Insulin delivery company Insulet Corporation (NASDAQ:PODD) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 31.2% year on year to $783.8 million. The company expects next quarter’s revenue to be around $716.9 million, close to analysts’ estimates. Its non-GAAP profit of $1.55 per share was 6% above analysts’ consensus estimates.

Is now the time to buy Insulet? Find out by accessing our full research report, it’s free.

Insulet (PODD) Q4 CY2025 Highlights:

- Revenue: $783.8 million vs analyst estimates of $768.2 million (31.2% year-on-year growth, 2% beat)

- Adjusted EPS: $1.55 vs analyst estimates of $1.46 (6% beat)

- Adjusted EBITDA: $194 million vs analyst estimates of $187.2 million (24.8% margin, 3.6% beat)

- Revenue Guidance for Q1 CY2026 is $716.9 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 18.7%, in line with the same quarter last year

- Free Cash Flow Margin: 6.1%, down from 15.7% in the same quarter last year

- Constant Currency Revenue rose 29% year on year (17.1% in the same quarter last year)

- Market Capitalization: $17.33 billion

“We ended the year with another excellent quarter, demonstrating the power of our business model, the strength of our technology, and the disciplined execution of our team,” said Ashley McEvoy, President and CEO.

Company Overview

Revolutionizing diabetes care with its tubeless "Pod" technology, Insulet (NASDAQ:PODD) develops and manufactures innovative insulin delivery systems for people with diabetes, primarily through its Omnipod product line.

