/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

Amazon (AMZN) will report fourth-quarter financial results tomorrow, Thursday, Feb. 5. The tech giant has delivered strong revenue performances through the first three quarters of 2025, and the upcoming quarter could continue that trend.

Amazon’s Q4 top line is expected to benefit from solid momentum across its three key businesses: e-commerce, cloud, and advertising.

That said, investors haven’t rewarded AMZN stock despite its steady performance. Amazon stock is down by over 6% in three months. Moreover, it has remained roughly flat over the past year. Thus, AMZN’s 14-day Relative Strength Index is 51.3, below the 70 level typically associated with overbought conditions. This suggests the stock has room to move higher.

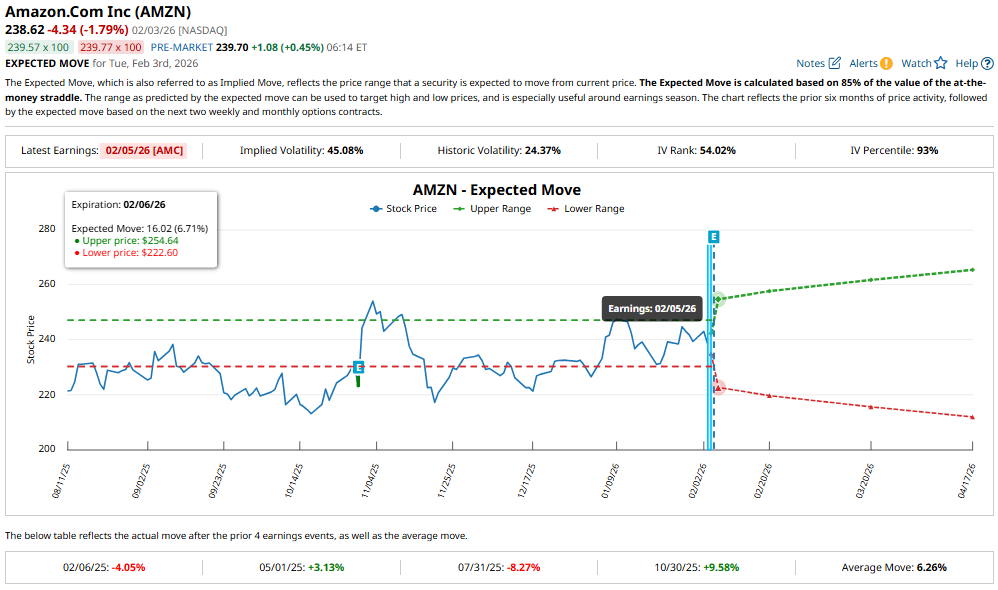

At the same time, options traders are pricing in a post-earnings move of about 6.7% in either direction for contracts expiring Feb. 6. That is roughly in line with Amazon’s average move of roughly 6.3% after earnings over the past four quarters. Investors should note that Amazon shares have climbed 9.6% following the Q3 earnings report.

Amazon’s Q4: Here’s What to Expect

Amazon could impress with its Q4 performance. The company could deliver strong top-line growth in the fourth quarter, driven by solid momentum in retail sales, strength in cloud business, and continued expansion of the fast-growing advertising unit.

For Q4, Amazon has guided net sales to a range of $206 billion to $213 billion. At the midpoint of $209.5 billion, that would represent year-over-year (YoY) growth of roughly 11.6%. This steady top-line expansion reflects the company’s ability to attract shoppers through competitive pricing, an unmatched product selection, and delivery speeds that continue to set the standard in e-commerce.

A major driver of Amazon’s growth story remains Amazon Web Services (AWS), its profitable cloud computing division. In the third quarter, AWS generated $33 billion in revenue, up 20.2% from the prior year and faster than the previous quarter's growth rate. Management noted that demand is being driven by increased adoption of AI workloads, alongside continued strength in traditional cloud services.

