With shares down 46% after a rough past three months, Coinbase Global (COIN) is once again testing the resolve of investors. While COIN stock reached an all-time high of more than $444 within the last year, shares are now trading as low as the $179 mark. This decline has been due to a sharp drop in crypto prices as well as the overall risk-off environment for high-beta assets.

As a result, COIN stock is in an extremely oversold position, as the Relative Strength Index has fallen to nearly 21. While it is always difficult to catch a falling knife, the 60-month beta of 3.7 also indicates a high level of risk. However, looking at the business fundamentals of the company, the picture appears far more robust than Coinbase's stock price indicates.

About Coinbase Stock

Founded in 2012, Coinbase is headquartered in San Francisco, California and operates one of the largest exchanges for cryptocurrencies. With a market capitalization of approximately $52.5 billion, the company has also moved far beyond being a typical exchange, positioning itself as an “Everything Exchange.”

While COIN stock has been through a rough period, shares still trade far higher than the 52-week low of $142.58. However, Coinbase remains far from its 52-week high of $444.64 as well, which was reached during a peak period for cryptos. While the S&P 500 Index ($SPX) has been trading within the same range, the decline in COIN stock has been sharp.

From a valuation standpoint, COIN trades at 29 times trailing earnings and about 35 times forward earnings. These are not inexpensive multiples by any means, but they are notably lower than where the stock traded in previous crypto cycles, particularly in light of Coinbase's profitability and balance sheet strength.

Coinbase Delivers a Profitable Q3

Coinbase's recent quarterly results offer a striking contrast to how the stock has been trading of late. For the third quarter, revenue came in at $1.9 billion, rising 25% sequentially. Net income came in at $433 million, while adjusted EBITDA was a healthy $801 million.

Transaction revenue was 37% higher sequentially at $1 billion as consumer activity picked up and derivatives trading volumes skyrocketed after the acquisition of Deribit. Importantly, subscription and services revenue also came to $747 million, up 14% sequentially, as stablecoin income benefited from USDC (USDCUST) balances.

This is important, as stablecoin revenue alone was $355 million in Q3. Moreover, average USDC balances “held in Coinbase products" was $15 billion. So, this is a revenue stream that is not as cyclical as transaction revenue. As management pointed out in its recent quarterly call, this helps offset transaction revenue volatility over time.

Looking forward, management expects Q4 subscription and services revenue between $710 million and $790 million. What's more, managmenet is cautioning investors against extrapolating its transaction revenue too quickly, as crypto is a very volatile space.

What Do Analysts Expect for Coinbase Stock?

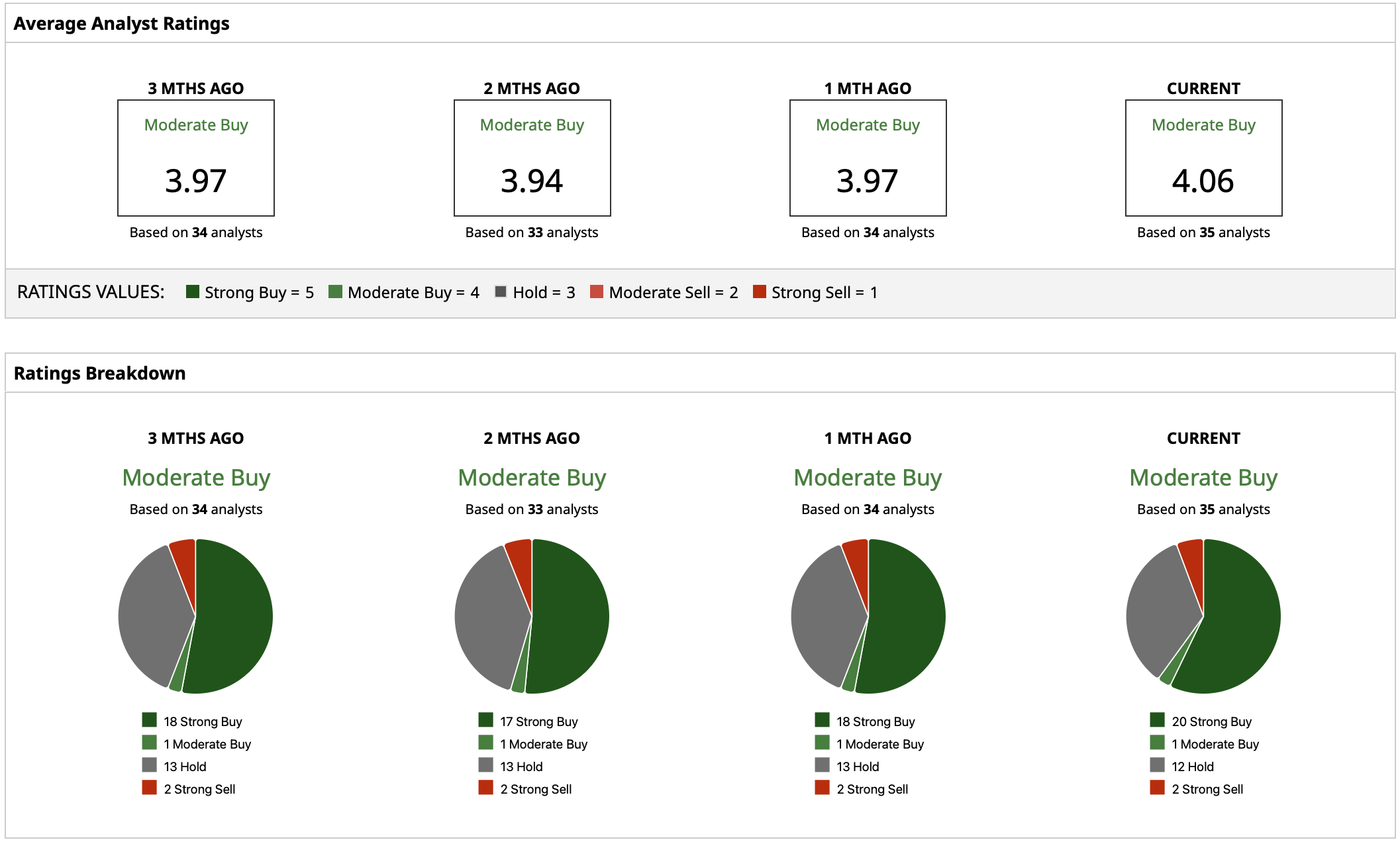

Despite the recent drawdown in COIN stock, there is a bullish sentiment about Coinbase among analysts. Coinbase stock has a “Moderate Buy” consesus rating based on 35 analysts with coverage. The mean target price for the stock stands at $345.49, indicating potential upside of approximately 92% from current levels. The highest target price stands at $505, while the lowest target price stands at $190, which is only slightly above recent price levels.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)