.jpg)

Investors in the shares of consumer goods makers haven’t exactly enjoyed the stock market’s rally in the past year. That’s because - if inflation does ebb - consumer goods companies have less justification to boost prices on their products, weighing on sales growth and threatening the outlook for profits.

That’s why the sector’s stocks are coming off their worst annual performance relative to the broader market since 1999, and are trailing again in 2024. Wall Street analysts project fourth-quarter results for S&P 500 consumer staples companies will show sales rising 2.8% from a year earlier. That’s the weakest since 2020, and sales are forecast to decelerate overall in 2024, according to data compiled by Bloomberg Intelligence.

Will Wall Street’s negative outlook be correct? Perhaps, but there are definite exceptions.

How Cooling Inflation Helps P&G

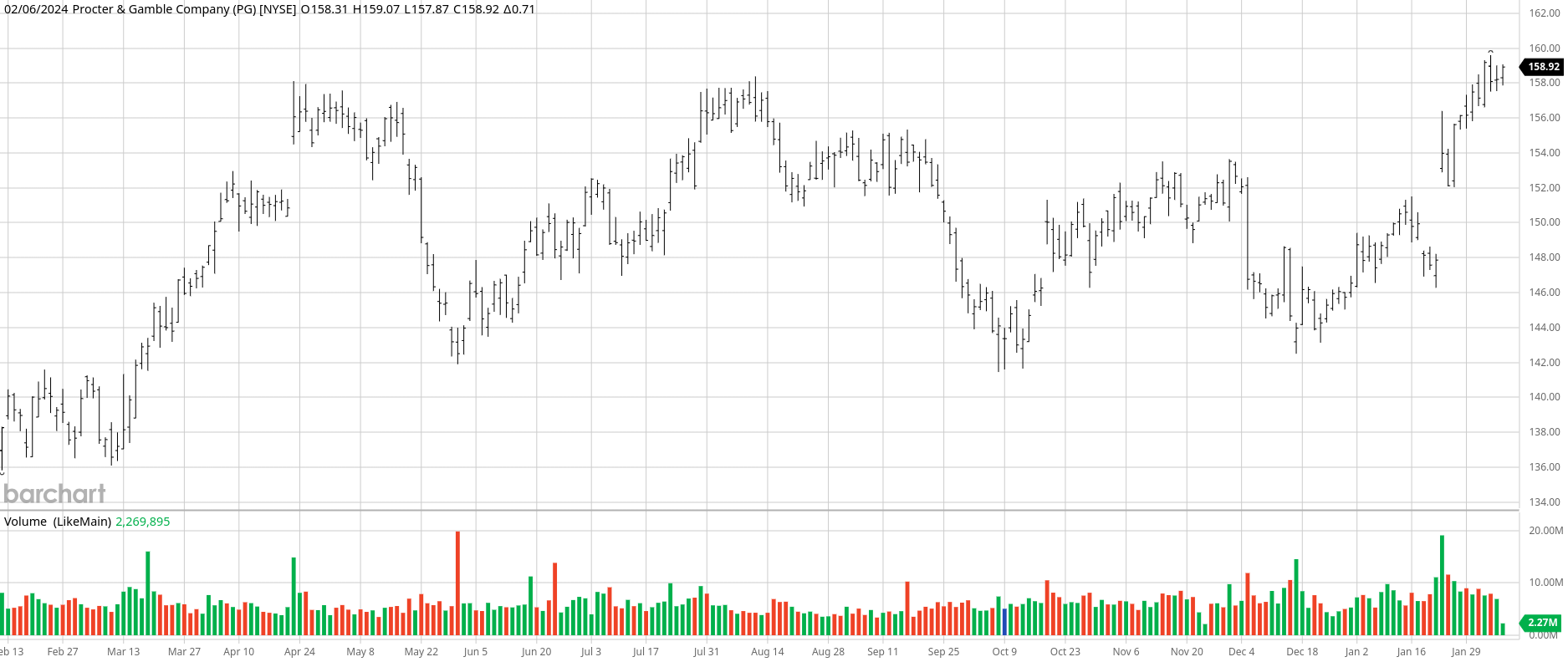

Let’s look at a bellwether for the industry, Procter & Gamble (PG), whose products are sold in more than 180 countries.