Revenue Growth

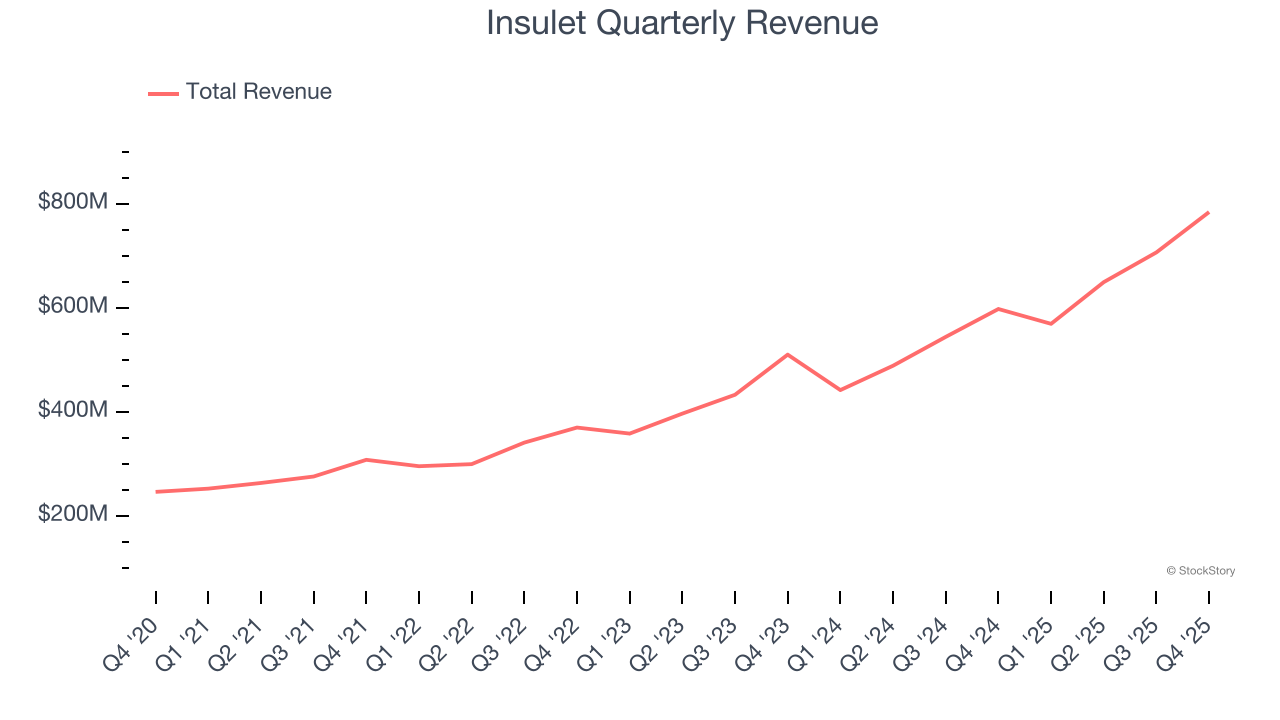

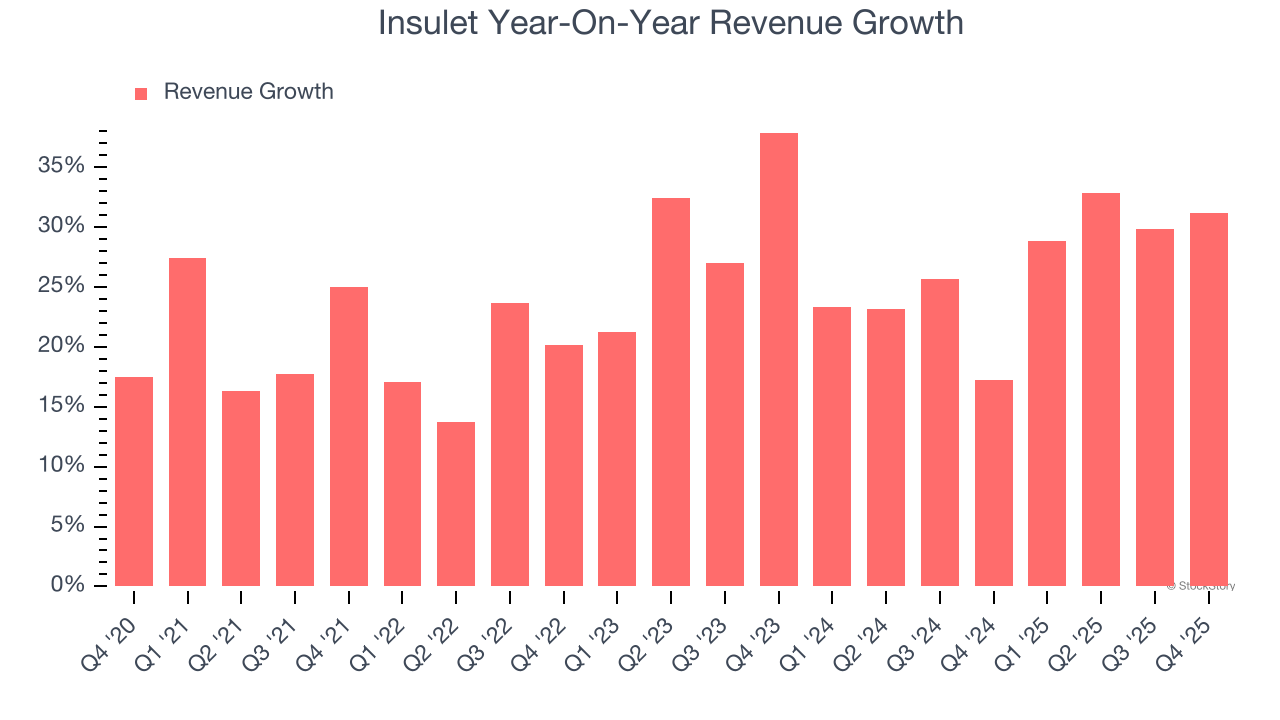

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Insulet grew its sales at an excellent 24.5% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Insulet’s annualized revenue growth of 26.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

