Growth stocks, such as CRISPR Therapeutics (CRSP), a cutting-edge biotech company that is just getting started, are often overlooked. Nonetheless, these often have the potential to yield enormous profits.

What makes CRISPR stand out is its revolutionary gene editing technology, which offers possibilities for treating various genetic disorders, cancer, and a myriad of other diseases. CRISPR-based therapies seek to correct the mutations that cause these genetic disorders at their source, offering potential cures rather than just symptom management.

In anticipation of its first approved product, CRISPR stock spiked by nearly 54% last year, outperforming the broader S&P 500 Index’s ($SPX) gain of about 25%. Now that CRISPR has received approval for its first product, how high can its stock soar going forward? Let’s find out.

CRISPR Therapeutics Has Its First Approved Product

Until the end of 2023, CRISPR had no approved products. Since 2015, CRISPR has collaborated with the renowned biotech company Vertex Pharmaceuticals (VRTX) to use CRISPR gene therapy to develop potential new treatments for a variety of life-threatening diseases.

The company intended to use exa-cel, a gene therapy, to treat sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT). In the fourth quarter of 2023, the company received approval for its first-ever product. The U.S. Food and Drug Administration (FDA) approved CRISPR/Cas9 gene-edited cell therapy, Casgevy, for the treatment of SCD.

Furthermore, on Jan. 16, the FDA approved Casgevy for the treatment of TDT. The approval was originally scheduled for March, so this is good news for the company.

CRISPR and Vertex are moving forward to make the treatment available to patients, with nine authorized treatment centers in the U.S. and three in Europe. The companies intend to open 50 centers in the U.S. and 25 in the European Union over time.

With this approval, Casgevy became the first approved therapy for TDT and SCD. Patients will require one course of treatment. The companies already have 16,000 patients aged 12 and up who are eligible for SCD treatment, while 1,000 patients are eligible for TDT.

According to Inside Precision Medicine, the one-time treatment is expected to cost approximately $2.2 million. CRISPR and Vertex estimate that the lifetime healthcare costs of managing SCD range between $4 million and $6 million.

The partnership deal specifies Vertex making a $200 million milestone payment to CRISPR while receiving 60% of the profits, with the remainder going to CRISPR.

A Long Way To Go

While CRISPR has achieved its first milestone with product approval, it will be years before the company sees significant revenue and earnings. Many more products are in the company's pipeline, undergoing clinical trials. Looking ahead, CEO Samarth Kulkarni stated, "We are well positioned to execute on our clinical trials across various therapeutic areas, including oncology, autoimmune, cardiovascular and diabetes, setting up a catalyst-rich 12-18 months for the company.”

He added, “In parallel, we are continuously innovating on our platform with next-generation gene editing and delivery technologies that could enable us to address even more diseases with potentially curative medicines.”

The global gene-editing market is projected to grow at a compounded annual growth rate of 15.5% to be worth $20 billion by 2030. CRISPR's first-approved product will also help the company build investor trust in its gene-editing therapy capabilities. It may also encourage larger biotechnology companies to work with CRISPR in the future.

CRISPR began 2024 with approximately $1.9 billion in cash, cash equivalents, and marketable securities, plus $200 million in milestone payments associated with Casgevy's approval. The partnership with Vertex has resulted in a debt-free balance sheet, which should help the company advance its pipeline.

What Do Analysts Say About CRSP Stock?