AWS’s growing backlog, which reached $200 billion by the end of Q3, indicates a strong growth trajectory ahead. Further, during the Q3 conference call, Amazon said several additional large deals were finalized in October but were not included in the backlog number, suggesting strong momentum in the coming quarters.

Amazon’s investment in AI hardware is also emerging as a meaningful long-term opportunity. The company’s custom-built AI chip, Trainium2, is becoming a multibillion-dollar business, with demand accelerating sharply. Management reported that Trainium2 capacity is now fully subscribed, and product growth surged 150% during the third quarter.

Amazon’s advertising segment, which continues to strengthen both revenue and profitability, will likely maintain solid growth. Advertising revenue reached $17.7 billion in Q3, with growth accelerating for three consecutive quarters. Amazon’s ability to deliver highly targeted ads across its retail and streaming platforms is making it an increasingly attractive channel for brands.

While revenue growth remains strong, Amazon’s AI investments could weigh on earnings growth in the near term. Analysts expect Q4 EPS of $1.98, up 6.5% YoY, representing a slowdown from the 37% EPS growth Amazon delivered in Q3.

However, Amazon has a history of beating analysts’ EPS expectations by a wide margin. In Q3, its EPS of $1.95 exceeded the Street’s average forecast by 23.4%.

With multiple growth engines firing, from retail to cloud to advertising, Amazon’s Q4 results could remain strong.

Is AMZN Stock a Buy, Sell, or Hold?

Amazon continues to show resilience in its retail business, while its cloud division is witnessing acceleration after a period of slower growth. Beyond retail and cloud, Amazon is also building new opportunities in fast-growing areas such as the AI chip business. At the same time, Amazon’s advertising segment is accelerating, adding a high-margin revenue stream that could further strengthen profitability.

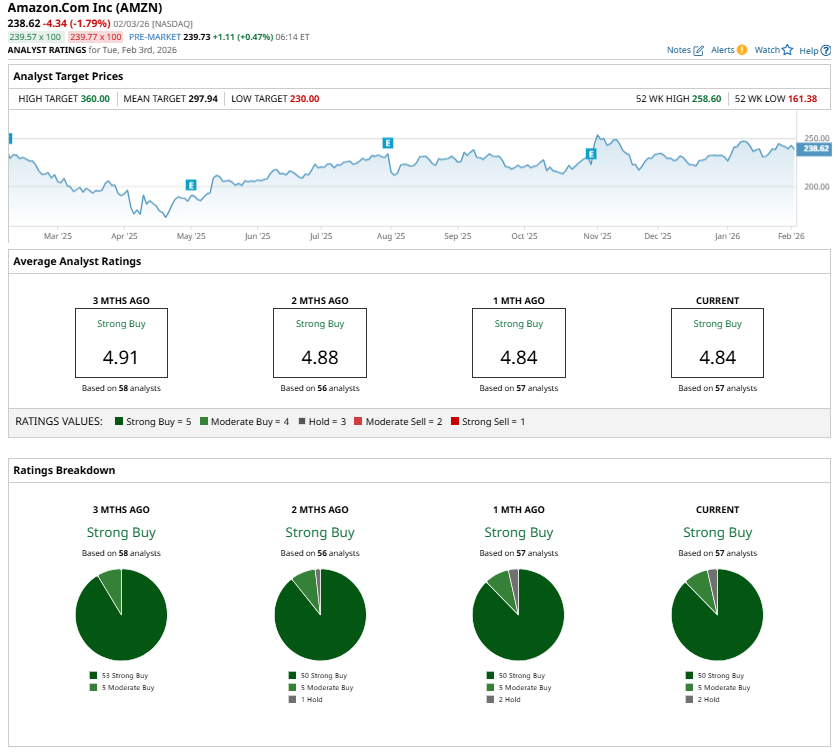

Overall, these catalysts provide a strong foundation for Amazon to deliver solid financial results in the fourth quarter and beyond. Wall Street analysts are bullish, with AMZN stock currently holding a “Strong Buy” consensus rating.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)