Two Structured Income Candidates as Sector Rotation Develops

As equities continue to rotate beneath the surface, leadership is becoming more selective. Technology is stabilizing after recent pressure, Consumer Discretionary is emerging from multi-month bases, and selective energy names remain technically constructive. In this environment, disciplined stock selection is more important than broad index exposure.

The Bull Strangle framework focuses on identifying technically stable stocks with defined support, improving momentum, and liquid option markets. The strategy combines long stock ownership with the sale of out-of-the-money covered calls and cash-secured puts. This dual-option structure generates premium income while expanding the potential profit range, reducing dependence on precise short-term direction. This week’s Watch List includes 18 stocks across multiple sectors. Two setups stand out based on structure, recent earnings catalysts, and constructive price behavior.

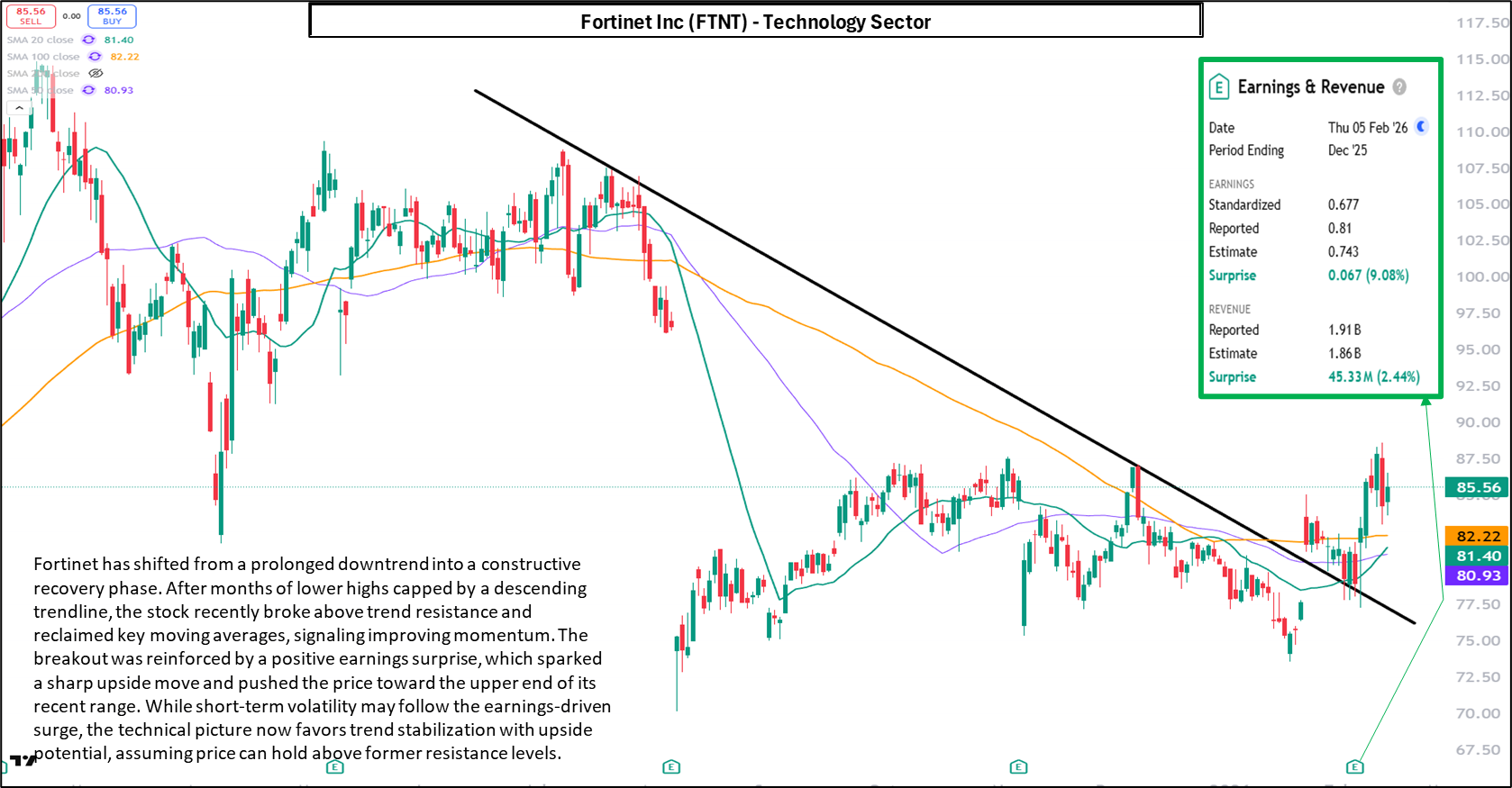

