/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

Alphabet (GOOG) (GOOGL) has once again captured Wall Street’s attention—this time not with a product launch or earnings surprise, but with a massive $31.5 billion bond sale. The Google parent tapped the U.S. debt market in its largest-ever bond offering, raising fresh capital to help fund its rapidly expanding AI infrastructure buildout. The move underscores just how aggressively the company is positioning itself for the next phase of AI-driven growth.

While Alphabet maintains one of the strongest balance sheets in corporate America, the bond sale marks a notable shift toward heavier borrowing to finance growth. Management is effectively leveraging its strong credit rating to borrow at attractive rates and accelerate its investment plans. With AI demand surging and competition among hyperscalers intensifying, securing infrastructure capacity now could translate into meaningful revenue and margin expansion later.

So what does this blockbuster bond sale really mean for GOOGL stock? Is it a smart, opportunistic use of leverage to accelerate growth, or does it introduce new risks? Let’s dive in!

About Alphabet Stock

Alphabet is a leading multinational technology company. It operates across three segments: Google Services, Google Cloud, and Other Bets. The Google Services segment, which accounts for the majority of the company’s total revenue, offers a broad range of products and platforms, including Search, Ads, Android, Chrome, YouTube, Gmail, Google Maps, Google Photos, and Google Play—serving billions of users globally. It has a market cap of $3.85 trillion, making it the world’s third most valuable company.

Shares of the Google parent have remained largely unchanged since the start of the year, slipping just 1%. GOOGL stock started 2026 on an upbeat note but wiped out its year-to-date (YTD) gains after the company’s Q4 earnings report, as investors were rattled by its spending outlook.

Alphabet’s Big Bond Play for AI Growth

Alphabet became the second big tech firm to tap the bond market this year, following Oracle’s $25 billion debt issuance a week earlier. The cloud and search giant raised nearly $32 billion in debt in under 24 hours to fund an unprecedented spending plan as it expands AI infrastructure to meet growing demand.

Alphabet raised $20 billion in its largest-ever U.S. dollar bond sale on Monday, well above the $15 billion initially expected, after drawing one of the biggest order books on record. Bloomberg reported that the offering drew more than $100 billion in orders at its peak. Saxo analysts described demand as “overwhelming.” The bond sale came in seven parts, according to the report.

Alphabet also diversified its funding sources by issuing offerings denominated in sterling and Swiss francs on Tuesday. The tech giant raised 5.5 billion pounds (about $7.5 billion) by issuing five tranches of sterling-denominated bonds. Notably, the sterling offering included an ultra-rare 100-year bond, marking the first time a technology company has issued debt with such an extreme maturity since the dot-com era. The company’s issuance of the 100-year bond is unusual for the tech sector, which typically favors short- to medium-maturity corporate debt. “The ability of a tech company to issue a 100-year bond shows how investors are increasingly treating hyperscalers as long-term infrastructure rather than cyclical tech,” said Lale Akoner, analyst at eToro. Alphabet also raised the equivalent of $4 billion in Swiss francs by issuing bonds with five different maturities.

Combined with the $20 billion in dollar-denominated debt issued on Monday, Alphabet has raised $31.5 billion this week, surpassing a $25 billion issue completed by rival hyperscaler Oracle a week earlier. Notably, the Google parent last accessed the U.S. bond market in November, raising $17.5 billion in a sale that attracted roughly $90 billion in orders. As part of that deal, the company issued a 50-year bond, the longest U.S. dollar-denominated corporate tech bond sold last year. At the time, the company also tapped the euro bond market, raising 6.5 billion euros ($7.7 billion).

The offerings came less than a week after Alphabet shocked Wall Street by saying its capital expenditures would reach as much as $185 billion this year to fund its AI ambitions. That amount exceeds what the company spent over the previous three years combined. Meanwhile, the technology firm said the investments are already lifting revenue, as AI is driving increased online search activity.

Alphabet is one of the few tech giants that have started borrowing aggressively to finance massive investments in AI infrastructure. Its long-term debt quadrupled in 2025, reaching $46.5 billion. CFO Anat Ashkenazi said on last week’s earnings call that as the company evaluates its overall investment plans, “we want to make sure we do it in a fiscally responsible way, and that we invest appropriately, but we do it in a way that maintains a very healthy financial position for the organization.”

What Does the Bond Sale Really Mean for GOOGL Stock Investors?

