/Facebook%20on%20a%20phone%20by%20Firmbee_com%20via%20Unsplash.jpg)

Meta Platforms (META) ended 2025 on a high note. The business is evolving beyond social media by investing extensively in artificial intelligence (AI), infrastructure, and new products that will strengthen its competitive position for years to come. With strong user growth, improving ad performance, and ambitious AI plans taking shape, is it a good time to buy META stock now?

Meta Platforms' Core Business Is Going Strong

Meta Platforms' core advertising business, via its Family of Apps segment, remained strong in the fourth quarter. Total revenue reached $59.9 billion, up 24% year-over-year (YOY), while Family of Apps revenue increased 25% YOY to $58.9 billion. Advertising revenue increased by 24% to $58.1 billion, thanks to an 18% rise in ad impressions, which were primarily driven by improved ad performance and advertiser demand.

The Reality Labs segment still remains a drag, with revenue declining 12% YOY to $955 million, with an operating loss of $6 billion due to prior-year product launch comparisons and timing of headset procurement. Meta predicts Reality Labs' losses in 2026 to be similar to those in 2025, indicating a peak before a steady turnaround. The company views AI glasses as a major long-term opportunity. Sales of its glasses more than tripled in 2025, making them among the fastest-growing consumer electronics products.

EPS increased 11% YOY to $8.88 per share in Q4. For the full year, revenue rose 22% to $200.9 billion but EPS dipped 2% to $23.49. Capital expenditures totaled $22.1 billion, which reflected investments in data centers and infrastructure. Nonetheless, the company generated $14.1 billion in free cash flow and ended the quarter with $81.6 billion in cash and marketable securities, alongside $58.7 billion in debt.

Meta With a New Moat

Having a moat in business refers to a long-term advantage over competitors that makes it difficult for others to steal customers or profits. Meta's new moat is more than just one product or feature. In fact, it is the combination of AI, scale, data, infrastructure, and distribution all working together in a way that is very difficult for competitors to replicate.

Meta Platforms already holds a strong position online, with more than 3.5 billion people using its apps every day. This shows its social media apps are highly dependable, with fewer odds of users transferring to other apps. With the help of AI, Meta can now better understand what people enjoy and want to view, allowing it to show more relevant content and ads without increasing the number of ads. Additionally, the company is investing heavily in data centers, chips, and computing power so it can build and run advanced AI systems more efficiently. Overall, the company is creating an ecosystem where its apps, AI, and business tools all work together, making it harder for competitors to match Meta’s scale, data, and technology.

CEO Mark Zuckerberg projected 2026 as the year when AI begins to significantly change products and workflows, with the business revamping its AI program in 2025. Meta anticipates total capital expenditures of $115 billion to $135 billion in 2026, driven mostly by infrastructure supporting AI projects and core business growth. Despite these investments, the company forecasts operating income to be higher in 2026 than in 2025.

Analysts see Meta’s revenue increasing by 25% in 2026, followed by 17% growth in 2027. While earnings are expected to increase by roughly 2% this year, they could surge by 18% in 2027, driven by heavy AI and infrastructure investments. Trading at 18.7 times forward 2027 earnings, META stock is still a reasonably valued AI stock.

What Does Wall Street Say About META Stock?

