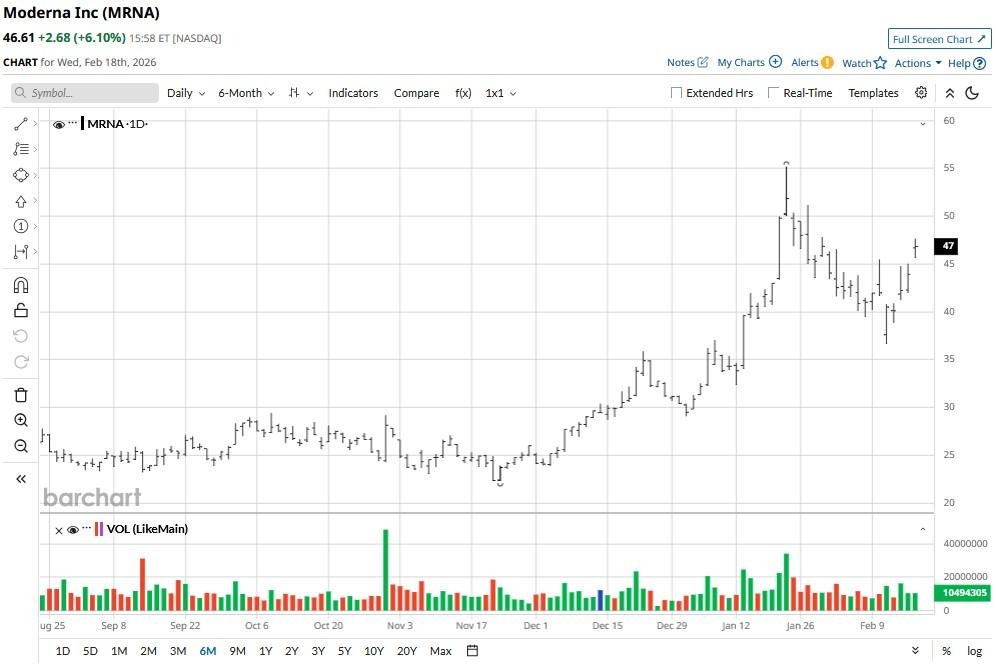

As the regulatory agency agreed to review MRNA’s revised application, its stock price rallied past its 20-day moving average (MA), signaling bullish momentum could sustain in the near term.

Despite today’s surge, Moderna stock remains down some 15% versus its year-to-date high.

Moderna Stock Remains Unattractive for the Long Term

The FDA news is largely positive for MRNA stock as it positions the company’s influenza vaccine for the upcoming flu season.

From a fundamental perspective, the global flu vaccine market represents a substantial opportunity worth some $9.2 billion annually. However, critical financial headwinds complicate the investment thesis.

In 2025, Moderna’s cash burn stood at an alarming $2.1 billion – and analysts aren’t particularly convinced that it can achieve profitability before 2029.

Simply put, while technical momentum and this regulatory milestone provide near-term catalysts, ongoing losses and extended timeline to profitability does raise questions about long-term value creation.

Where Options Data Suggests MRNA Shares Are Headed

Caution is warranted in playing Moderna shares also because they’re trading at a notable premium.

MRNA’s price-to-sales (P/S) multiple of 8.49x appears rather stretched given it’s an $18 billion giant that hasn’t made a penny in profit since 2022. Plus, it faces a mounting legal and competitive moat problem as well.

A high-stakes patent infringement lawsuit involving lipid nanoparticle (LNP) technology, the very delivery system for its mRNA platform, poses a multibillion-dollar liability risk that could siphon future royalties.

Options contracts expiring mid-April have the lower price set at $36.59 currently, indicating potential decline of more than 20% over the next two months.

How Wall Street Recommends Playing Moderna

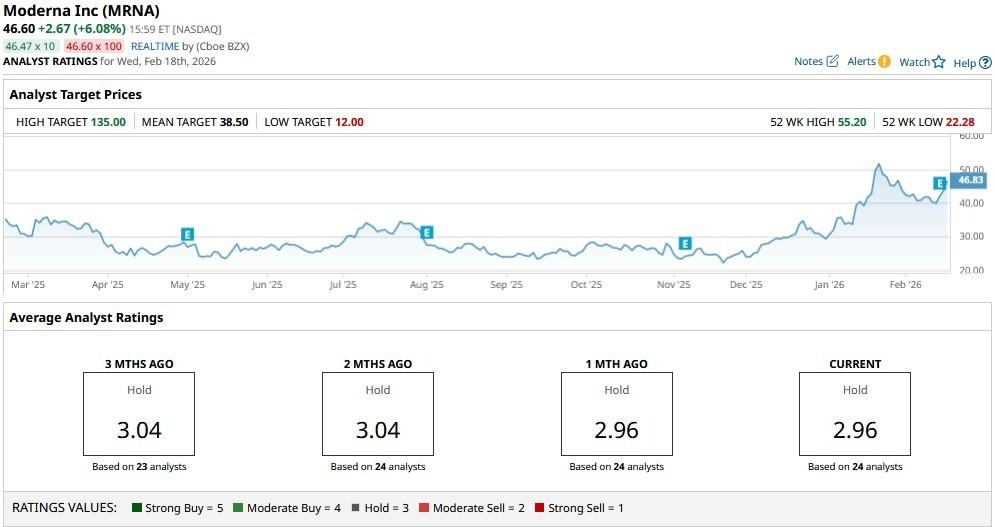

Wall Street analysts seem to agree with the options market’s bearish view on Moderna as well.

According to Barchart, the consensus rating on MRNA shares currently sits at “Hold” only with the mean target of about $38 suggesting they’ll reverse their gains since mid-January by the end of 2026.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)