Investing in exchange-traded funds (ETFs) makes sense for almost any investor.

Buying ETFs is the easiest way to put together a diversified portfolio of stocks without having to do the hard work of managing them yourself. Typically, the only additional cost to owning an ETF is a modest expense ratio, which could be just a fraction of a penny on the dollar.

The most popular ETFs track the S&P 500, but investors have a wide range of options beyond these basic index funds. If you are a growth stock investor, two ETFs worth looking at are the Vanguard Growth Fund (NYSEMKT:VUG), which tracks the performance of the CRSP U.S. Large Cap Growth Index, and the Invesco QQQ Trust (NASDAQ:QQQ), which tracks the Nasdaq-100 index, made up of the 100 biggest non-financial companies traded on the Nasdaq stock exchange.

Let's take a look at how the Vanguard Growth Fund and the Invesco QQQ Trust compare to each other to see which is the better buy today.

Image source: Getty Images.

Vanguard Growth Fund vs. Invesco QQQ Trust: holdings

It might not come as a surprise that these ETFs have many overlapping holdings. After all, they're both focused on large-cap stocks and skew toward growth companies. One key difference is that the Invesco QQQ Trust is made up exclusively of Nasdaq stocks, while the Vanguard Growth Fund also holds stocks that trade on the New York Stock Exchange.

The chart below shows the top 10 holdings in each fund and their exposure.

| Top 10 VUG Holdings | Exposure | Top 10 QQQ Holdings | Exposure |

|---|---|---|---|

| Apple | 13.02% | Apple | 11.02% |

| Microsoft | 12.89% | Microsoft | 10.37% |

| Alphabet | 6.95% | Alphabet | 6.04% |

| Amazon | 6.34% | Amazon | 5.67% |

| Nvidia | 4.91% | Nvidia | 4.16% |

| Meta Platforms | 3.44% | Meta Platforms | 3.87% |

| Tesla | 2.78% | Broadcom | 3.07% |

| Eli Lilly | 2.43% | Tesla | 2.63% |

| Visa | 1.88% | Adobe | 2.26% |

| Mastercard | 1.62% | Costco | 2.10% |

Source: Yahoo! Finance and fund websites.

The Vanguard Growth Fund holds 221 stocks compared to just 100 stocks in the Invesco QQQ Trust, so it might seem surprising the Vanguard fund has more exposure to the "Magnificent Seven" stocks than the QQQ does. That's likely due to a special rebalancing in the Nasdaq-100 that helped diversify it away from those big tech stocks earlier this year.

Vanguard Growth Fund vs. Invesco QQQ Trust: performance

While it's important to understand how the holdings differ between these two ETFs, the most important factor in your decision is likely going to be performance.

While past performance isn't a guarantee of future returns, it's a good place to start, especially since one can't analyze the "underlying business" of an ETF in the way that one can with an individual stock.

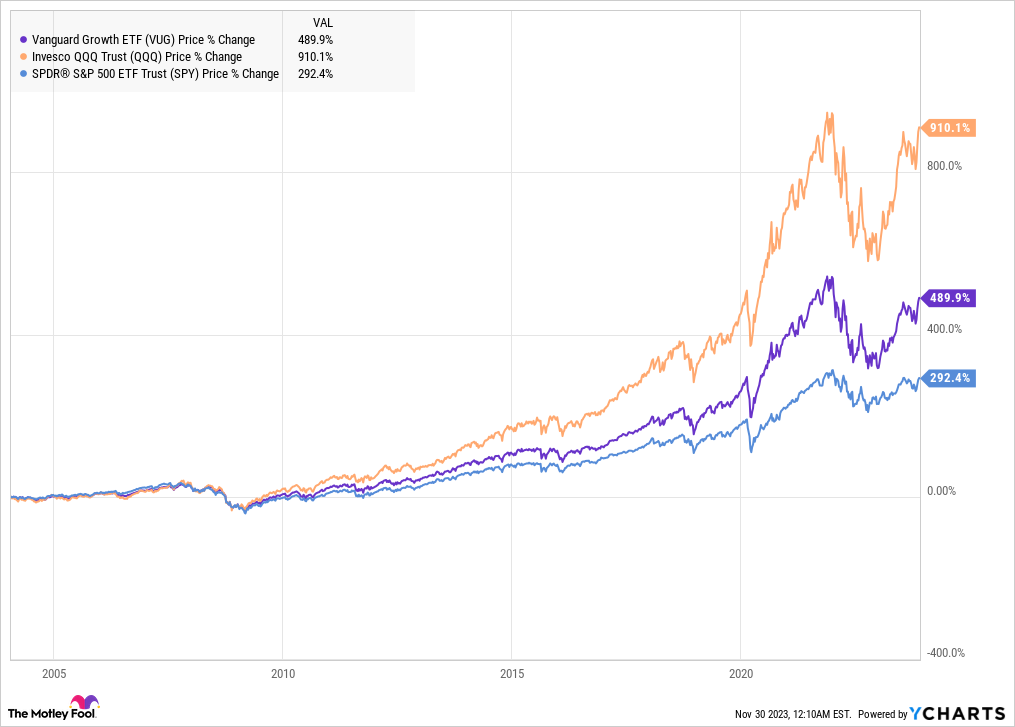

The chart below shows how these two ETFs and the SPDR S&P 500 ETF have performed since 2004.

Data by YCharts.

As you can see, the Invesco QQQ Trust has beaten the Vanguard Growth Fund by a wide margin during that time, but both ETFs have topped the SPDR S&P 500 ETF, showing that owning either one has been a reliable way to outperform the broad market long term.

The Invesco QQQ Trust has also outperformed the Vanguard Growth Fund in more recent time frames as well, showing a consistent track record of besting its fellow growth fund.

Other factors

In addition to the holdings and performance, the two other factors worth considering in evaluating an ETF are the expense ratio and the dividend yield.

The Vanguard Growth Fund has an expense ratio of just 0.04% and offers a dividend yield of 0.62%. The Invesco QQQ Trust, meanwhile, is more expensive with an expense ratio of 0.20%, and it pays an identical dividend yield of 0.62%.

Which is the better ETF to buy?

Given the Invesco fund's stronger track record, it's worth paying the higher expense ratio to own it. However, the Invesco fund's advantage could be diminished by the rebalancing that took place this year, especially as the Vanguard fund now has more exposure to the top tech stocks.

To hedge your bets, you could easily invest in both of these ETFs, but between the two, the Invesco QQQ ETF is more deserving of your investment dollars.

10 stocks we like better than Invesco Qqq Trust, Series 1

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Invesco Qqq Trust, Series 1 wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 29, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jeremy Bowman has positions in Amazon, Broadcom, and Meta Platforms. The Motley Fool has positions in and recommends Adobe, Alphabet, Amazon, Apple, Costco Wholesale, Mastercard, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Index Funds-Vanguard Growth ETF, and Visa. The Motley Fool recommends Broadcom and Nasdaq and recommends the following options: long January 2024 $420 calls on Adobe, long January 2025 $370 calls on Mastercard, short January 2024 $430 calls on Adobe, and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)