/AI%20(artificial%20intelligence)/AI%20technology%20concept%20by%20NMStudio789%20via%20Shutterstock.jpg)

Artificial intelligence (AI) is reshaping the tech space at a fast pace, but the biggest long-term winners may not simply be the companies building AI models. For investors looking for the next Big Tech winners, the race may now be determined by who makes AI work at scale rather than who builds it. If that's the case, there are two clear winners.

Let's take a closer look.

Tech Stock #1: Palantir Technologies

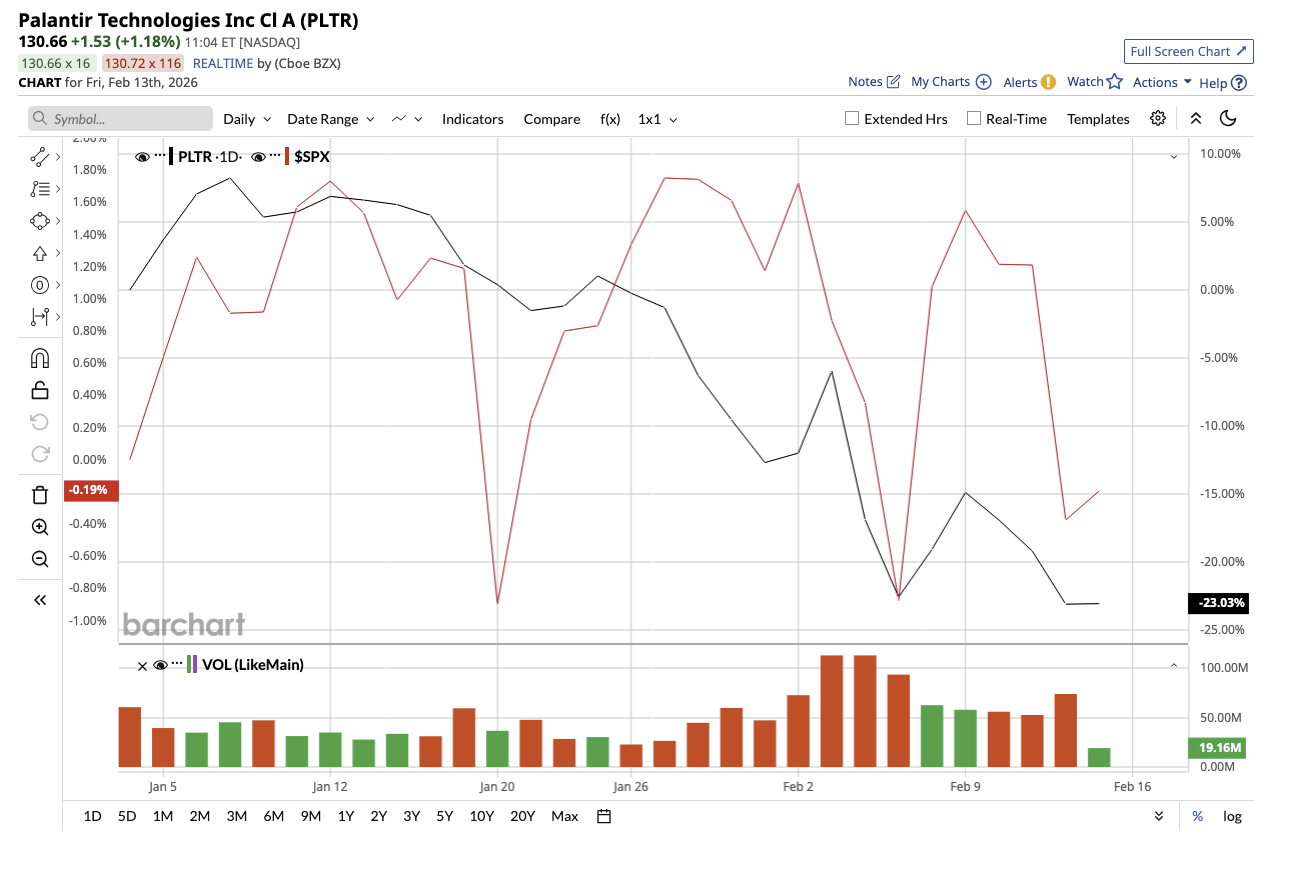

Valued at $313 billion, Palantir Technologies (PLTR) has quickly transformed from an under-the-radar tech stock to one of the fastest-growing AI stocks. The company builds software platforms — namely Gotham, Foundry, and the Artificial Intelligence Platform (AIP), — to assist organizations in analyzing vast amounts of data and making faster operational choices. Palantir soared more than 130% last year, wildly outperforming the broader market. So far this year, the stock is down 26%, but analysts see much more upside ahead.

