/CPU%20Chip.jpg)

Advancements in Artificial Intelligence (AI) continue to disrupt industries. Investors have witnessed this with the software sell-off earlier this month. OpenAI has now released its latest model called GPT-5.3-Codex, while Anthropic has come up with its Claude Opus 4.6 model. And these systems aren’t improving linearly; each is exponentially better than the last one.

Moreover, these new models can write code better than humans. So as a consequence, they are much better equipped to improve themselves. The resulting iterative process will be so fast that it is likely some industries will be replaced as soon as by the end of this year.

Investors have already started looking at companies that will benefit from this increasing AI domination, such as Broadcom (AVGO), a tech giant widely considered as the best custom chipmaker worldwide.

Cathie Wood of ARK Innovation ETF (ARKK), known for keeping a close eye on disruptive technologies, is one investor people follow for guidance. During the last week, she added Broadcom shares worth $27 million during a market dip. It seems she also sees the demand for AI infrastructure and custom AI chips skyrocketing soon.

About Broadcom Stock

Founded in 1961 and headquartered in Palo Alto, California, Broadcom is a U.S. technology company involved in the design, development and supply of semiconductor chips, along with infrastructure software solutions and networking equipment.

AVGO stock has returned 45.83% over the past 52 weeks, quite impressive for any tech stock. Yet, it has underperformed the iShares Semiconductor ETF’s (SOXX) 63.8% returns in the same period.

A possible reason is the expectation that now, secondary industries associated with AI or companies making technologies with AI will rally. This thought process could change soon due to the unpredictability of these developments and the likelihood that demand for more computing will continue to grow.

AVGO’s trailing twelve month price-to-earnings ratio is 61.42x, which is high compared to the iShares Semiconductor ETF’s trailing P/E ratio of around 44x. On a forward P/E basis, the company looks much cheaper at a multiple of 39.55.

The PEG Non-GAAP forward value of 1.05x does show that the high P/E is justified, and the stock is trading close to its fair value based on earnings expectations. To become undervalued as per Peter Lynch's PEG criterion, earnings expectations would need to rise from here. For now, Wall Street expects a 50% earnings growth in 2026 and 40% in 2027. These are lofty expectations but if AI trends are anything to go by, compute requirements are going to keep rising and Broadcom is a direct beneficiary of that.

Broadcom Stock Earnings

AVGO announced its Q4 earnings report on Dec 12, reporting a revenue of $18.02 billion and an EPS of $1.95, thus beating Wall Street estimates on both counts. The Semiconductors segment brought in the major chunk of revenue at $11.1 billion, registering 35% year-over-year (YOY) growth. Backlog for the company’s networking equipment also grew to over $10 billion. The chipmaker is experiencing record demand for its Tomahawk 6 switch, which is the best Ethernet switch available for AI networking in the industry right now.

With newer AI models in the market right now, the company’s fiscal first-quarter earnings call next month will attract significant investor attention. As AI improves and more AI applications become possible, the demand for more infrastructure and custom chips could go through the roof.

