/Quantum%20Computing/A%20concept%20image%20of%20a%20neon%20pink%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

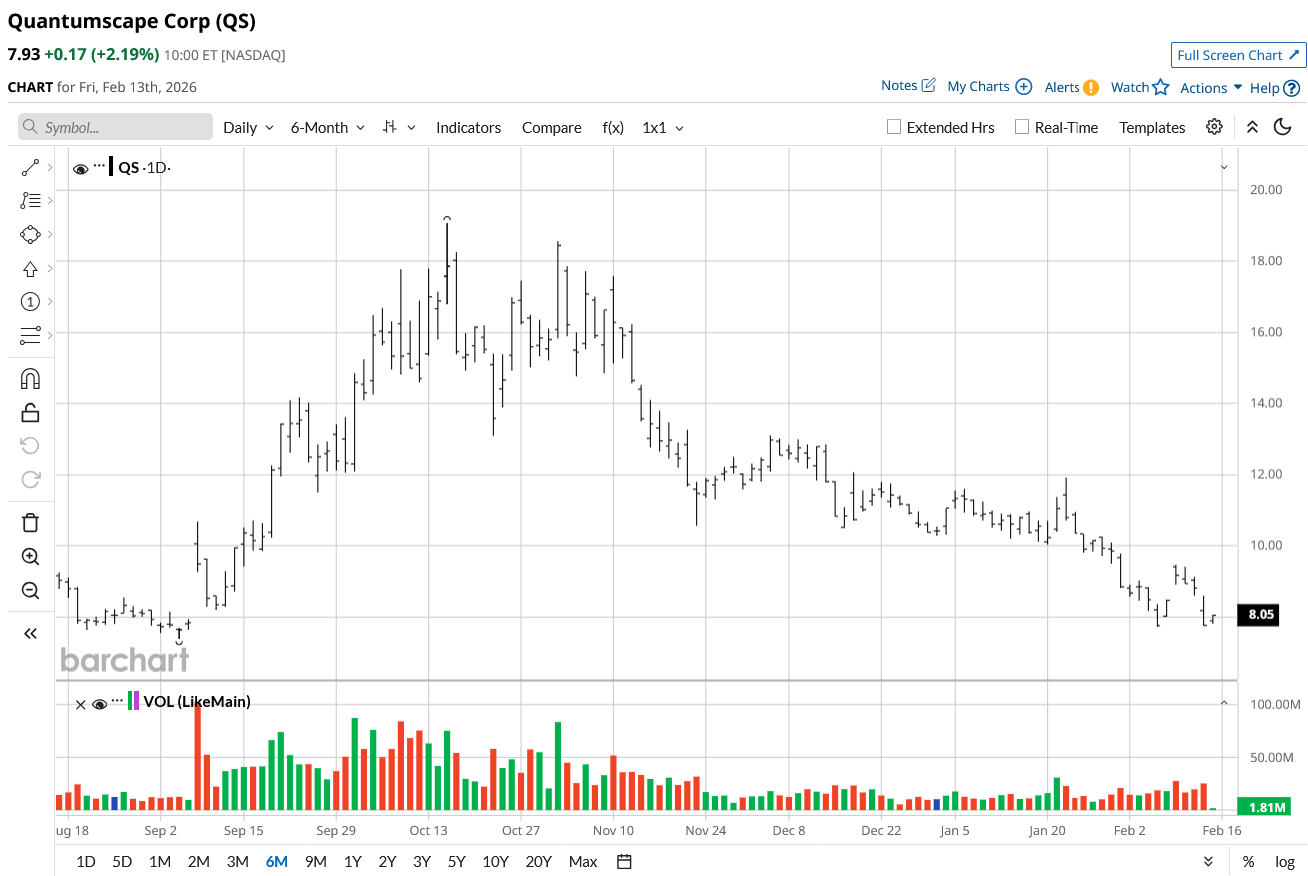

QuantumScape (QS) stock isn’t winning any fans post-earnings this week, as the stock continues its downslide under the pressure of its latest quarterly earnings report. The company’s core business still does not generate any revenue, which continues to frustrate investors. For now, the company has managed to lower its operating expenses by 14%, helping it lower its losses to $0.17 per share. This has, however, impressed neither investors nor analysts.

The most disappointing part for investors has been the absence of revenue guidance, so investors may have to get used to zero revenue this year as well. While billings bring in healthy cash flow, they are no substitute for revenue, and the stock price reaction clearly reflects that. This year, QS is expected to further invest in scaling its solid-state battery production using the Eagle Line. The company is focused on bringing its revolutionary technology to the market, but investors have started wondering if it's something worth waiting for, especially when their own money is on the line.

About QuantumScape Stock

QuantumScape Corporation works on the development of lithium batteries for electric vehicles. The company’s upcoming battery technologies allow faster charging, higher energy density, and improved safety. It is headquartered in San Jose, California.