In summary, the bond sale means that Alphabet is leveraging its strong financial position (rated AA+ by S&P Global Ratings and Aa2 by Moody’s Investors Service) to borrow at attractive rates. The debt is being used to finance a portion of the company’s massive capital expenditure plans to expand AI infrastructure. This includes building data centers and acquiring high-end chips like those from Nvidia (NVDA) to maintain its competitive edge. Of course, that comes at a cost. The company must pay interest on its debt, which in turn reduces retained earnings. Alphabet’s fourth-quarter interest expenses totaled $298 million, up from $53 million a year earlier. While still modest, that represents a new factor for investors to keep an eye on. Alphabet said it is already seeing a boost in revenue from its investments as online search activity rises, and if that trend continues, alongside strong cloud growth, the heavy capex will be more than justified.

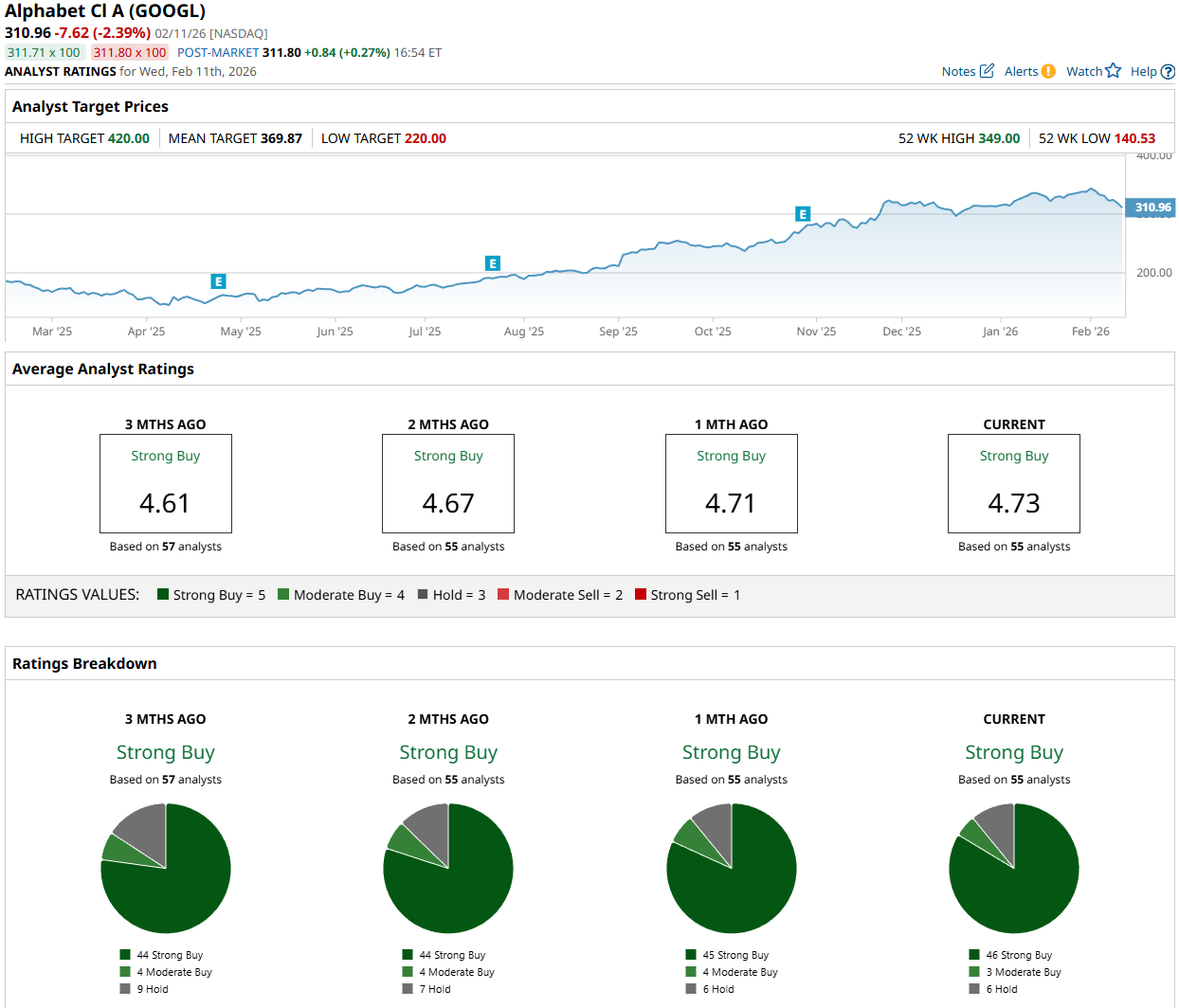

Wall Street analysts are very bullish on Alphabet, assigning the stock a top-tier “Strong Buy” consensus rating. Among the 55 analysts covering the stock, 46 recommend a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining six give a “Hold” rating. The average price target for GOOGL stock is $369.87, implying a 19% upside potential from current levels.

On the date of publication, Oleksandr Pylypenko had a position in: GOOGL . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)