In the most recent fourth quarter, revenue surged 70% year-over-year (YOY) to $1.4 billion, the company's fastest growth rate since becoming public. The U.S. business drove most of the growth, accounting for 77% of total revenue and growing 93% YOY. Palantir's reliance on government contracts has been repeatedly questioned, but the company has addressed the issue by expanding its commercial operations. Notably, commercial revenue surged 82% YOY in Q4 to $677 million, while government revenue increased 60% YOY to $730 million due to demand from the Department of War (formerly the Department of Defense) and civil agencies.

In the quarter, the U.S. Navy granted a contract worth up to $448 million to modernize shipbuilding supply chains and speed up naval vessel deliveries. Management stated that lessons acquired from commercial supply chains are now being applied to national security concerns. The company’s “Rule of 40” score (a key metric combining growth and profitability) reached 127%. With the help of AI, the company has managed for rapid expansion and strong profitability to coexist. Palantir has adopted a smart strategy of not just relying on a single big client. In fact, revenue from the top 20 customers climbed by 45% YOY, hitting $94 million per client on a trailing 12-month basis, indicating increasing engagement and customer loyalty.

The total contract value (TCV) in the quarter stood at $4.3 billion, the company’s highest ever. For the full year, total remaining deal value increased 105% YOY to $11.2 billion, with remaining performance obligations rising 144% and net dollar retention rising to 139%. Revenue for the full year grew 56% to $4.475 billion. Adjusted free cash flow reached $2.27 billion for the year, with the company ending the quarter with $7.2 billion in cash, cash equivalents, and short-term U.S. Treasury securities.

According to CEO Alex Karp, Palantir has expanded beyond traditional software categories and is growing entirely organically, driven by direct customer connections rather than acquisitions or co-investment techniques. Looking ahead, Palantir expects continued momentum in 2026 driven by ongoing investment in AIP development. Revenue could increase by 61% YOY to $7.19 billion at the midpoint, in line with consensus estimates.

Analysts expect Palantir’s earnings to increase by 76% in 2026, followed by another 39% in 2027. At 122 times forward earnings, Palantir is trading at a premium, reflecting investor optimism.

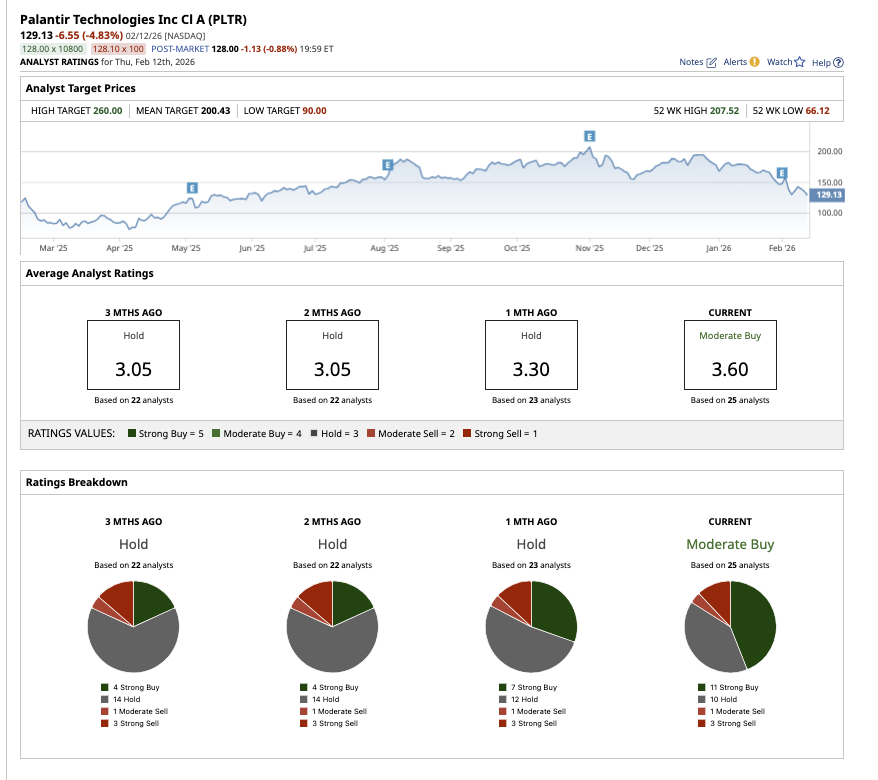

As interest in PLTR stock has renewed, so has Wall Street’s enthusiasm. Over the last two years, analysts have remained cautious of PLTR stock, rating it an overall “Hold” due to its lofty valuation and unconventional work methods. But the consensus rating for the stock has now changed to an overall “Moderate Buy.”