The company’s stock is down 58% from its October peak, but over the past 12 months, it is still up by over 54%. This has been a rollercoaster ride for investors, but unfortunately nothing special for those who got in during the July and September 2025 rallies. The S&P 500 ($SPX) has delivered a much more stable 11.55% return during the same 12 months.

The improving financial metrics make the stock an interesting but volatile play. Stocks often generate the most returns when the company is about to turn profitable. Over 20% growth in each of the last two quarters means QS is now closer to that milestone. Consensus EPS estimate growth rates of 14.6% in 2026, 9.95% in 2027, and 59.57 in 2028 bode well for the company’s future. A technological breakthrough or a contract with a major company could unlock huge upside in the stock. It is therefore more a bet on the company’s technology than on stock price appreciation based on valuation at the moment.

The company also has minimal debt at $73 million, with nearly a billion dollars in cash. Despite being an early-stage technology company, it enjoys substantial liquidity, which alleviates any short-term liquidity concern for investors. Battery development cycles can be long, and a balance sheet like this certainly helps in staying solvent while the tech is being perfected.

QuantumScape Stock Falls After Earnings

QS announced its Q4 2025 earnings on Feb. 11, delivering in-line earnings and revenue. The adjusted EBITDA loss for the quarter was $63.3 million, while for the full year it stood at $252.3 million. The company spent $36.3 million during the full year on capital expenditure. It ended the year with $970 million in cash.

For the ongoing year, management expects an adjusted EBITDA loss of $262.5 million at the midpoint, with capex expected to be between $40 million and $60 million. Management highlighted its intention to expand into high-value markets and maintain a capital-light licensing business model. Going forward, investors should expect lumpy customer billings, depending on which phase of the agreed work the contract is currently in.

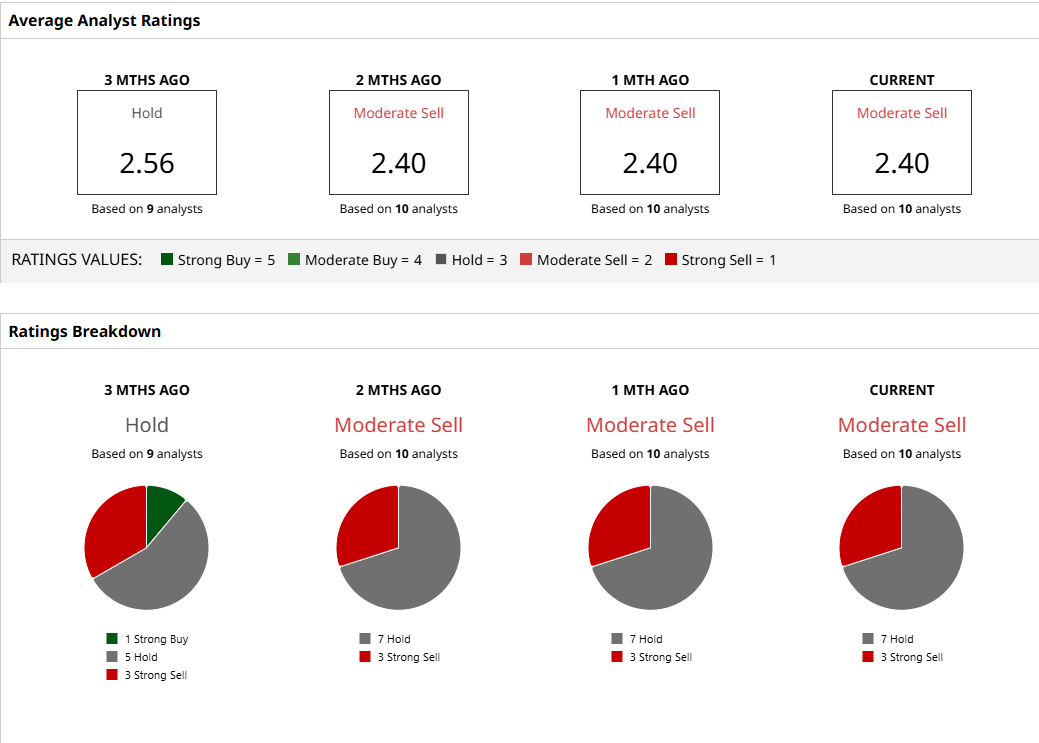

What Are Analysts Saying About QS Stock?

On Feb. 12, Baird analyst Ben Kallo brought his firm's target price on the stock from $13 to $12. He maintained the prior “Neutral” rating on the stock. This reaction could force the other nine analysts who cover the stock on Wall Street to change their stance as well, though nothing major is expected. For now, the median price target of $9.55 offers a further 23% upside. It must be said, though, that the $16 price target, which is the highest among these analysts, seems a bit far-fetched for now.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)