What Are Analysts Saying About Broadcom Stock

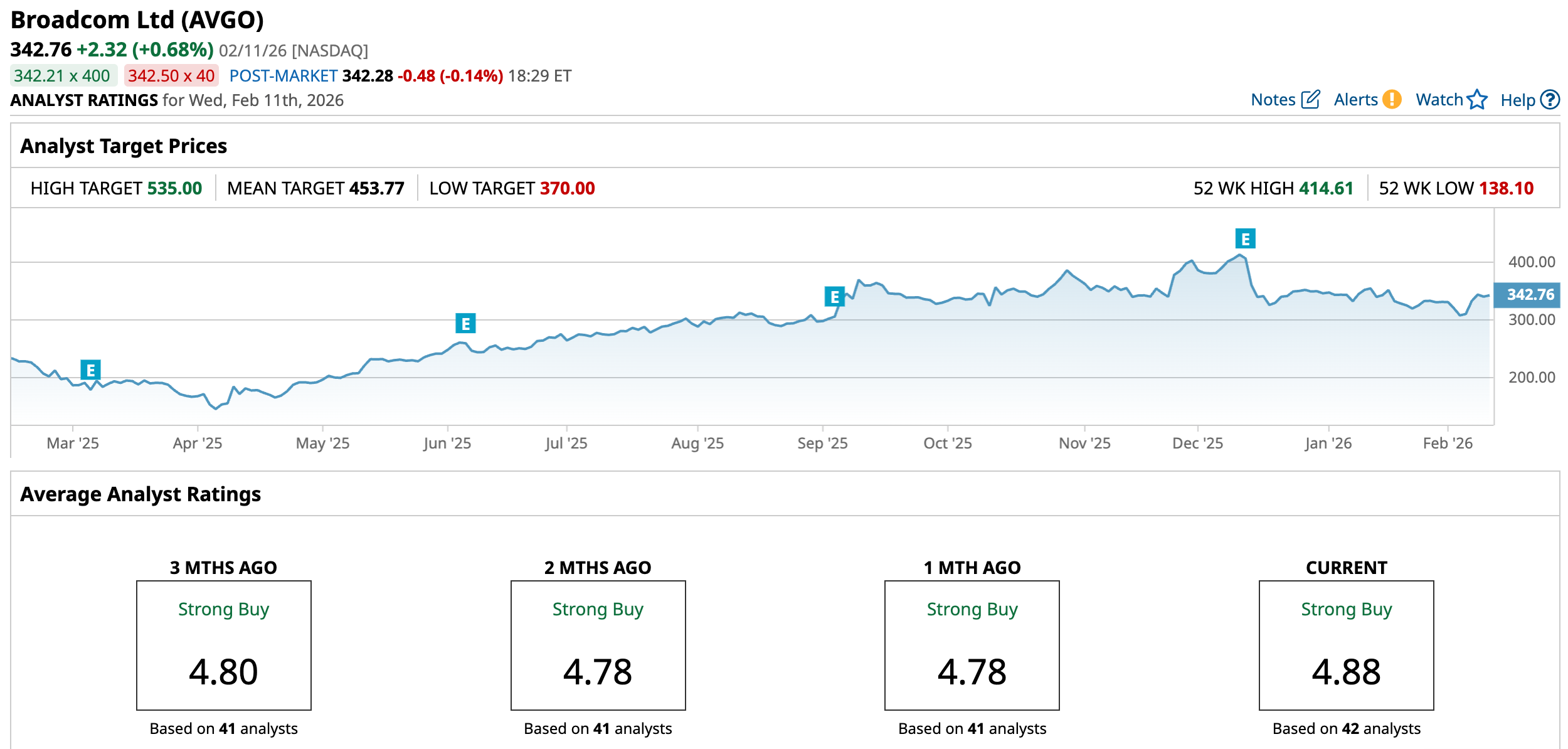

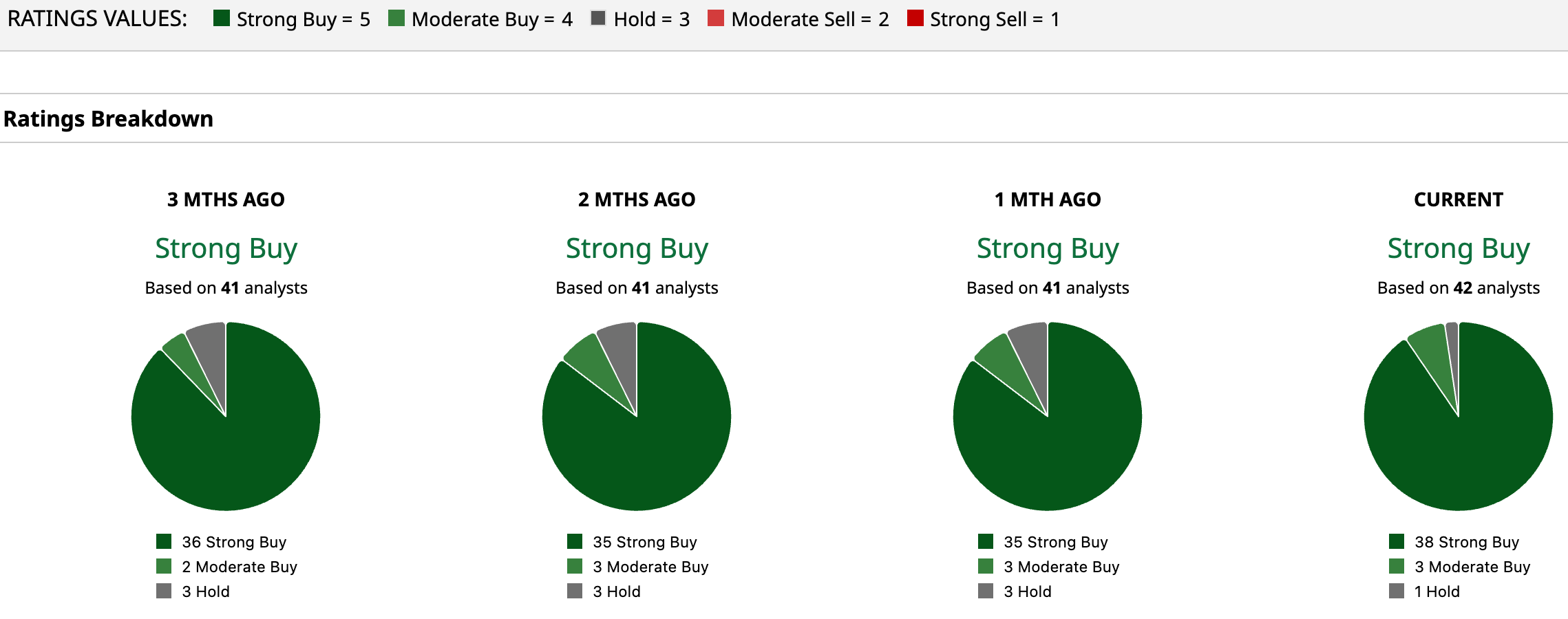

Less than two weeks ago, Broadcom was upgraded from “Peerperform” to “Outperform” at Wolfe Research, which also raised its price target to $400. However, the rest of Wall Street is even more bullish, with the mean target price at $453.77, reflecting upside of 32.4% from here.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)