Global retail e-commerce sales hit an estimated $6 trillion in 2024 and are expected to rise to nearly $8 trillion by 2028, a 31% increase over the next few years. In this market, U.S. retailers led by Amazon (AMZN) and Walmart (WMT) still lead the pack across both in-store and online shopping. Online shopping is also taking a bigger share of the total, making up over 23% of all retail purchases in 2025, and that share is expected to keep rising through the decade.

Walmart has been one of the clearest winners of this mix of physical and online retail. The company recently hit a major milestone by crossing the $1 trillion market capitalization mark, putting it in a small group that has mostly been comprised of Big Tech companies.

And it's not just a headline. Walmart’s results have backed it up, with sales strength driven by over 27% growth in e-commerce, while its store network continues to support fast fulfillment and reliable delivery, helping it stand out amid a tough retail backdrop in 2025.

But with the stock now trading at record highs and technical indicators pointing to an overbought setup, does Walmart’s blue-chip dividend track record still make it a buy at these valuations? Or have most of the gains already been made? Let’s find out.

The Numbers Behind the Surge

Walmart is still, at its core, a scale-driven retailer. It leans on everyday low prices and a huge store footprint to bring in steady customer traffic, then builds on that with digital services like pickup and delivery, a third‑party marketplace, and advertising.

That mix helps explain the stock’s run. Over the past 52 weeks, Walmart is up about 28%, and it’s up 15% year-to-date.

The valuation also reflects how much optimism is already priced in. Walmart’s forward price-to-earnings (P/E) ratio is about 42x versus roughly 16x for the sector. In plain terms, investors are paying up for consistency and continued earnings growth, not just a “safe” retail name.

The operating results have supported that confidence. In fiscal Q3, Walmart posted revenue of $179.5 billion, up 5.8% year-over-year. Global eCommerce sales grew 27%, led by store‑fulfilled pickup and delivery and marketplace gains. The global advertising business rose 53%, including VIZIO, while Walmart Connect in the U.S. was up 33%. Membership and other income increased 9%, including 16.7% growth in membership income.

Operating income dipped 0.2% due to a non‑cash share-based compensation charge at PhonePe tied to initial public offering (IPO) preparation, but adjusted operating income still rose 8% on a constant-currency basis. Adjusted earnings per share (EPS) was $0.62, and returns stayed solid with ROA at 8.4% and ROI at 14.8%, even after discrete headwinds.

Walmart’s Next Chapter

Walmart Marketplace is being more intentional about expanding into higher-quality, more specialized categories. The goal is to offer a wider selection without needing more space in stores. A good example is the Premium Musical Instrument Shop, a curated destination featuring respected brands like Fender, Roland, Boss, Zildjian, Ernie Ball, Hercules, Squier, and Barton Bags.

That broader selection feeds into a second growth lever, which is using artificial intelligence (AI) to make shopping easier and faster. Walmart and Google have shared plans for a new experience that pairs Google’s Gemini with Walmart and Sam’s Club’s assortment, value, and convenience. Walmart is building the experience, and it will be accessible inside Gemini through the Universal Commerce Protocol.

A third lever is Walmart’s reach as a national distribution platform. AXIL Brands has signed a national retail distribution agreement with Walmart. Its AXIL X30 LT in‑ear hearing protection plugs are expected to launch nationwide in February 2026, with placement in more than 3,700 Walmart stores.

What The Street Thinks Comes Next

For the current quarter, the average EPS estimate is $0.73 versus $0.66 a year ago, representing 10.6% year-over-year growth. Looking ahead to next quarter, the estimate is $0.68 versus $0.61, or about 11.5% growth. For the full fiscal year, the average estimate stands at $2.63 versus $2.51, implying roughly 4.8% growth.

