/Meta%20Platforms%20by%20Primakov%20via%20Shutterstock.jpg)

Forecasts suggest that the wider artificial intelligence economy could reach roughly 4.8 trillion dollars by 2033, helped by AI agents and automation tools that are growing at more than 40% a year. At the infrastructure level, AI data center chip revenue alone is projected to jump from $207 billion in 2025 to roughly $286 billion by 2030, which shows just how much money is pouring into the companies that can build and sell AI at real scale.

Meta Platforms (META) sits right in the middle of that spending cycle. Meta’s AI investments are already helping lift revenue growth and strengthen its competitive “moat,” and some analysts are now debating whether the stock could climb toward 1,000 as AI-powered ad tools, recommendation systems, and hardware efforts start adding up over time.

This is also why Meta is getting renewed attention as an AI platform, not just a social media company, and it helps explain why billionaire investor Bill Ackman has stepped in. Pershing Square disclosed a new stake in Meta while reshaping its portfolio over the past year.

If AI really is setting up a multi-trillion-dollar opportunity and Meta is becoming one of its central platforms, with a high-conviction buyer like Ackman now on board, should everyday investors be thinking about following his lead into META stock, or is the market already running ahead of itself? Let’s find out.

Meta by the Numbers

Meta Platforms, the parent of Facebook, Instagram, WhatsApp, and Threads, mainly makes money by selling digital ads based on what people do across its apps. At the same time, it is adding more AI tools and business products to help it earn more from that same activity.

Over the past 52 weeks, META stock is down about 11% and is also down 2.2% year-to-date (YTD).

META trades at roughly 22.8x forward earnings, which is well above the sector’s 14.5x, so investors are still paying a premium for its growth profile.

Income investors also have something new to consider. Meta now pays a quarterly dividend and has started increasing it. The stock yields about 0.31% on an annualized basis, or 2.10 in yield terms, and the forward payout ratio is just 6.93%, which leaves room for future increases. The most recent dividend was $0.525 per share, paid on Dec. 15, 2025, and the company has a one-year track record of raising the payout.

The 2025 operating numbers help explain why it can do all of this at once. The number of daily active users reached 3.58 billion, up 7%. Ad impressions rose 18% in Q4 and 12% for the full year, while the average price per ad increased 6% and 9%, respectively. Revenue climbed to $59.89 billion in Q4 and $200.97 billion for 2025, up 24% and 22% year-over-year (YoY).

Costs and expenses grew faster, up 40% in Q4 and 24% for the year to $35.15 billion and $117.69 billion, reflecting heavier AI and infrastructure spending. Even so, Meta produced $36.21 billion in operating cash flow in Q4 and $115.80 billion for the year, with free cash flow of $14.08 billion and $43.59 billion.

Capital expenditures were $22.14 billion in Q4 and $72.22 billion for 2025, and cash, cash equivalents, and marketable securities ended the year at $81.59 billion. That kind of cash position also supported $26.26 billion of share repurchases for the full year.

The Growth Engines Powering Meta’s Next Act

Meta and Corning (GLW) have a multiyear agreement worth up to $6 billion to speed up the buildout of some of the most advanced data centers in the U.S. Under the deal, Corning will supply Meta with its newest optical fiber, cable, and connectivity solutions, and it will expand manufacturing in North Carolina, where Meta will serve as the anchor customer. This links straight back to Meta’s AI plans because higher-capacity fiber networks are a key part of running large AI workloads and delivering more advanced features across Meta’s apps.

On the power side, Meta has a major agreement with TerraPower to develop up to eight Natrium advanced nuclear plants in the U.S. The plan would provide Meta with up to 2.8 GW of carbon-free baseload energy, and the built-in energy storage could lift total output to 4 GW, with initial units targeted as early as 2032.

This is Meta’s largest support of advanced nuclear technology so far, and it is aimed at locking in clean power for the kind of energy demand that comes with expanding AI and data center capacity.

Moreover, Meta has reached about 2.5 GW of clean energy contracts with NextEra Energy Resources (NEE), made up of 11 power purchase agreements and two energy storage agreements, which adds another long-term source of low-carbon electricity for its growing data center footprint.

What Wall Street Sees in META Stock

Wall Street’s average earnings estimates are $6.67 for the March 2026 quarter, $29.67 for fiscal 2026, and $33.79 for fiscal 2027. Compared to the prior year, those numbers point to estimated YoY growth of +3.73% for the current quarter, -0.07% for fiscal 2026, and +13.89% for fiscal 2027. On the company side, Meta’s guidance for Q1 2026 revenue is $53.5 billion to $56.5 billion, and it expects full-year 2026 total expenses to land between $162 billion and $169 billion.