Its many well-known brands include: Pampers, Downy, Tide, Bounty, Charmin, Gillette, Old Spice, Head & Shoulders, Dawn, Febreze, Mr. Clean, Crest, Ivory, Olay, Vicks and Pepto-Bismol. PG reports results in five segments: Fabric & Home Care (35% of fiscal 2nd quarter sales); Baby, Feminine & Family Care (24%); Beauty (18%); Healthcare (15%); and Grooming (8%).

The company kicked off the earnings season for the sector on Jan. 23, and reported quarterly sales that trailed expectations for the first time since early 2020.

But the results also showed the silver lining from cooling inflation - lower commodity prices helped its bottom line, and fed into an improved profit and earnings outlook, which boosted the stock. P&G’s adjusted earnings of $1.84 a share in its latest quarter topped market projections, as the company benefited from those lower commodity costs and production cost savings.

Management reiterated their organic sales and revenue guidance for the current year, and lifted their forecast for adjusted earnings to a range of $6.37 to $6.43 a share. The company expects both its organic sales and adjusted earnings to be at the upper end of its guidance range this fiscal year.

The takeaway from P&G’s results is that, while higher prices for goods like apparel are weighing on shoppers, they’re still willing to shell out more money on essentials. P&G’s prices were 4% higher in the latest quarter than a year ago.

The quantity of items shipped by Procter & Gamble continued to trend downward, thanks to lagging demand in China, although U.S. and European volumes (+3%) were very good. P&G management expects volumes to pick up in China - its second largest market - in the second half of 2024, as do I. Much of the decline in sales in China was due to a COVID-related 34% drop in sales of SK-II, its high-end beauty brand from Japan.

North America, though, is where the company gets about half of its revenue. Volumes here grew by 4% in the last quarter. On the earnings call, P&G CFO Andre Schulten said that U.S. shoppers remain resilient.

“The U.S. continues to be very solid, continues to impress,” Schulten said. The company has been able to grow its U.S. market share, even with private-label shares also increasing, he said.

P&G Stock Forecast for 2024

It wasn’t long ago that Procter & Gamble was dogged by lackluster sales growth. However, after posting its 22nd consecutive quarter of at least mid-single-digit organic revenue growth, these concerns are nothing but a distant memory.

The volume gains in the U.S. and Europe are impressive, when you consider that the industry’s growth in the last two years has been driven entirely by price increases.

The other impressive item from P&G’s results was the strength of its profit margins in the quarter, which took Wall Street analysts by surprise. The combination of price growth, productivity savings, and more favorable commodity costs lifted Procter & Gamble’s gross margin by 590 basis points before currency effects.

The company’s earnings reflected a “barbell” trend that has been going on for a while now. That’s where some consumers pay up for high-quality products, while other consumers trade down to cheaper, private-label goods.

The quality of Procter & Gamble’s profit beat and stable fiscal 2024 outlook, combined with easing costs, underpins my confidence in the company easily achieving guidance.

Add in a 2.4% dividend yield (I expect a dividend raise again in 2024) and stock buybacks, and P&G will prove to be unmatched in the household goods industry.

The company has paid a dividend for over 130 consecutive years, and has increased the dividend for 67 straight years. Over the last five years, P&G has raised the dividend at a compound annual rate of 6%. It forecasts about $9 billion in dividends and $5 billion to $6 billion in share repurchases for fiscal year 2024.

PG stock is a buy anywhere below $160 a share, with the potential for a conservative 12% to 13% share price gain in 2024.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)