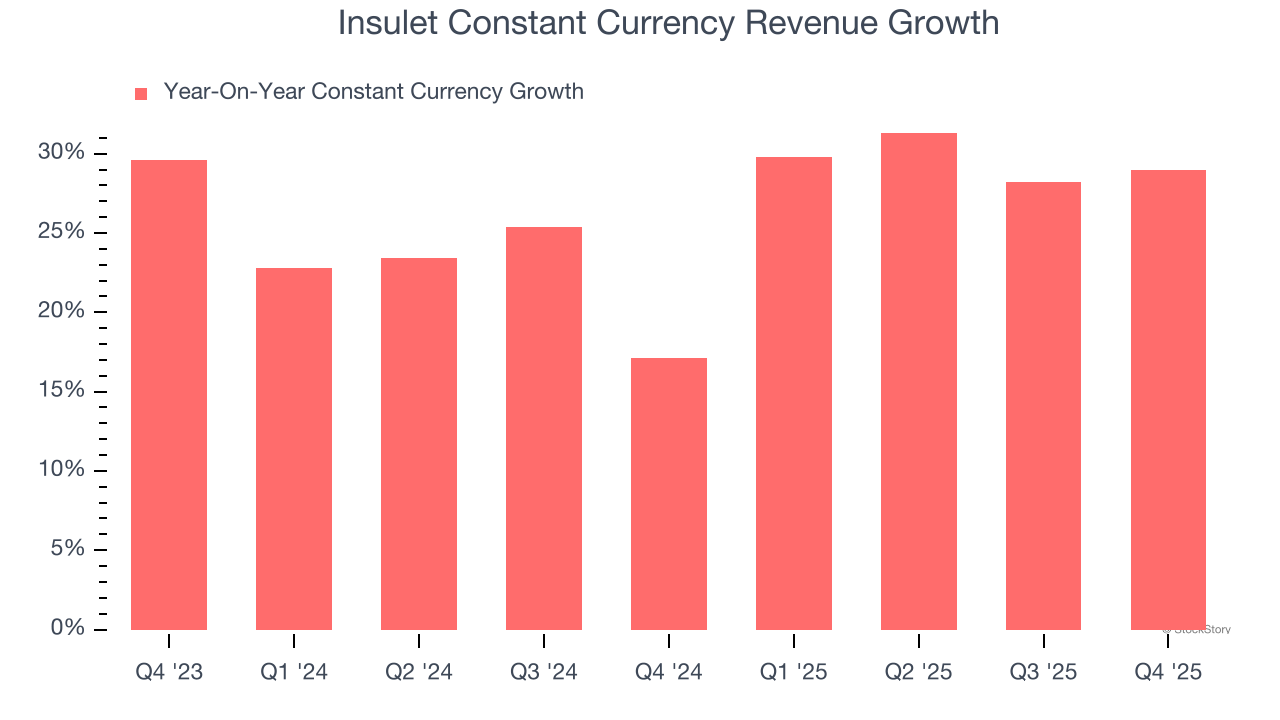

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 25.9% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Insulet has properly hedged its foreign currency exposure.

This quarter, Insulet reported wonderful year-on-year revenue growth of 31.2%, and its $783.8 million of revenue exceeded Wall Street’s estimates by 2%. Company management is currently guiding for a 26% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and suggests the market sees success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