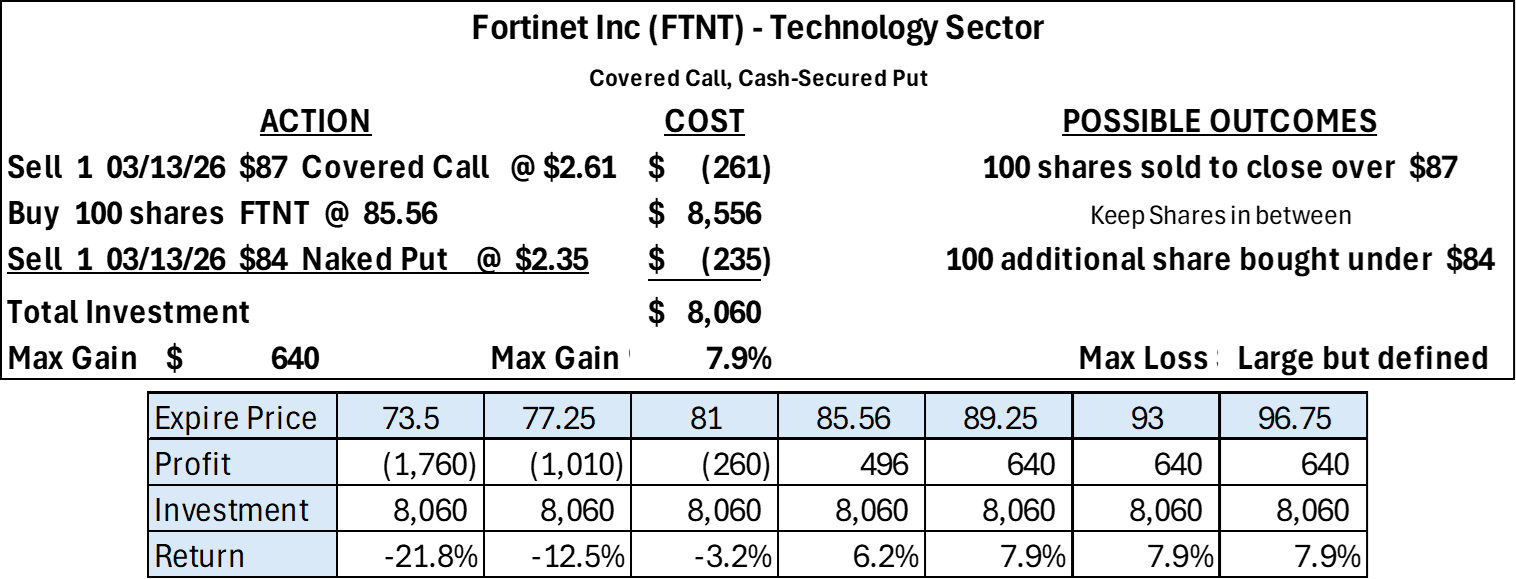

Fortinet (FTNT) — Technology Sector Stabilization

Fortinet provides cybersecurity and network security solutions worldwide. FTNT has transitioned from a prolonged downtrend into a constructive recovery phase. After months of lower highs capped by a descending trendline, the stock recently broke above trend resistance and reclaimed key moving averages, signaling improving momentum.

A positive earnings surprise reinforced the breakout, shifting short-term control back to buyers. Price is now stabilizing above reclaimed resistance and holding near short-term averages. While some consolidation following the earnings-driven surge is normal, the technical structure suggests a shift from repair toward potential trend stabilization. As long as FTNT maintains support above prior resistance and rising short-term averages, the risk profile improves. The combination of technical repair and solid option liquidity makes FTNT suitable for structured premium strategies that benefit from continued stabilization.