Among the 25 analysts covering the stock, 12 rate Palantir as a “Strong Buy,” 10 call it a “Hold,” one has a “Moderate Sell" rating, and two analysts say it is a “Strong Sell.” The average target price of $200.43 implies that shares can climb 51% from current levels. The Street-high estimate of $260 implies that the stock has potential upside of 95% from current levels.

Tech Stock #2: Fortinet

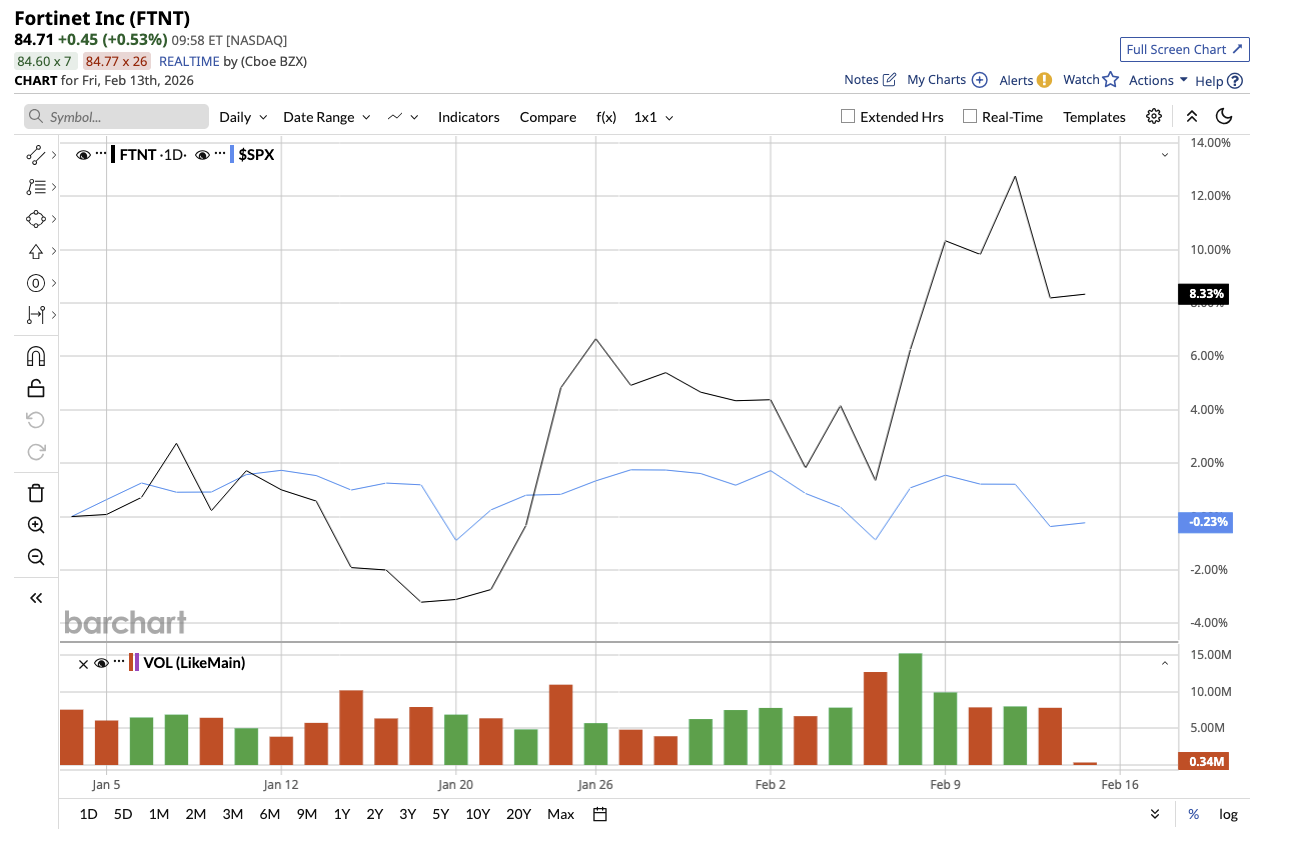

Valued at $63.6 billion, Fortinet (FTNT) is a cybersecurity company that provides software and hardware solutions to protect networks, devices, and data from cyber threats. The company is benefitting from the strong demand across cybersecurity markets.

