Bitcoin (BTCUSD)-related stocks have never been an exception; they ride a roller coaster just like every other stock. With so many short sellers in the mix, it can get even crazier, where abrupt rallies can occur, and you have the bulls and the bears taken by surprise.

The company that is getting buzz presently is Bit Digital (BTBT). It is considered one of the shortest crypto stocks on the market, though it has a market capitalization close to $2 billion. Shortly in late January, nearly a fifth of his stock was shorted, and everybody is keeping a close eye on it.

However, the best part about Bit Digital is that its bearish bets are supported by a balance sheet that is as strong as possible. They own a number of Ethereum (ETHUSD), and their WhiteFiber (WYFI) division is quickly expanding in AI and high-performance computing. The shift of the company toward the old Bitcoin mining grind to staking, cloud computing, and growing data centers, which some analysts do not believe the market is adequately valuing.

The question for investors, then, is whether BTBT stock will blow up in a short squeeze and whether skepticism is probably real. Let’s try to find out.

Bit Digital focuses on Ethereum and AI infrastructure

Bit Digital is a New York–based digital-asset company that has been shifting away from Bitcoin mining toward Ethereum staking and artificial intelligence infrastructure. Management positions the firm as a strategic asset platform centered on Ethereum and high-performance computing, with WhiteFiber serving as its primary AI vehicle.

The company builds value by accumulating and staking Ethereum while operating data centers and cloud services used for AI training. Bit Digital began staking ETH in 2022 and now holds about 155,239 ETH, valued near $380 million as of now. Roughly 89% of those holdings are staked, generating an annual on-chain yield of about 2.9%.

On the AI side, Bit Digital reaffirmed in January 2026 that it will not sell its 27 million shares of WhiteFiber during the year, underscoring its long-term commitment to the business. It also secured a $20.2 million, two-year contract to supply 576 Nvidia H200 GPUs to DNA Holdings’ AI Compute Fund, supporting a goal of reaching $100 million in annualized HPC and data-center revenue.

To expand capacity, the company also purchased a 32-megawatt data center in Montreal for roughly 23.3 million CAD, upgrading the site to Tier-3 standards. Together, its Ethereum treasury and growing AI infrastructure form the backbone of Bit Digital’s long-term strategy, even if revenue gains take time to materialize.

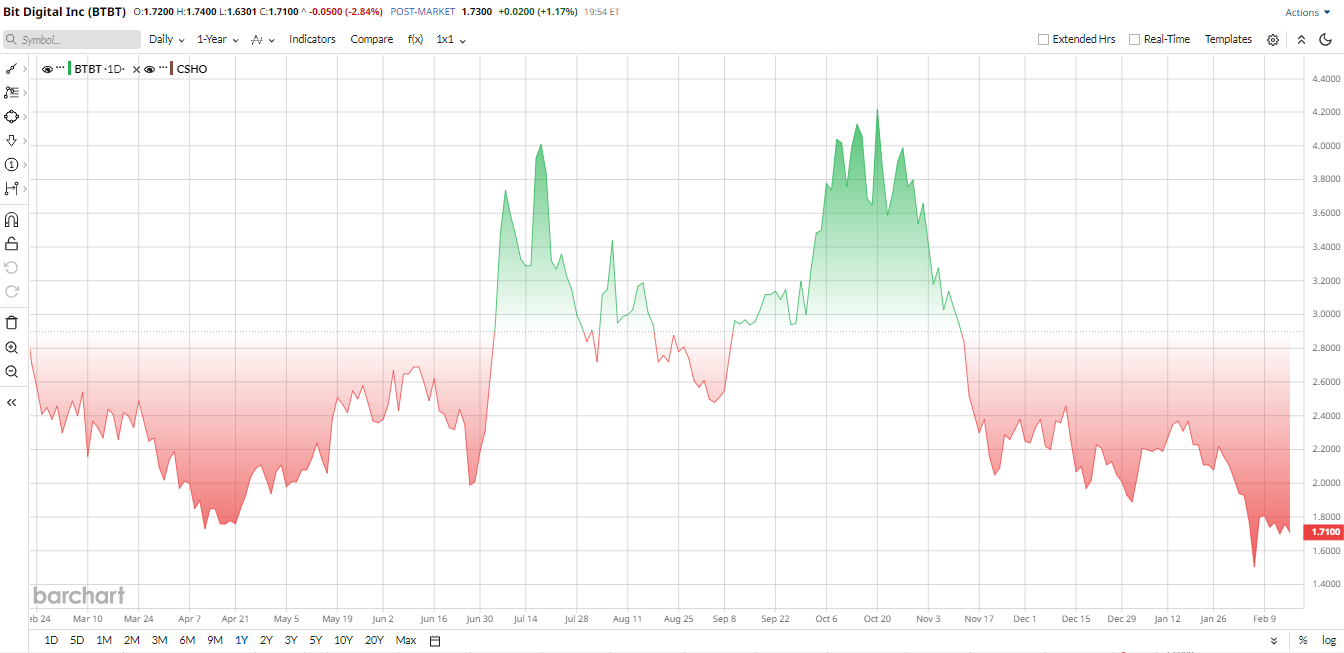

Bit Digital Posts Volatile 2025

Bit Digital saw sharp volatility in 2025. Shares rallied early, reaching a 52-week high near $4.55, as enthusiasm around Ethereum exposure, AI infrastructure, and strong Q3 results lifted sentiment. That strength faded later in the year, with the stock pressured by a broader crypto selloff, dilution from equity and convertible financing, and profit-taking. BTBT stock is now 42% down over the past 52 weeks.