Even with that level of spending, most analysts are staying positive. Bank of America raised its price target to $885 from $810. Cantor Fitzgerald moved its target to $860 from $750. Jefferies analyst Brent Thill is even more aggressive, with a $1,000 target, and he named Meta a “Top Pick” while saying the market has already priced in the near-term worries around AI spending.

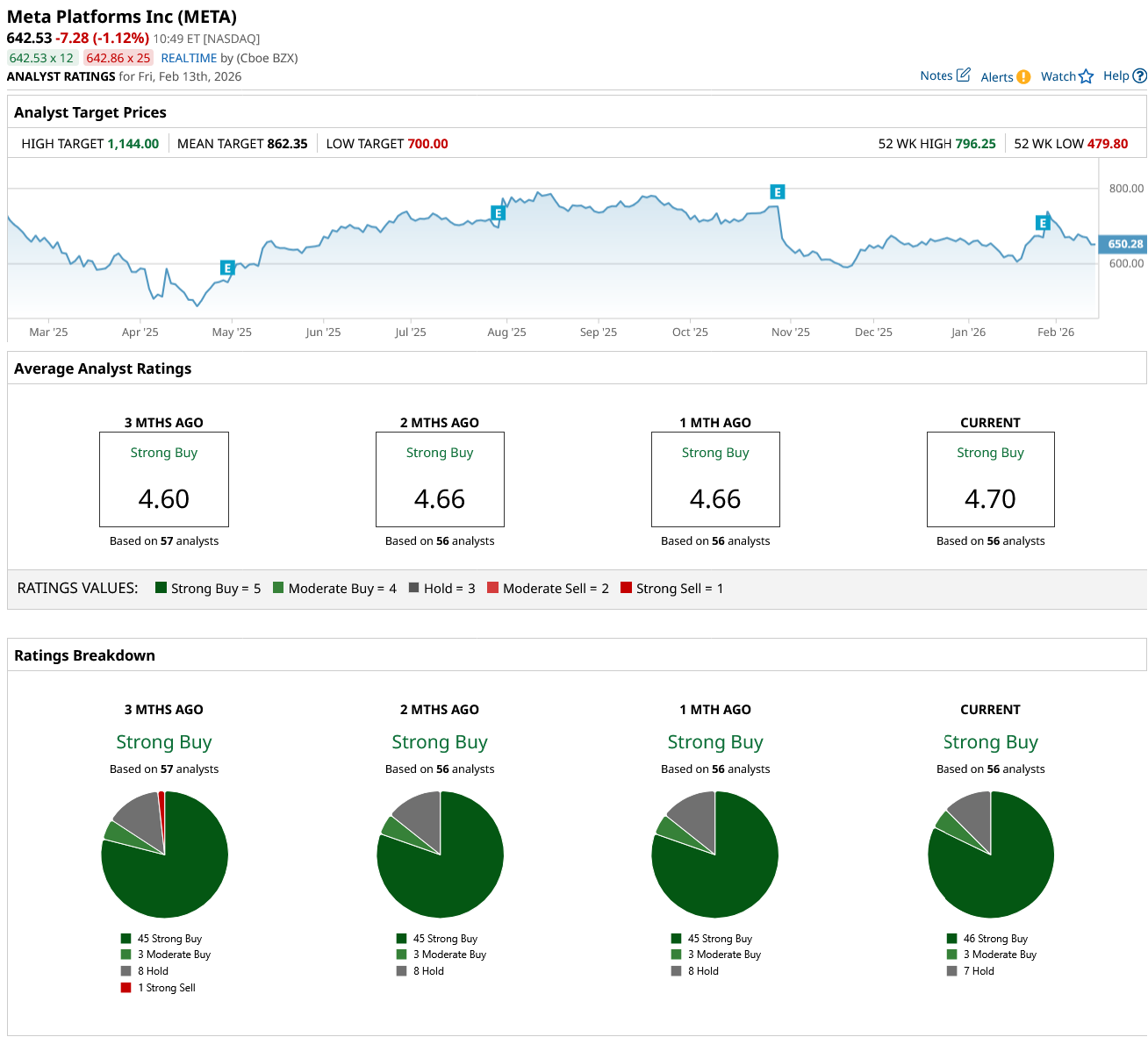

Taking the full picture, all 56 analysts surveyed rate Meta a consensus “Strong Buy,” and the mean price target of $862.35 suggests about 34% upside from $642.53.

Conclusion

For everyday investors, META stock still looks like a name worth owning alongside Bill Ackman, but only if you can stomach volatility and think in years, not quarters. The company is leaning hard into AI, pouring billions into data centers, fiber, and clean energy, yet it is doing so from a position of huge cash generation, a fortress balance sheet, and growing capital returns. With 56 analysts calling it a “Strong Buy” and a mean target that points to roughly 29% upside from here, the odds still favor shares grinding higher over the next couple of years rather than meaningfully breaking down, even if sentiment gets bumpy along the way.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)