In the fourth quarter, total revenue grew 15% to $1.91 billion, supported by product revenue growth of 20%. Both hardware and software increased by 20%, supported by technology upgrades and expansion into new use cases. Total billings rose 18% as secure networking billings grew 13%, outperforming the broader secure networking market as Fortinet continued gaining market share. What was impressive in the quarter was Fortinet's continued dominance as the top firewall provider, with a 55% unit market share and the greatest product revenue among its security rivals.

Fortinet's long-term strategy has focused on merging networking and security into a single platform. Management stated that secure networking is likely to outperform regular networking by the end of the year, highlighting the significance of this convergence trend. Most of Fortinet’s competitive advantage lies in its FortiOS operating system and proprietary FortiASIC technology. The company intends to launch FortiOS 8.0 at its annual customer and partner conference in March, with expanded security and networking capabilities, including AI security innovations.

Recently, the company partnered with Nvidia (NVDA) to use the BlueField 3 DPU to secure AI infrastructure, highlighting the growing relevance of AI-related security deployments. Annual recurring revenue increased 21%, thanks to “more than 20 AI-powered solutions” that enable customers to consolidate multiple security vendors onto Fortinet’s platform. The company generated adjusted free cash flow of $589 million and repurchased $57 million worth of shares during the quarter and an additional $356 million worth of shares quarter-to-date. The company's remaining share repurchase capacity stands at $1.4 billion.

Looking ahead, Fortinet expressed confidence in its long-term strategy, driven by secular tailwinds including rising cybersecurity spending, convergence of networking and security, and the growing need to secure AI and operational technology environments. Analysts see Fortinet’s earnings increasing by 8% in 2026, followed by 11% in 2027.

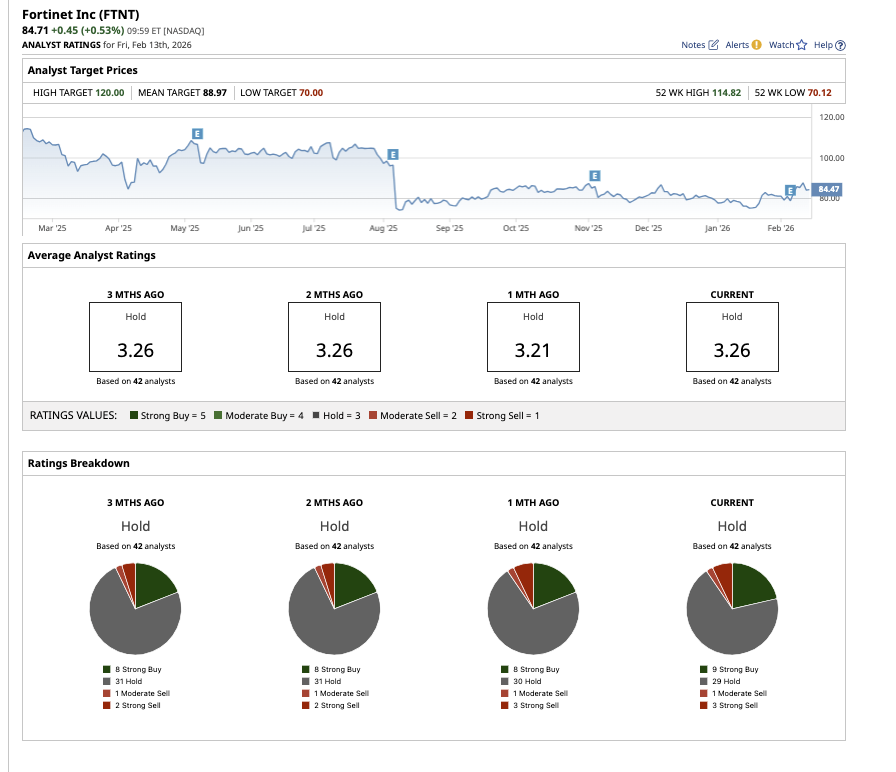

Overall, FTNT stock is rated as a consensus “Hold.” Among the 42 analysts covering the stock, nine rate it a “Strong Buy,” 29 have a “Hold" rating, one rates the stock a “Moderate Sell,” and three call it a “Strong Sell.” FTNT stock is trading close to its average target price of $89.03, while the Street-high estimate of $120 implies potential upside of 47% from current levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)