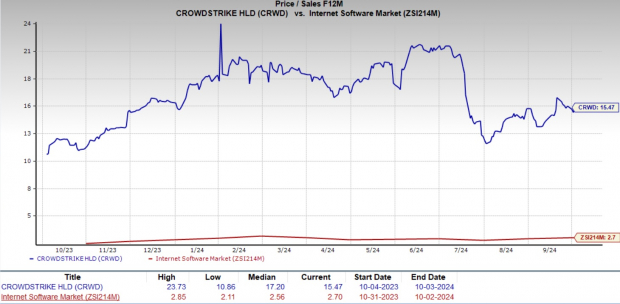

CrowdStrike Holdings, Inc. CRWD has been a dominant player in the cybersecurity space, but its current valuation raises significant concerns. Trading at a premium price-to-earnings (P/E) multiple of 69.38X, well above the Zacks Internet – Software industry average of 34.16X, the stock’s valuation seems inflated. Similar is the case with the price-to-sales (P/S) multiple.

Image Source: Zacks Investment Research

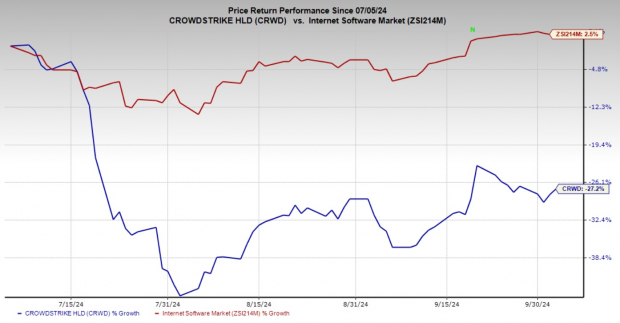

Even more concerning is that CRWD trades at such a lofty valuation multiple despite a 27.2% decline in its share price over the past three months. In such a scenario, investors should question whether its current valuation is justified given the headwinds it faces.

Image Source: Zacks Investment Research

High-growth companies like CrowdStrike typically trade at elevated multiples, but only when they can deliver the kind of explosive growth that justifies such valuations. In CrowdStrike’s case, slowing sales growth and operational missteps suggest that the stock’s premium pricing may no longer be warranted.

Even competitors like Palo Alto Networks, Inc. PANW and Fortinet, Inc. FTNT, which are delivering solid growth and innovation, trade at more reasonable multiples. PANW has a forward P/E of 52.45X, while Fortinet trades at 35.97X — both significantly lower than CrowdStrike. This makes CRWD particularly vulnerable in a market that has grown increasingly cautious about high-priced tech stocks.

CrowdStrike’s Slowing Growth Raises Concerns

One of the primary reasons for CrowdStrike’s recent struggles is its slowing revenue growth. In its second-quarter fiscal 2025 earnings report, the company posted a 32% year-over-year increase in revenues, bringing in $963.9 million. While this may seem strong at first glance, it pales in comparison to the 50%-plus growth rates the company had been consistently delivering until fiscal 2023.

Adding to the concern is the slowing net new annual recurring revenues (ARR). The company’s net new ARR growth has dropped to just 11%, signaling that CrowdStrike’s core business is no longer expanding as quickly. This deceleration raises doubts about whether CRWD can justify its elevated valuation, particularly as it faces growing competition from industry heavyweights like Palo Alto Networks and Fortinet.

The July IT Outage: A Major Blow for CrowdStrike

One of the most significant setbacks for CrowdStrike this year was the global IT outage on July 19, 2024, which disrupted millions of Microsoft Corporation MSFT Windows devices. The incident was traced back to CrowdStrike’s Falcon platform, dealing a serious blow to its reputation. The company estimated that more than $60 million worth of deals were delayed due to the outage in the second quarter, impacting its financial performance.

The outage raised questions about the reliability of CrowdStrike’s cloud-native cybersecurity platform. In an industry where trust and reliability are paramount, any hint of instability can lead customers to seek out alternative providers. With competitors like Palo Alto Networks and Fortinet offering more diversified product portfolios, CrowdStrike’s loss of confidence among clients could have long-term ramifications.

CrowdStrike Lowers FY25 Guidance Amid Challenges

Considering the ongoing challenges, CrowdStrike has lowered its guidance for fiscal 2025. Management now expects revenues to fall between $3.89 billion and $3.90 billion, implying a growth rate of 27%-28% — well below the company’s historical averages. Non-GAAP net income per share is projected to come in between $3.61 and $3.65, lower than previous estimates.

CrowdStrike’s cautious outlook has led analysts to revise their earnings estimates downward, reflecting a more challenging environment ahead. When analysts lower their expectations, it often signals a shift in market sentiment, and CrowdStrike is no exception. The downgrades suggest that Wall Street sees more downside risk in the company’s stock.

Image Source: Zacks Investment Research

Conclusion: Sell CRWD Stock Now

CrowdStrike’s combination of a high valuation, slowing growth and operational challenges make it difficult to justify holding the stock. The July IT outage, along with the company’s lowered guidance and analyst downgrades, point to a tough road ahead. Moreover, the stock’s premium pricing seems out of step with its current growth trajectory, making it vulnerable to further declines.

For investors seeking more stability and better value, it may be time to sell CrowdStrike stock. While the long-term prospects for the cybersecurity industry remain promising, the near-term risks surrounding this Zacks Rank #4 (Sell) company are too significant to ignore.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Netflix%20open%20on%20tablet%20by%20rswebsols%20via%20Pixabay.jpg)