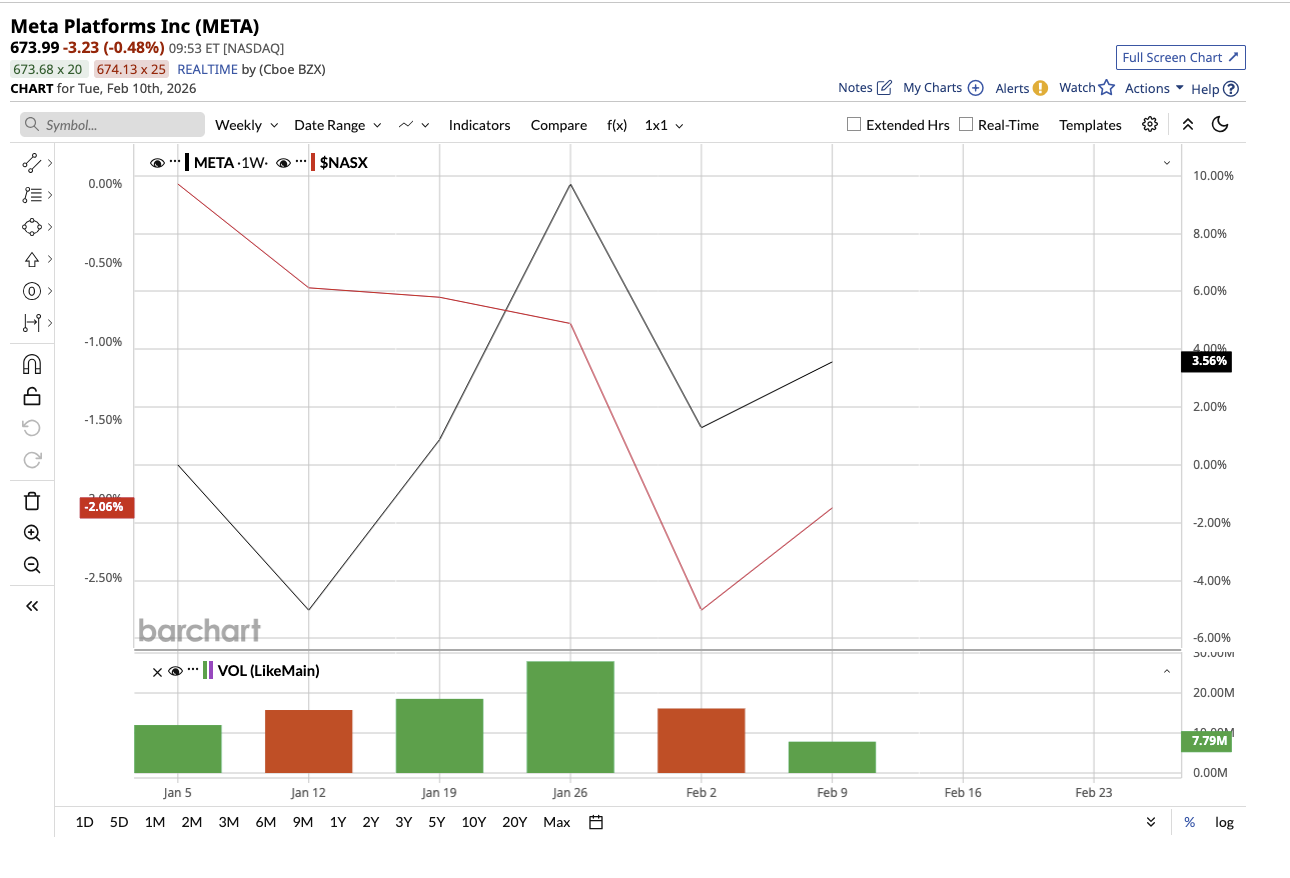

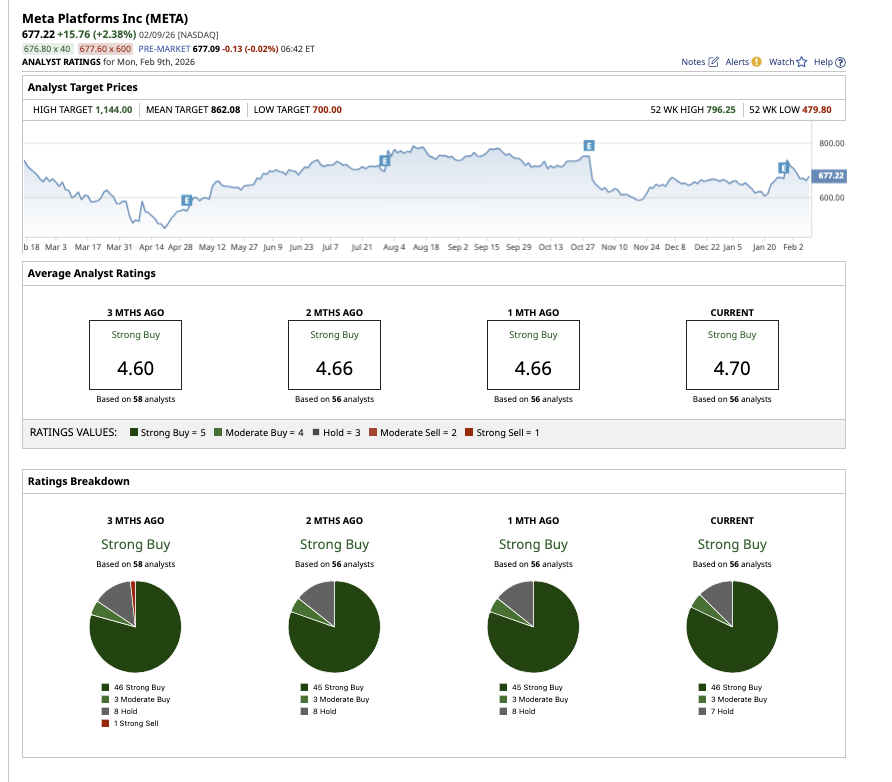

Meta Platforms stock is up 1.3% so far this year and analysts see potential upside of 29% from current levels if META hits the average price target of $862.08. Plus, the high price target of $1,144 implies that the stock could surge by as much as 71% over the next year.

Overall, the consensus for META stock is a “Strong Buy” rating. Among the 56 analysts covering the company, 46 give shares a “Strong Buy” rating, three recommend a “Moderate Buy,” and seven suggest a “Hold” rating.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)