Shares of eToro (ETOR) stock rallied nearly 20% today after the online trading platform posted better-than-expected Q4 earnings on a more than 9% increase in funded accounts to 3.81 million.

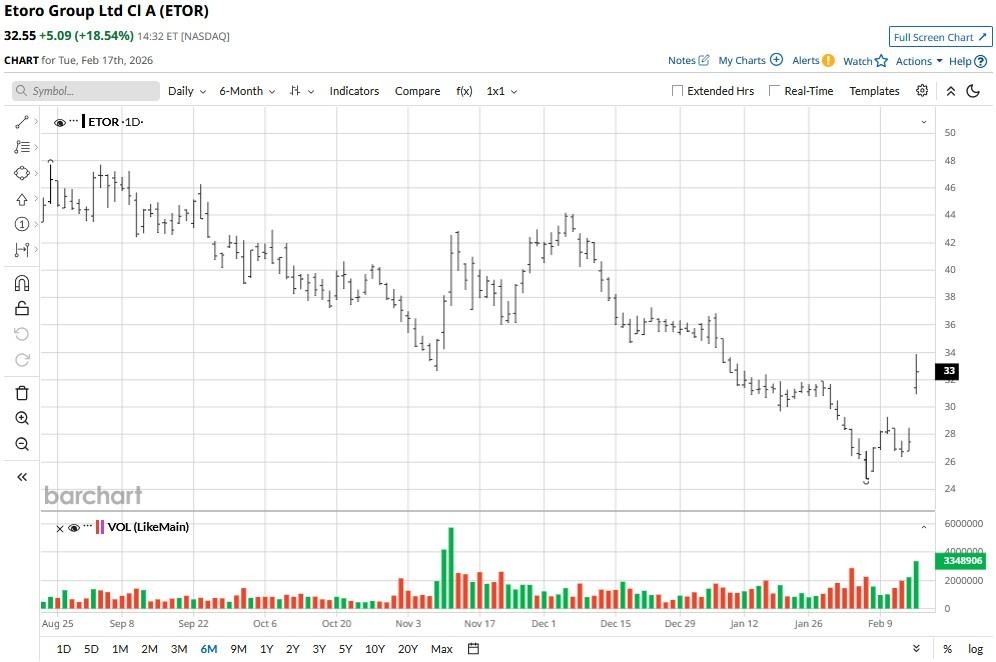

ETOR earned $0.71 per share in the fourth quarter, handily beating the $0.69 consensus, helping the stock price soar past its 20-day moving average (MA).

Technical analysts often read this setup as indicating continued bullish momentum ahead. Versus its year-to-date high, eToro shares are still down some 10%.

Should You Buy eToro Stock Into Post-Earnings Strength?

Beyond headline figures, ETOR stock is worth owning because its management announced a $100 million increase to the share repurchase authorization on Tuesday.

The Israel-based company simultaneously committed to an accelerated stock buyback worth $50 million, suggesting the board sees eToro Group as undervalued at current levels.

At the time of writing, the stock trades at a forward price-to-earnings (P/E) ratio of less than 11x, which is lower than the firm’s historical multiple.

This means the market is still valuing eToro as a mature, cyclical brokerage — not the disruptive financial technology specialist it has evolved into in recent years.

AI Ambitions Could Drive Further Upside in ETOR Shares

While eToro’s overall revenue was down about 34% year-over-year in Q4, management attributed much of this to temporary crypto-market volatility.

In fact, executives dubbed it as “healthy rotation” in the release — not permanent demand destruction — as crypto-native clients switched to commodities like gold (GCJ26) and silver (SIH26) for portfolio hedging.

If anything, ETOR’s fourth-quarter print confirms its multi-asset approach is actually bearing fruit.

Plus, eToro is aggressively pivoting toward an AI-first ecosystem to future-proof its platform. The upcoming eToro App Store, powered by nearly 1,000 community-developed trading tools and public APIs, transforms the broker into a scalable financial hub.

As decentralizing innovation helps it capture tech-centric Gen Z and millennial cohorts better than its traditional peers, eToro shares could push sustainably higher over the next few years.

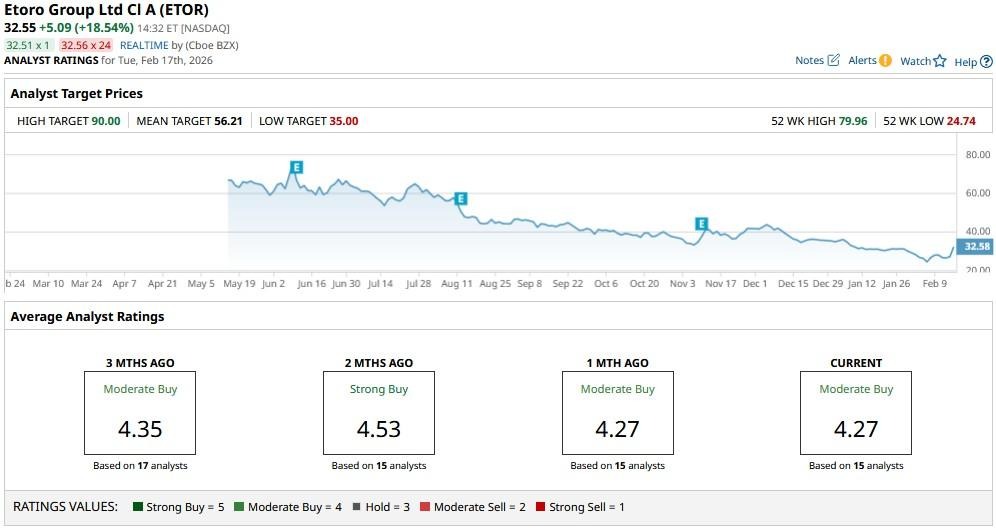

What’s the Consensus Rating on eToro?

Wall Street firms also believe ETOR shares will continue to recover through the remainder of 2026

The consensus rating on eToro Group remains at a “Moderate Buy,” with the mean target of roughly $56 indicating potential upside of more than 70% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)