Positive drivers included growth in cloud and HPC revenue and rising Ethereum holdings, while headwinds came from weaker Bitcoin-mining economics and dilution tied to capital raises, including a late-year convertible note.

BTBT showcases an attractive valuation. The forward P/E of 5 is significantly lower than the sector median of 29, reflecting the stock's relative affordability. Additionally, the price/book ratio of 1 is an 81% discount compared to the sector, indicating it may be undervalued.

Meme Traders Jump In

In the meantime, everything in the short-term interests has been whirling around. In 19% float, shorts are still shorted; there have been ideas about a squeeze in some retail forums. The trade in BTBT has seen a boom at certain points as meme-stock enthusiasts continue to monitor technical indicators. For example, when Bitcoin shot up a few days in early 2026, BTBT spiked as well, suggesting some short covering.

However, the biggest factor was the general crypto sentiment in Q4, when Bitcoin collapsed; BTBT dropped despite having that short in place. Concisely, the chatter has been about a squeeze, although BTBT's price action has thus far been more consistent with overall crypto trends and company-specific news events, such as the convertible offering, than with a full-scale blow-up.

Bit Digital Delivered Strong Q3 Earnings

In the latest quarter, Bit Digital delivered strong year-over-year (YoY) growth. Total revenue reached $30.5 million, up 33% from $22.8 million a year earlier, driven by WhiteFiber’s contribution, consolidated at 70.7% ownership, and rising Ethereum staking revenue.

Profitability swung sharply. Q3 net income was $146.7 million, or $0.47 per diluted share, compared with a $38.8 million loss, or -$0.26 per share, in the prior year. Most of the upside came from crypto-asset gains, with adjusted EBITDA jumping to $166.8 million from -$19.7 million a year earlier. Cash and equivalents totaled $179.1 million at quarter-end, up from $95.2 million at the end of 2025, highlighting a strong liquidity position. The company also remains debt-free.

Between the lines, management emphasized strategy execution. CEO Samir Tabar said, “This quarter further solidified Bit Digital’s position at the intersection of ... Ethereum and artificial intelligence,” noting that ETH accumulation and WhiteFiber (AI/HPC) create “durable and diversified” growth pillars. He added Bit Digital “views dislocations as opportunities,” given its strong treasury.

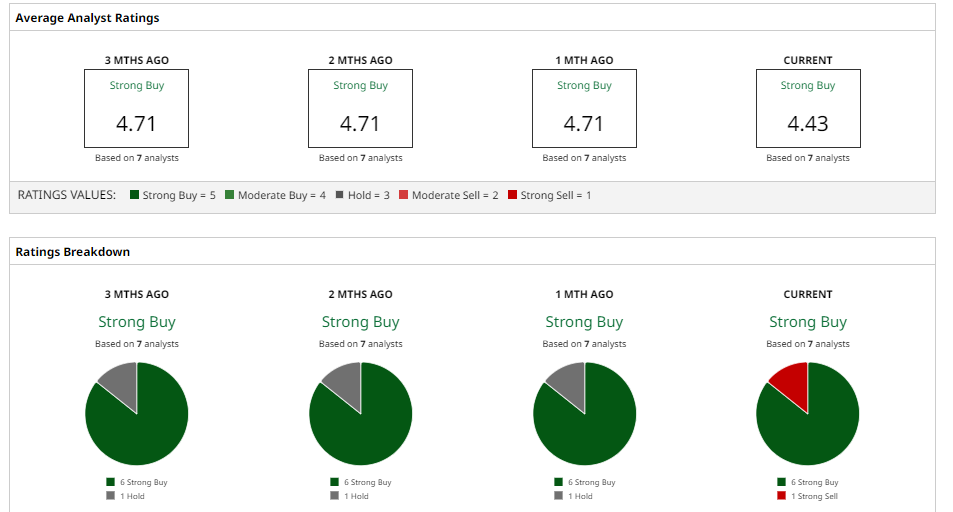

Analyst's Opinions on BTBT Stock

Research firms are broadly bullish on Bit Digital, citing its unique asset mix. For example, Clear Street on January 2026 initiated coverage with a “Buy” rating and an $11 price target, arguing the market underappreciates its high-performance computing (HPC) segment and revenue growth. HC Wainwright’s Kevin Dede has likewise maintained a “Buy” rating with a $7 target.

Across Wall Street, the median target is in the mid-$5s. Barchart data show a roughly “Strong Buy” consensus, with an average target price of around $5.40. This bullish target suggests more than 200% upside potential over current levels.

Some firms have even raised forecasts in light of recent crypto strength, like B. Riley and others, lifted targets after Bitcoin’s late-2025 rally. That said, not all opinions are unanimously positive; only a few analysts caution that BTBT’s upside may hinge on execution in the new markets.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)