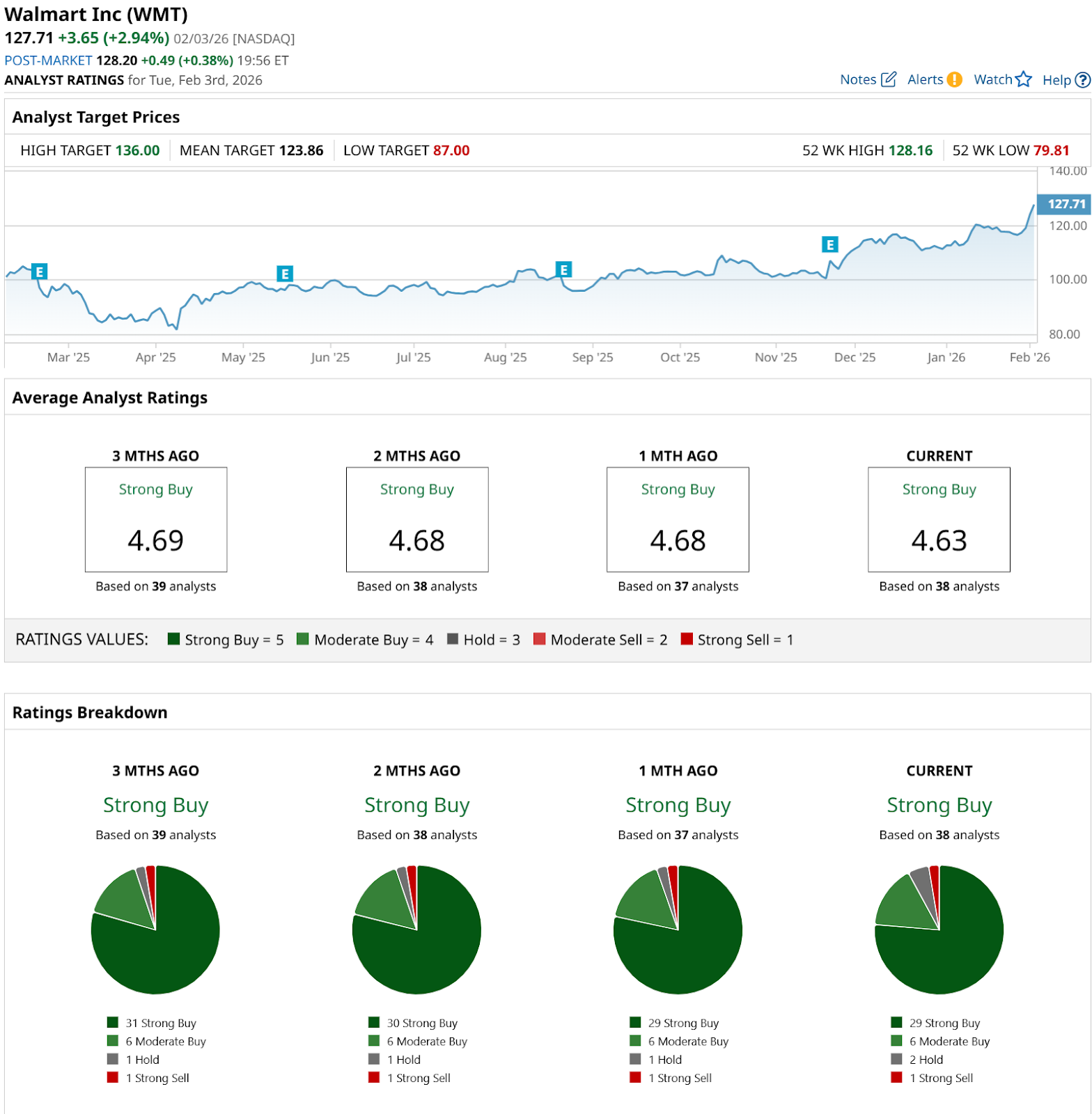

Regarding analyst ratings and price targets, Tigress Financial has been clearly positive. On Jan. 23, it raised Walmart’s price target to $135 and maintained a “Buy” rating. That tells you that some bulls believe Walmart can justify its premium through solid execution, not just a higher valuation multiple. Bernstein also moved its target up, raising it to $129 from $122 on Jan. 5, and maintaining an “Outperform” rating. Bernstein’s view is that middle- to high-income consumers could be on firmer financial footing in 2026 and also pointed to additional tax refunds likely helping those households more, which matters because Walmart has been attracting this group in recent quarters.

Stepping back, all 38 analysts surveyed rate Walmart a consensus “Strong Buy,” with a mean price target of $124.22. With the stock currently trading at $127.71, it is already about 2.81% above that average target, which often means the stock needs either stronger earnings or more target hikes to keep pushing higher from here.

Conclusion

At a $1 trillion valuation, Walmart still looks like a buy, but it is likely more of a steady compounder than a bargain. The business is executing, e-commerce and higher-margin lines like advertising are growing fast, and analysts are broadly positive, which supports the idea that this is not just a defensive rally. That said, the stock is priced at a clear premium and already sits above the average Street target, so near-term upside may be volatile and more earnings-dependent. Most likely, shares will grind higher over time, but investors should expect pauses or pullbacks around earnings as this valuation gets stress-tested.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)