Texas Capital Bancshares, Inc. TCBI stock looks like an attractive investment option now. With ongoing progress in its strategic business plan, the company is well-poised to capitalize on growth opportunities while continuing to enhance its financial stability and operational capabilities. A strong capital position is an added positive.

Analysts seem optimistic regarding TCBI’s earnings growth potential. The Zacks Consensus Estimate for the company’s 2024 earnings has been revised 5.7% upward over the past 30 days. Thus, TCBI currently sports a Zacks Rank #1 (Strong Buy).

TCBI’s Estimate Revision Trend

Image Source: Zacks Investment Research

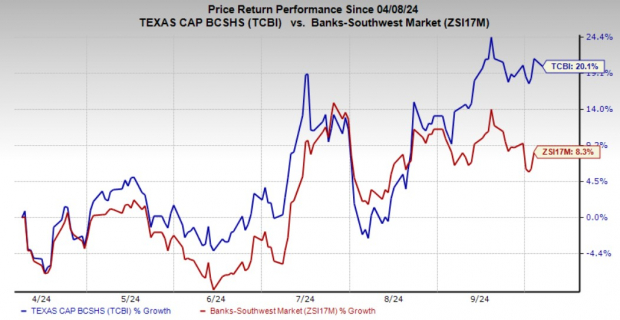

In the past six months, shares of TCBI have gained 20.1% compared with the industry’s growth of 8.3%.

Image Source: Zacks Investment Research

Let’s Discuss some of the factors that make TCBI a solid pick right now.

Strategic Business Plan: Texas Capital is progressing well with its strategic plan announced in 2021 to improve operating efficiency. Pursuant to this, Texas Capital agreed to purchase a portfolio of about $400 million in committed exposure to healthcare companies.

Further, the company continues to progress with investment banking offerings every quarter and building a base of consistent and repeatable revenues that will be a differentiator in the marketplace and a meaningful contributor to future earnings.

The company is also implementing technology-enabled process innovations that improve customer experiences, reduce risk and deliver structural efficiencies. Further, it is broadening its offerings with the establishment of Texas Capital Securities Energy Equity Research and the debut of Texas Capital Direct Lending.

These efforts are expected to increase the company's NII and reduce non-interest expenses by 2025.

Key revenue growth strategies include expanding Treasury Solutions, targeting these services to generate 5% of total revenues by 2025 and increasing investment banking and trading income to 10%, driven by corporate advisory, underwriting and sales & trading.

TCBI aims to elevate non-interest income from 11% in 2020 to 15-20% of total revenues by 2025, strengthening its treasury, investment banking and private wealth divisions. The proposal includes aggressive hiring plans to more than double the number of client-facing professionals across Texas by 2025.

Revenue Strength: TCBI’s top-line growth is impressive. An elevated level of investment banking, trading income and higher NII drove revenues to witness a compound annual growth rate (CAGR) of almost 2% over the last five years (2018-2023).

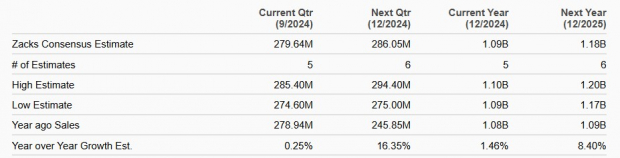

Although revenues declined in the first half of 2024, the company’s progress on its strategic plan (announced in September 2021), efforts to expand banking capabilities and expansion of customer portfolio are expected to support revenue growth in the quarters ahead.

TCBI’s Sales Estimates

Image Source: Zacks Investment Research

Strong Balance Sheet Position: As of June 30, 2024, Texas Capital had a total debt (comprising long-term debt and short-term borrowings) of $2.33 billion. The company’s liquid assets (including its cash and due from banks and interest-bearing cash and cash equivalents) as of the same date were $2.91 billion. Given the decent liquidity position, its debt seems manageable.

Strong Capital Position: Texas Capital is well-capitalized as its capital ratios remain exceptionally strong compared with its peer group. These ratios have enhanced with the additional capital raised since 2008. As of June 30, 2024, the bank's total capital ratio was 15.7%, while its Common Equity Tier 1 ratio was 11.6%. Both figures are well above regulatory requirements, underscoring the bank’s solid capital position.

Other Finance Stocks Worth a Look

Some other top-ranked stocks from the banking space are Hilltop Holdings Inc. HTH and First Reliance Bancshares, Inc. FSRL, each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings estimates for HTH for the current year have been revised 1.5% upward over the past 60 days. The company’s shares have gained 1.4% in the past six months.

Estimates for FSRL’s current-year earnings have been revised 11.25% upward in the past 60 days. The company’s shares have surged 23.8% in the past six months.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Capital Bancshares, Inc. (TCBI): Free Stock Analysis Report

Hilltop Holdings Inc. (HTH): Free Stock Analysis Report

First Reliance Bancshares Inc. (FSRL): Free Stock Analysis Report

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)