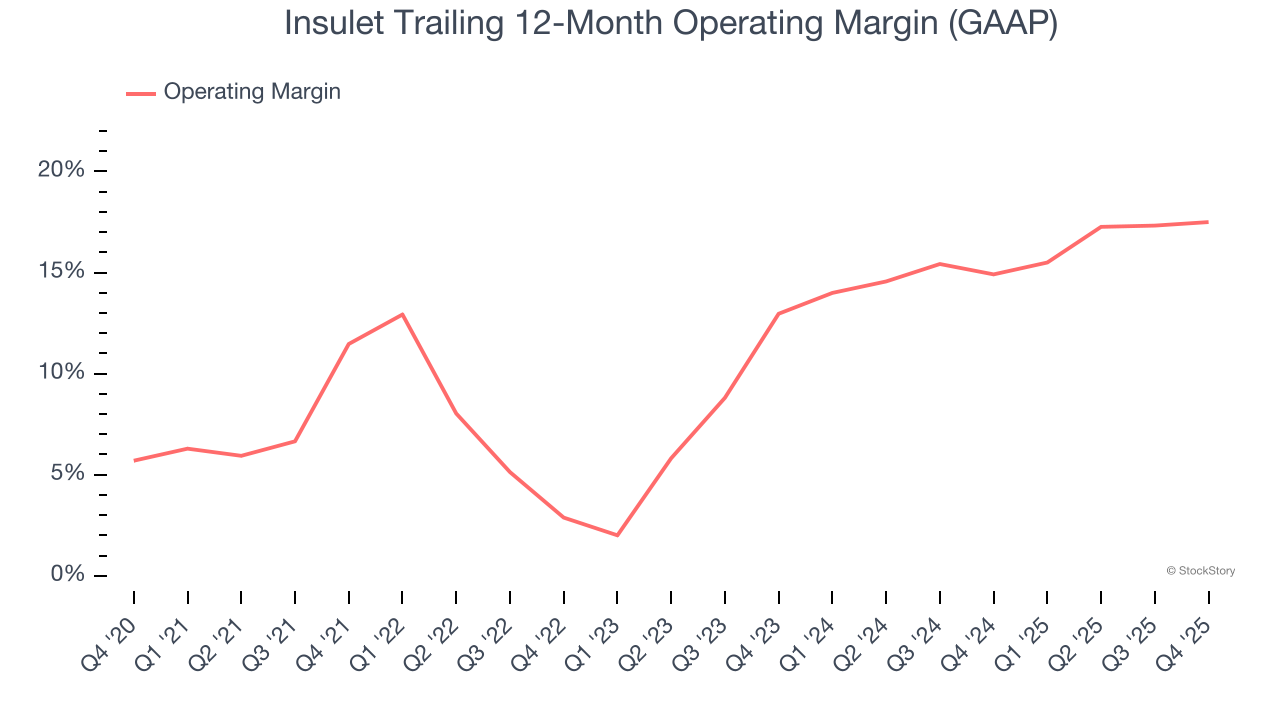

Insulet has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.1%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Insulet’s operating margin rose by 6 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 4.5 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q4, Insulet generated an operating margin profit margin of 18.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

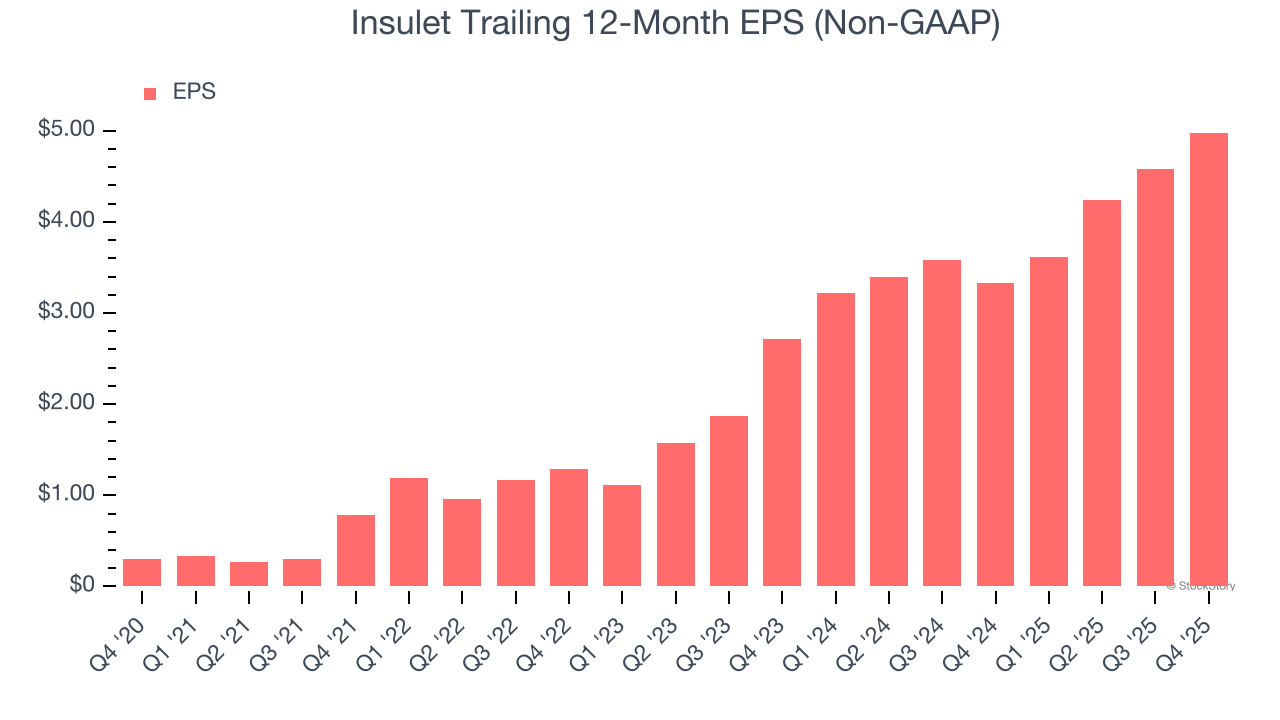

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Insulet’s EPS grew at an astounding 74.8% compounded annual growth rate over the last five years, higher than its 24.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Insulet’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Insulet’s operating margin was flat this quarter but expanded by 6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Insulet reported adjusted EPS of $1.55, up from $1.15 in the same quarter last year. This print beat analysts’ estimates by 6%. Over the next 12 months, Wall Street expects Insulet’s full-year EPS of $4.98 to grow 25%.

Key Takeaways from Insulet’s Q4 Results

It was encouraging to see Insulet beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.4% to $252.18 immediately after reporting.

Insulet had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)