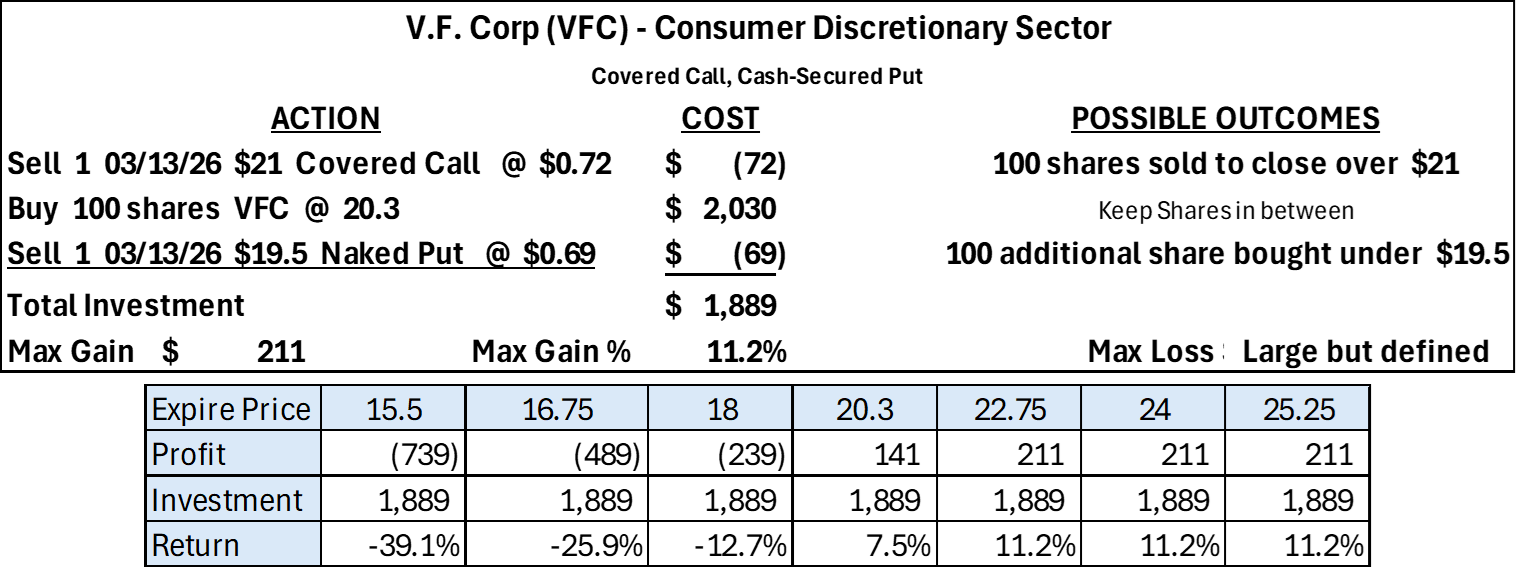

V.F. Corp (VFC) — Emerging Uptrend in Consumer Discretionary

V.F. Corporation operates globally through brands including The North Face, Vans, and Timberland. VFC has transitioned from a prolonged basing phase into a steady uptrend characterized by higher highs and higher lows. Price has reclaimed and is holding above short- and intermediate-term moving averages, with pullbacks finding support along a rising trendline.

A recent earnings surprise accelerated the advance, reinforcing the improving structure. Recent consolidation near the $20–21 area appears constructive, suggesting digestion of gains rather than distribution. Momentum remains positive as long as the stock respects trendline support and the 50-day moving average. The orderly advance and clearly defined support levels create a favorable backdrop for income-oriented strategies that rely on stability and time decay.

Structural Takeaway

This week’s highlighted names represent four different but constructive technical environments:

- FTNT — Technology stabilization after earnings-driven trend repair

- VFC — Emerging discretionary uptrend with defined support

In each case, defined support levels, improving or stable momentum, and liquid option markets create conditions where disciplined stock-plus-premium strategies can widen profit ranges while managing directional risk.

For readers interested in a structured, rules-based framework for combining stock ownership with systematic premium selling, The Bull Strangle Strategy book is available on Amazon. The Bull Strangle Newsletter provides weekly trade planning, strike selection guidance, and portfolio management insights built around the same disciplined methodology.

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)