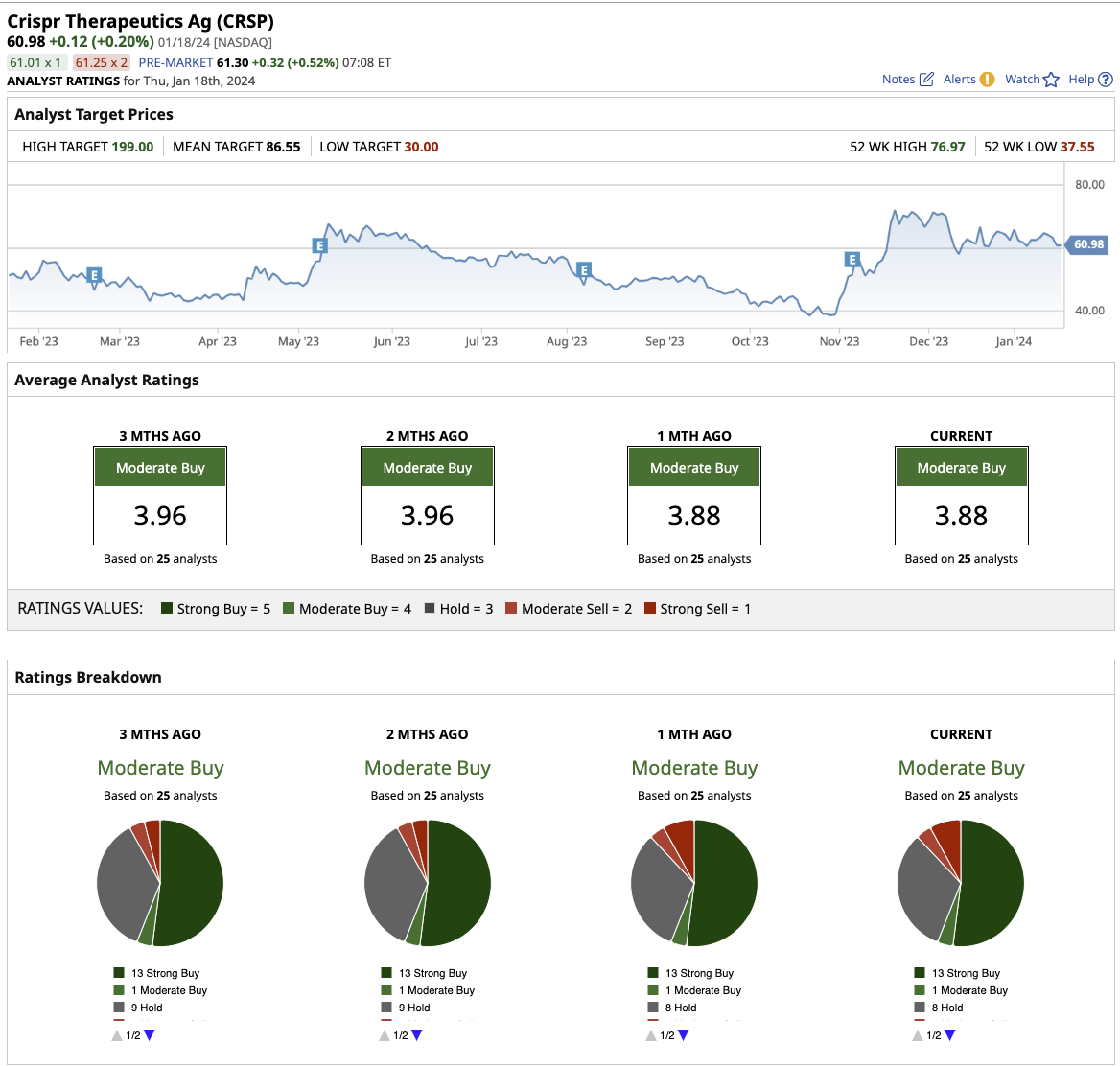

Overall, Wall Street has assigned a “moderate buy” rating to CRSP. Out of the 25 analysts covering the stock, 13 rate it a “strong buy,” with one “moderate buy” rating and eight “hold” ratings. Plus, it has one “moderate sell” and two “strong sell” recommendations. Its average target price of $86.55 implies a potential upside of 32.7% over the next 12 months.

The Key Takeaway

I believe this innovative biotech company will achieve even greater success in the next decade or so. Exa-cel has demonstrated promising results in clinical trials for both devastating diseases. Positive results from the one-time treatment could help the stock reach its average target price this year.

However, I reckon it will be a wise decision not to cash in on the gains and instead hold CRISPR stock for the long term, as biotech stocks involved in cutting-edge technology tend to generate huge long-term returns. CRISPR is likely one of the best undervalued growth stocks for investors willing to wait until the company uncovers its full potential. The stock is still trading 15.2% below its 52-week high, making now the ideal time to buy.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)