When short sellers crowd into a stock, they are essentially sitting on a coiled spring, and in Under Armour’s (UA) case, that spring is tightly wound. Short interest across S&P 500 Index ($SPX) consumer discretionary names barely moved last month, but traders kept leaning hard against apparel and retail stocks.

Under Armour drew some of the heaviest pressure, with about 33.4% of its float sold short, a strikingly high figure that shows negative sentiment. However, the latest earnings forced the market to reassess that view. On Feb. 6, Under Armour posted Q3 fiscal 2026 results that beat expectations on both the top and bottom lines.

Buyers stepped in decisively. The stock jumped 19.4% that day and hit a new 52-week high of $7.70 in the next trading session as short sellers moved quickly to limit losses. But the rebound stalled when Citigroup downgraded the stock from “Neutral” to “Sell” on Feb. 10, sending shares down nearly 10.7% and erasing much of the rally.

With short interest still elevated, let us see if this setup favors another squeeze, or if the easy trade already played out?

About Under Armour Stock

Based in Baltimore, Maryland, Under Armour builds athletic apparel, footwear, and accessories aimed at everyday athletes and professionals alike. The company holds a market cap of roughly $2.9 billion and sells its products through retail partners, its own stores, and digital platforms, while also leveraging brand licensing to extend its reach.

After spending much of the past year treading water, the stock has found fresh energy. While the shares edged up just 2.87% over the last 52 weeks, the pace has accelerated meaningfully, with UA stock up 39.34% in the past six months and 48.8% over the last three months.

From a valuation perspective, Under Armour’s shares are trading at 0.60 times sales, placing the stock below both the industry average and its own five-year historical multiple. The market continues to price in caution, but the discounted valuation could attract value-oriented investors who see credible turnaround potential and improving execution ahead.

Under Armour Surpasses Q3 Earnings

On Feb. 6, Under Armour reported fiscal 2026 third-quarter results, wherein the company exceeded analyst expectations and lifted its full-year profit outlook, even as demand in North America remained soft.

Revenue declined 5.2% year-over-year (YOY) to $1.33 billion, yet it surpassed the $1.31 billion analyst estimate. Meanwhile, adjusted net income per share grew 12.5% to $0.09, beating the expected $0.20 loss per share.

Regional performance revealed both strain and opportunity. North America revenue fell 10% to $757 million, underscoring continued challenges in its largest market. In contrast, international revenue increased 3% to $577 million, led by a 20% surge in Latin America.

The company strengthened its financial footing as well. It closed the quarter with $464.6 million in cash and cash equivalents and allocated $600 million in restricted investments to retire senior notes due in June 2026.

Looking ahead, management now expects fiscal year 2026 revenue to decline about 4%, narrowing its prior 4% to 5% projected drop. It has also raised adjusted diluted EPS guidance to $0.10 to $0.11, up from $0.03 to $0.05, signaling growing confidence in sustained progress.

What Do Analysts Expect for Under Armour Stock?

Citi took a clear step back as it downgraded UA stock to “Sell” and kept its price target unchanged at $6.20. The firm argued that the company’s turnaround efforts in North America will face several pressures in fiscal 2026, signaling limited confidence in near-term execution.

Williams Trading sees the situation differently. The firm has raised its price target to $10 from $8 and maintained its “Buy” rating. Analysts at the firm said the third-quarter results reinforced their conviction that management has begun to stabilize operations and improve profitability trends.

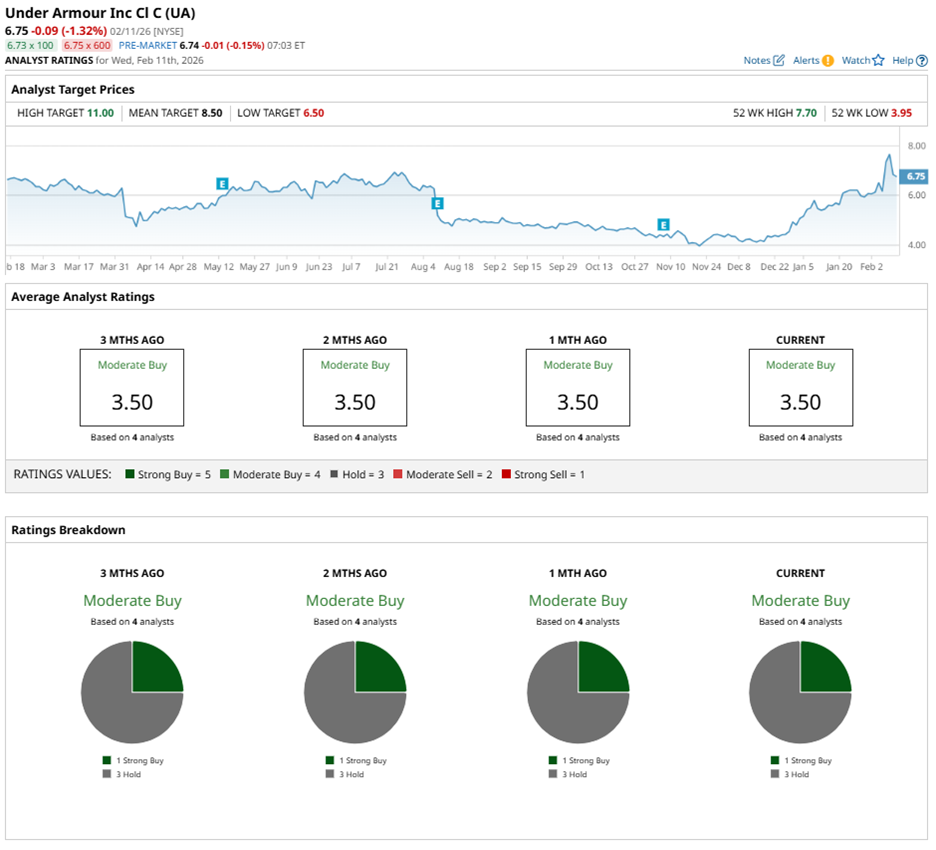

Wall Street has currently assigned UA stock a “Moderate Buy” rating. Out of four analysts, one recommends a “Strong Buy,” while three suggest “Hold.”

The average price target of $8.50 represents potential upside of 26%. Meanwhile, the Street-high target at $11 set by UBS Group AG indicates a gain of 63% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)